(Bloomberg) -- South Korean exports continued to grow last month, helped by rising demand from the US that overtook China as the biggest market for the first time in two decades.

The value of global shipments adjusted for working-day differences increased 14.5% from a year earlier, according to data released Monday by the trade ministry. Headline exports rose 5.1%, compared with economists' forecasts for a 3.7% increase. Overall imports declined by 10.8%, resulting in a trade surplus of $4.5 billion.

In a sign of closer ties with Washington and Beijing's economic challenges, South Korea sold $11.3 billion in goods to the US compared with $10.9 billion to China in December. Still, one month's data doesn't offer conclusive proof of an enduring shift in trading patterns.

China remains South Korea's biggest trading partner by a large margin given the scale of Seoul's imports from the world's second-largest economy.

South Korea's exports emerged from a yearlong slump late last year after global demand for its products ranging from electronics and automobiles to petrochemicals and shipbuilding finally started to recover.

Semiconductor exports jumped 21.8% from a year earlier in December as memory-chip prices continued to rebound, the trade ministry said. Prices are rising again on the back of demand for artificial intelligence and other emerging technologies. The impact on economic growth in South Korea and countries including Taiwan and Vietnam will be closely watched in 2024.

Demand for South Korean goods has generally been recovering across the world, indicating consumers may be regaining confidence after a prolonged period of higher interest rates.

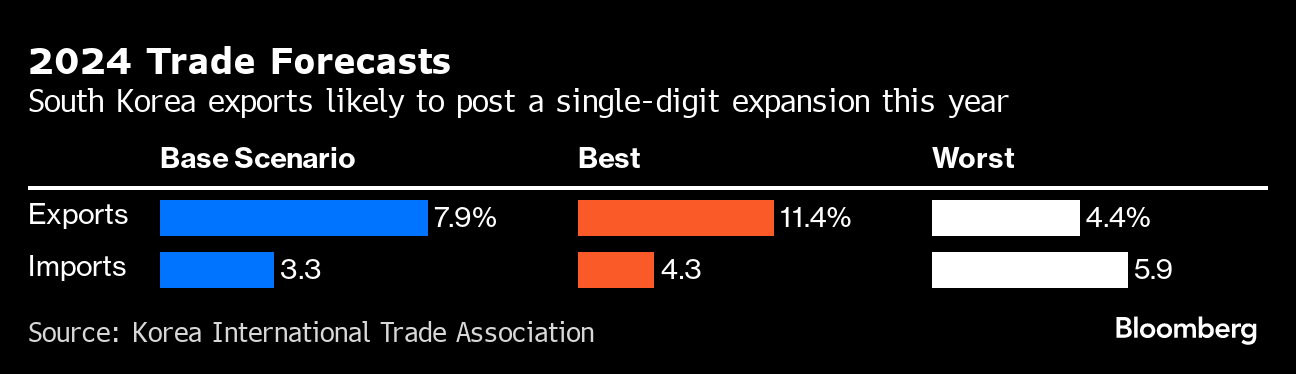

South Korea's exports will probably rise by 7.9% in 2024, reaching $680 billion, according to base-case forecasts by the Korea International Trade Association. The association expects imports to increase 3.3%, with the trade surplus reaching $14 billion.

Still, downside risks remain. Bloomberg Economics forecast last week that global growth will slow to 2.7% in 2024 from 3.1%, the slowest since 2001 excluding the global financial crisis in 2009 and the Covid pandemic in 2020.

“Korean exports are still bottoming out and likely to start a weak recovery trend in 2024,” Pantheon Economics said in a note last month. “Global demand is still soft.”

Geopolitical tensions such as the Israel-Hamas war and growing protectionism add to risks for Korea, while questions remain surrounding the health of the economic recovery in China.

China is also ramping up domestic production of goods as it moves up the value chain. One key area that China is focusing on is semiconductor and smartphone manufacturing, a development that has threatened market shares held by Samsung Electronics Co. and other South Korean exporters.

Exports to China in December slid 2.9% from a year earlier, while shipments to the US rose 20.8%, the ministry said.

The US-China rivalry also casts a shadow over global trade. The US has been looking to generate support for its agenda to reduce dependence on China in global supply chains and limit the country's access to advanced semiconductor technology.

That has placed countries like South Korea and Japan in an awkward spot between their two biggest trading partners. Both Seoul and Tokyo are key military allies of Washington, another important dimension given Beijing's increasing assertiveness in the Indo-Pacific and rising tensions in the region.

(An earlier version of this story corrected the decline in overall imports.)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.