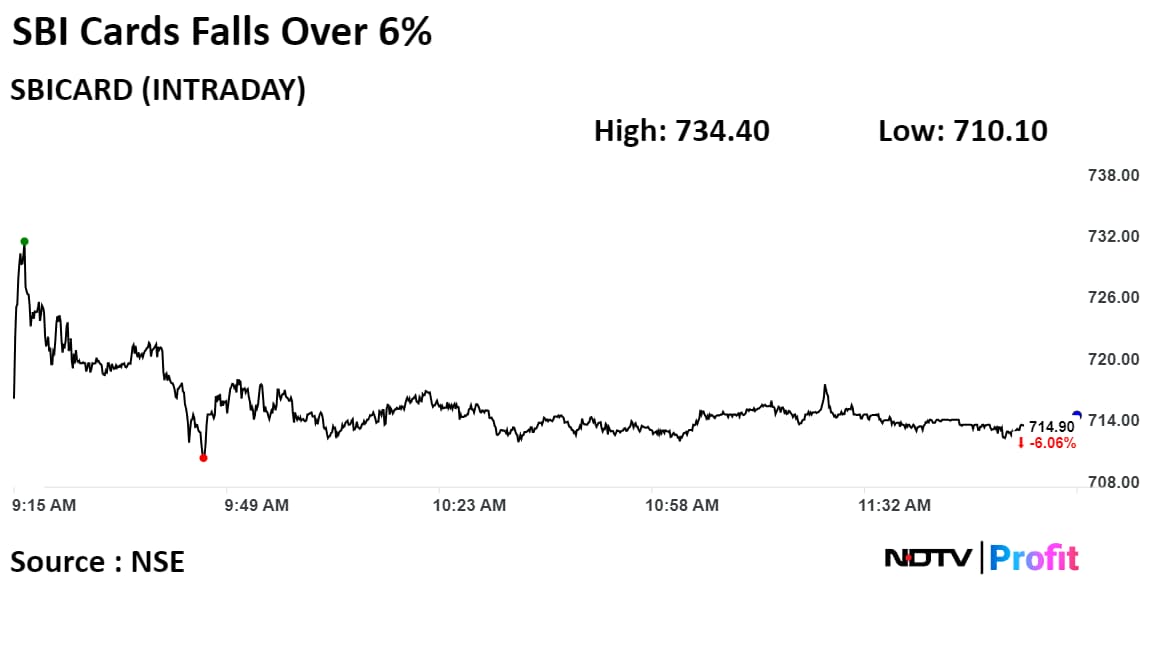

SBI Cards and Payments Services Ltd. shares fell over 6% as its third-quarter profit fell below analysts' estimates, prompting brokerages to downgrade and cut target price on the stock amid credit cost concerns.

The company's standalone net profit rose 7.8% year-on-year to Rs 549.1 crore, and the total income gained 20.1% to Rs 4,714.6 crore for the quarter ended December. The management expects the credit costs to be elevated for the next two quarters, but it doesn't see normalisation beyond that.

Jefferies expects margins to remain under pressure in the near term due to a rise in short-term rates and a falling revolver mix.

While Motilal Oswal Financial Services Ltd. anticipates hardening interest rates along with risk weights to exert pressure on funding costs, Morgan Stanley sees an increase in the cost of funds in the next quarter.

Here is what brokerages have to say.

Morgan Stanley

Morgan Stanley downgraded SBI Card to 'equal-weight' and reduced the target price to Rs 750 from Rs 950 earlier.

Net slippages in Q3 FY24 are higher than estimated, it said.

"Management expects two more quarters of elevated credit costs but could not give confidence on normalisation beyond that," it said.

SBI Card is guided to an increase in the cost of funds in Q4 FY24 "due to rate increases by banks by 25–30 bp, given higher risk weights on loans to NBFCs and also tighter liquidity conditions," said Morgan Stanley.

PE multiples are to be capped until clarity on credit costs emerges, the brokerage said.

It cut the EPS forecast by 5% each in FY24–26 on higher credit costs and lower fee income.

"Asset quality uncertainty will cap the stock price and de-rate valuation multiples until clarity emerges, in our view," it said.

Jefferies

Downgraded SBI Card to a 'hold' rating and cut the target price to Rs 830 from Rs 950 earlier.

PAT was in line with the brokerage estimate, but credit costs rose 80 basis points quarter-on-quarter, more than the estimate, the brokerage said.

"Margins will remain under pressure in the near term due to a falling revolver mix and a rise in short-term rates," said Jefferies.

The brokerage has a positive outlook on card spending and forecasts receivables to grow at a 19% CAGR over FY24–26E.

Stabilisation of asset quality and rate cuts are possible positives that should be watched, it said.

Motilal Oswal

The brokerage downgraded SBI Card to 'neutral' and revised the target price on the stock to Rs 850.

It also cut FY24E/FY25E EPS by 2%/3%, factoring in higher credit costs.

"While we expect SBI Card to deliver healthy earnings CAGR over FY24-26, however the disappointing earnings run-rate over past several quarters, which has driven consistent cut in our estimates along with limited near-term earnings visibility keeps us watchful."

Margins should remain muted in Q4 and H1 FY25, the brokerage said, as recent hardening of interest rates, along with the impact of risk weights, will exert pressure on funding costs.

Spending growth continues to remain healthy, and the company sees healthy traction in new card additions, it said.

"The outlook on any increase in the mix of EMI and revolver loans remains uncertain, while the asset quality stress is likely to drive provisions high in the coming quarters as well," it said.

Emkay Global Financial Services Ltd.

Emkay Global downgraded the stock to 'reduce' and cut target price to Rs 725 from Rs 865 earlier.

SBI Card's CET 1 has fallen sharply by 450 bps quarter-on-quarter to 16.3%, which would call for capital raise soon and hence, further RoE dilution, the brokerage said.

"With the revolver portfolio being relatively lower at 23% from the peak of 40%, we do not expect a full-blown asset-quality fallout similar to that during Covid, but delinquencies would continue to rise as stress in the multi-card and lower-bucket customer portfolio comes to the fore," said Emkay.

Shares of the company fell as much as 6.55%, the lowest level since March 28, 2023, before paring some loss to trade 6.14% lower at 12:03 p.m. This compares to a 1.43% advance in the NSE Nifty 50.

The stock has fallen 0.45% in the last 12 months. Total traded volume so far in the day stood at 7.1 times its 30-day average. The relative strength index was at 33.

Of the 28 analysts tracking the company, nine maintain a 'buy' rating, eight recommend a 'hold,' and 11 suggest a 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 2.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.