A monopoly over lucrative cricket broadcast, 120 television channels and two over-the-top platforms—the merger of Reliance Industries Ltd.'s television and streaming business with Walt Disney Co.'s India unit is the country's largest media deal.

The post-money value of the joint venture is pegged at over Rs 70,000 crore or $8.5 billion. Still, it's $1.5 billion shy of $10 billion pegged for the now-collapsed Zee Entertainment Enterprises merger with Sony Group Corp.'s Indian unit.

The Reliance and Viacom18 transaction with Disney will create a broadcasting giant with a 40-45% advertising market share and significant overlap in urban markets, according to brokerage Emkay. And it will be a well capitalised entity that will certainly bid for future cricket rights in India.

The merger is subject to regulatory and third-party approvals.

Valuations

The joint venture is valued at over Rs 70,400 crore. RIL will invest Rs 11,500 crore for 16.4% stake in the JV for "growth strategy". In addition, Viacom18 has Rs 10,500 crore of cash it received from RIL and Bodhi Tree for its foray into sports entertainment.

The transaction values the Star India media business at $3.14 billion for its 36.84%. That's significantly lower than $14-15 billion valuation it had pre-Covid, reflecting the depletion due to loss of IPL rights. Viacom18 is valued at $4 billion for its 46.82%, implying the rights has given Viacom18 additional value of $850 million.

The Star India balance sheet seems to be heavily dependent on IPL cricket rights and the absence of this event has tilted the valuation in favour of well-capitalised Viacom18.

RIL's media business is valued at around Rs 40,300 crore. And that's despite the fact it has invested close to Rs 40,100 crore so far in the media business, including the proposed Rs 11,500-crore infusion into the new JV.

The value accretion is not significant in the short term but is advantageous strategically, given that Disney's valuation is significantly lower than previously reported, said Emkay Global

For Disney, the joint venture with Reliance caps its long-drawn struggle in India, with subscribers declining from 6.13 crore in October 2022 to 3.76 crore a year later, according to CLSA.

Synergies

Based on figures for FY23, the combined revenue of the joint venture, pro forma, is nearly Rs 25,000 crore. The operating profit is nearly Rs 1,800 crore and the net profit is pegged at Rs 1,300 crore.

The JV will boast 120 television channels, including Colors, StarPlus and Star Sports, and two over-the-top platforms, Hotstar and JioCinema. The merged entity will have access to over 750 million viewers across India and will also cater to the Indian diaspora across the world. It will also get access to the 460-million Reliance Jio subscriber base.

The behemoth is set to monopolise cricket broadcasting in the country as Viacom18 owns digital rights for the Indian Premier League, while Disney won the television rights for it. However, both the companies have been struggling to monetise these rights bought at nearly $6.3 billion even as payments for these are set to rise in FY25.

Disney Star India also won the overall rights for ICC events from 2024–2027, including the Cricket World Cup.

"Disney may also contribute certain additional media assets to the JV, subject to regulatory and third-party approvals," according to the joint statement.

The merger will likely improve the operating income for Disney's sports segment that has been a pain point for its India business, according to a note by Morgan Stanley. It will also limit volatility to net adds at Disney Plus, and likely have a modest but fairly immaterial negative impact on linear entertainment operating income from Star entertainment, it said.

The JV will also be granted exclusive rights to distribute Disney films and productions in India, with a licence to more than 30,000 Disney content assets, providing a full suite of entertainment options for the Indian consumer.

Shareholding Pattern

The JV will be controlled by RIL and its step-down subsidiary Viacom18, with a combined stake of over 63%, with RIL directly holding 16.34%.

Nita Ambani will be the chairperson of the combined entity, and Bodhi Tree's Uday Shankar will be the vice chairperson, according to a joint statement by both companies.

