Reliance Industries Ltd. is expected to report year-on-year decline in its September quarter earnings, as global fuel supply remains high, according to Morgan Stanley. The brokerage has also cut its target price on the stock to Rs 3,325 per share from Rs 3,416 apiece, implying a 19% upside.

The leading brokerage firm has also trimmed the company's earnings per share estimates of the current and the next fiscal by 12% and 7%, respectively. However, it has maintained 'overweight' rating on the stock.

Sequentially, Morgan Stanley expects earnings and Ebitda to grow 3%.

"RIL is rationalising its retail floor space and segment Ebitda should be flattish YoY, chemical margins are sluggish," Morgan Stanley said. "Telecom remains the bright spot as tariff hikes are reflected in earnings and Ebitda grows despite subscriber churn."

The brokerage also expects refining margins to remain near mid-cycle until -0.9mbpd of new capacity added last quarter is absorbed by mid-2025.

At the same time, it has priced in the continued cyclical challenges, especially in refining and retail. "In 2025, as new refining capacity is absorbed, retail profitability improves, and new energy cashflows kick in, re-rating should regain traction," it said.

The brokerage has also moved the stock higher in its preference order to fifth from sixth earlier as it notes that the stock has relatively underperformed its peers on a year-to-date basis.

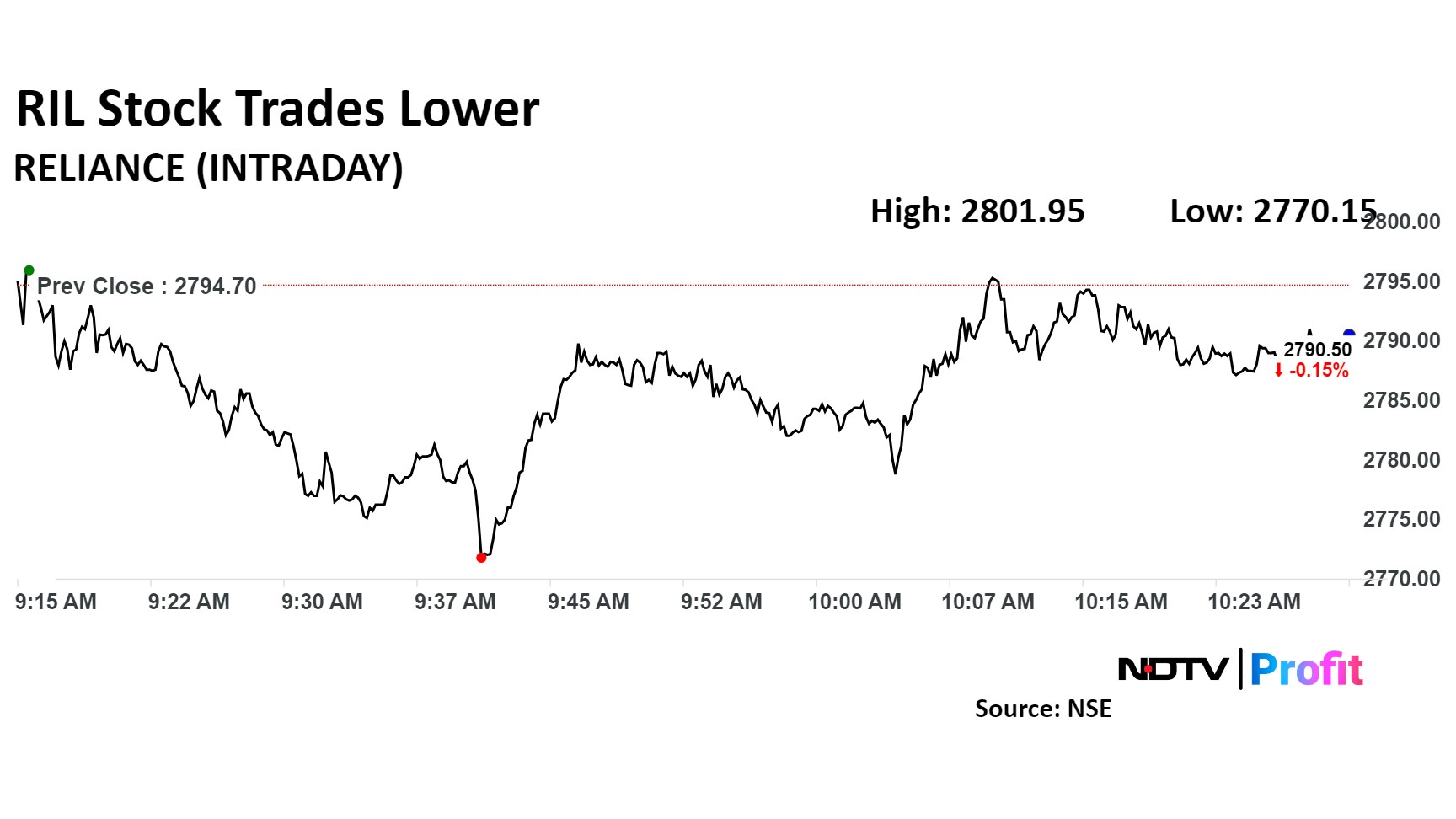

The stock fell on Wednesday after a one-day rise on Tuesday. Before that, it had fallen for five consecutive sessions. On a year-to-date basis it has risen 7.9%.

Reliance Industries Share Price

Shares of RIL fell as much as 0.9% to Rs 2,770.15 apiece, before paring loss to trade 0.2% lower at Rs 2,790.50 apiece, as of 10:36 a.m., compared to a 0.5% advance in the NSE Nifty 50.

Total traded volume so far in the day stood at 0.22 times its 30-day average. The relative strength index was at 35.

Of the 36 analysts tracking the company, 26 maintain a 'buy' rating, seven recommend a 'hold' and three suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 18%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.