(Bloomberg) -- Wall Street has been talking up a much-needed revival of firms tapping markets for the first time after a two-year dearth of initial public offerings. But when it came to two of the three biggest debuts so far this year, investors didn't want to hear it.

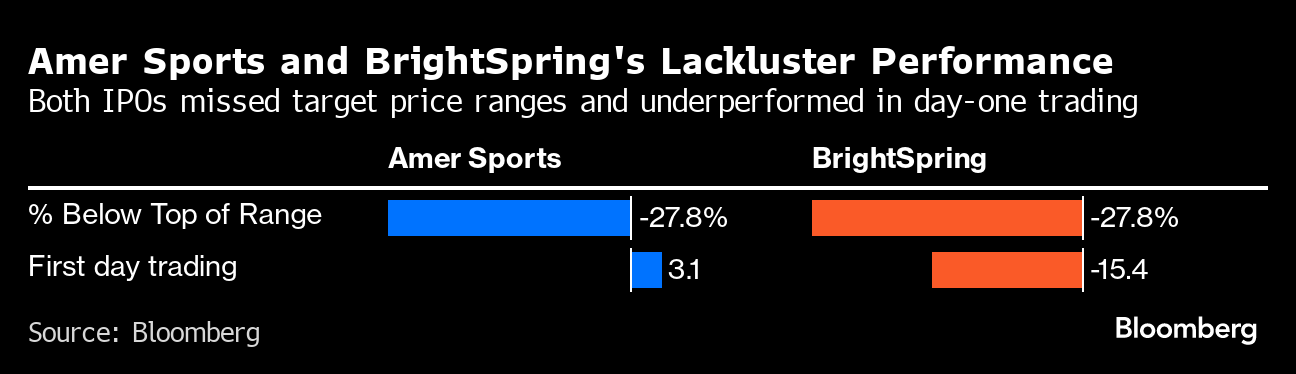

Amer Sports Inc., the maker of Wilson tennis rackets and Salomon ski boots, raised $1.37 billion in its IPO — the biggest US listing since October, but priced at $13 per share, below the range it had proposed. The underwhelming IPO came less than a week after KKR & Co.-backed BrightSpring Health Services Inc. raised $693 million from selling shares while also pricing them under a marketed range — and worse, slumped 15% in its first trading day.

The lackluster debuts reflect the distance between what issuers and their bankers were offering, and what investors were willing to support. That's not the way IPOs are supposed to work, especially when the US's key stock benchmarks are at record highs. After balking at both companies' leverage and growth prospects, will investors warm up to the next batch of new listings?

“There's no doubt that you get some knock on effects — good or bad — from the last deal that can impact the next deal and how you place expectations related to pricing,” said Gareth McCartney, UBS Group AG's global co-head of equity capital markets. “It can be a tactical and sentiment-driven market, so each deal does have an impact into the next one.”

The class of 2023's mixed performance after a choppy period for IPO buyers may still be lingering, too. Yet with $8.3 billion raised across 64 share sales by existing companies in the year to date, data compiled by Bloomberg show, it's not as though activity as a whole has shut down.

Read More: IPO Market Rebound Hinges on Post-Debut Trading, Retail's Return

“Investors have the ability to be selective across every variable, but the good news is that they are communicating early and often on what is working for them,” said Seth Rubin, head of equity capital markets at Stifel Financial Corp. “We are continuing to rebuild - this recovery is going to take some time and people are looking at everything on a deal-by-deal basis.”

Modest Expectations

Ideally, IPO bankers set modest expectations to draw investors for meetings to get a piece of the action. Strong day-one rallies leave investors feeling like they got a good deal, and while the company and insiders left some money on the table, they can capitalize on higher share prices in the years ahead.

A key point of disagreement between these IPO candidates and investors appears to have been the companies' use of leverage. Along with the proceeds from selling shares, BrightSpring raised a further $400 million via tangible equity units sold concurrently with the share sale. The move was set to lower its $3.4 billion worth of debt from 5.9 times its capital to closer to 4 times, according to a sellside analyst report seen by Bloomberg.

Read More: BrightSpring Leverage Draws Scrutiny After IPO Slump: ECM Watch

Amer Sports' net debt of $6.2 billion in the year to Sept. 2023 gave it a leverage ratio of 10 times, whereas excluding the related party loans and leases, the debt was $1.9 billion and a leverage ratio of 3.1 times, according to Arun George, an analyst for Global Equity Research Ltd. writing on the SmartKarma platform.

The marketed IPO price range of $16 to $18 per share, meanwhile, translated to an “implied valuation of over $8 billion for a mature but unprofitable firm in a competitive industry,” said Jay R. Ritter, a finance professor at the University of Florida.

The demand was so lackluster that three members of a consortium of Amer's existing backers, led by majority owner Anta Sports Products Ltd., bought about 60% of the issue, Bloomberg News reported earlier.

“That's a high percentage and a sign of weak demand, especially because this is an exit,” said Matthew Kennedy, senior IPO market strategist at Renaissance Capital.

Read More: Amer Sports to Focus on Growth After ‘Frustrating' Share Pricing

Smaller Deals

Despite the sturm und drang around the deals that disappointed, the 20 IPOs that listed so far in 2024 returned an average of 13.8%, according to data compiled by Bloomberg.

More modestly-sized deals have performed better than their jumbo brethren. Seventeen of the 27 companies to raise between $100 million and $500 million in the past year are trading above their offer price. Biotechnology has been a particular bright spot with CG Oncology Inc., whose shares have nearly doubled, and Alto Neuroscience Inc., which jumped 29% in its Friday debut after pricing its expanded offering at the top of a marketed range.

Recent concern could also fade as February is likely to see a lull in IPO activity, with potential issuers rushing to get their full-year financial statements audited before submitting their applications to the US Securities and Exchange Commission. Some companies may want to present preliminary first-quarter numbers as further proof of their IPO-readiness to investors, at a time when many firms are in cost cutting mode, and layoffs are being mentioned on earnings calls at the highest rate since the pandemic.

The next test of Wall Street's ability to whip up excitement for the revival could come from more biotech firms, or sectors like tech, which often are a leading indicator of IPO enthusiasm about to break out.

The market for technology deals is still taking a “wait-and-see” approach, according to Barrett Daniels, US IPO services co-leader at Deloitte LLP.

“Listings that we've seen here recently give us some broader view about how the investment community is thinking about IPOs, but it is sort of apples-to-oranges,” Daniels said.

The small and mid-cap sector of the US market has significantly underperformed large cap stocks, but interest in these companies will increase when the Federal Reserve starts to cut interest rates, according to Brad Miller, global head of equity capital markets syndicate at UBS.

“Although we are seeing a modest uptick in activity I don't think we get back to a true normalized IPO market until back half of 2024 at the earliest,” Miller said.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.