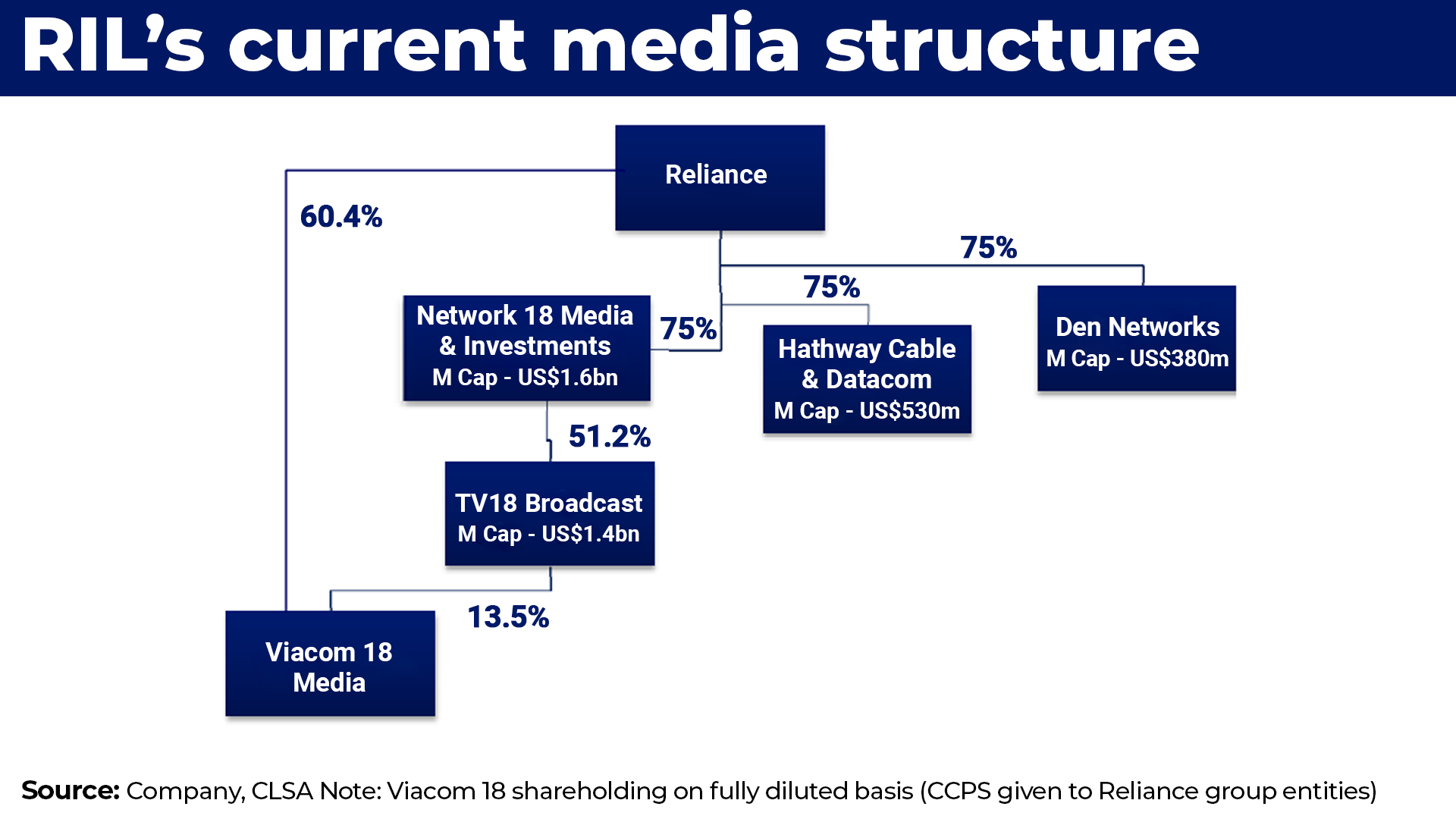

Mukesh Ambani-owned Reliance holds a 60.4% stake in Viacom18 and 13.5% is owned by TV18 Broadcast. Bodhi Tree is the second-largest shareholder in Viacom18 with a stake of 16%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.