Narendra Modi's emphatic win in elections has led to a record rally in Indian stock markets. The Sensex breached the psychological 25,000 levels on May 16, when results were announced, but since then markets have been consolidating. The action now has shifted to midcap and smallcap stocks, which had hugely underperformed last year.

The indiscriminate buying in smaller stocks, however, is unnerving, given many stocks that have witnessed spectacular rise over the last month are companies with broken balance sheets and corporate governance issues.

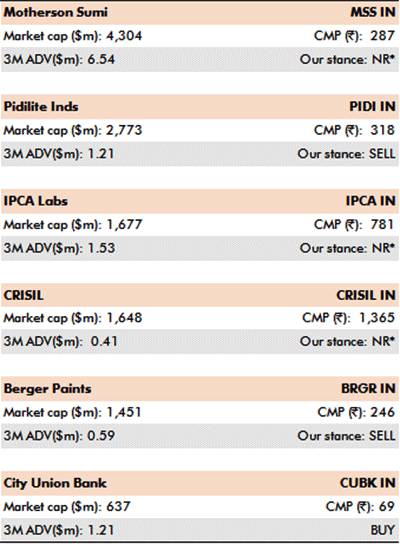

In this backdrop, Ambit has come out with a report on six midcap stocks that could make their way to the bluechip Nifty index in the foreseeable future. Ambit has a buy call on one of these six stocks.

Courtesy: Ambit Research

1) Motherson Sumi: This is a market leading franchise with Sumitomo's technology support in the wiring harness business complimented by a strong track record of inorganic growth.

2) Pidilite Industries: The company dominates the adhesives and sealants market through: a) its distribution network which has strong relationships with carpenters; and b) expansion of its product portfolio through innovation and acquisitions.

3) IPCA Labs: The drugmaker has focused on incremental innovations in API (Active Pharmaceutical Ingredients) manufacturing (cost) and in formulations (patient benefit). The business is also moated due to its relationship with opinion makers and contracts with governments.

4) CRISIL: India's first and its biggest credit rating agency has a significant presence in research and advisory businesses. Its reputation of being an independent, knowledge-based organisation and a timely entry into the KPO business has driven robust growth and profitability for CRISIL.

5) Berger Paints: India's second largest paints manufacturer has a consistent focus on: a) building a robust distribution network; b) strengthening relationships with dealers/painters; and c) proactive product innovation.

6) City Union Bank: The bank has focused on MSME & trade financing in Tamilnadu. A stable management team, collateralised lending underpinned by relationship banking has driven steady growth and profitability.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.