(Bloomberg) -- The Monday meltdown across assets is hammering a slew of derivatives trades betting on enduring calm in the stock market — threatening to set off a chain reaction that could intensify the global turbulence.

Wall Street has for months been minting money with various strategies tied to stock tranquility, often via products that sell protective options in order to juice returns. But the scale of the boom in these so-called short volatility bets had stirred worries of what would happen when turbulence hit.

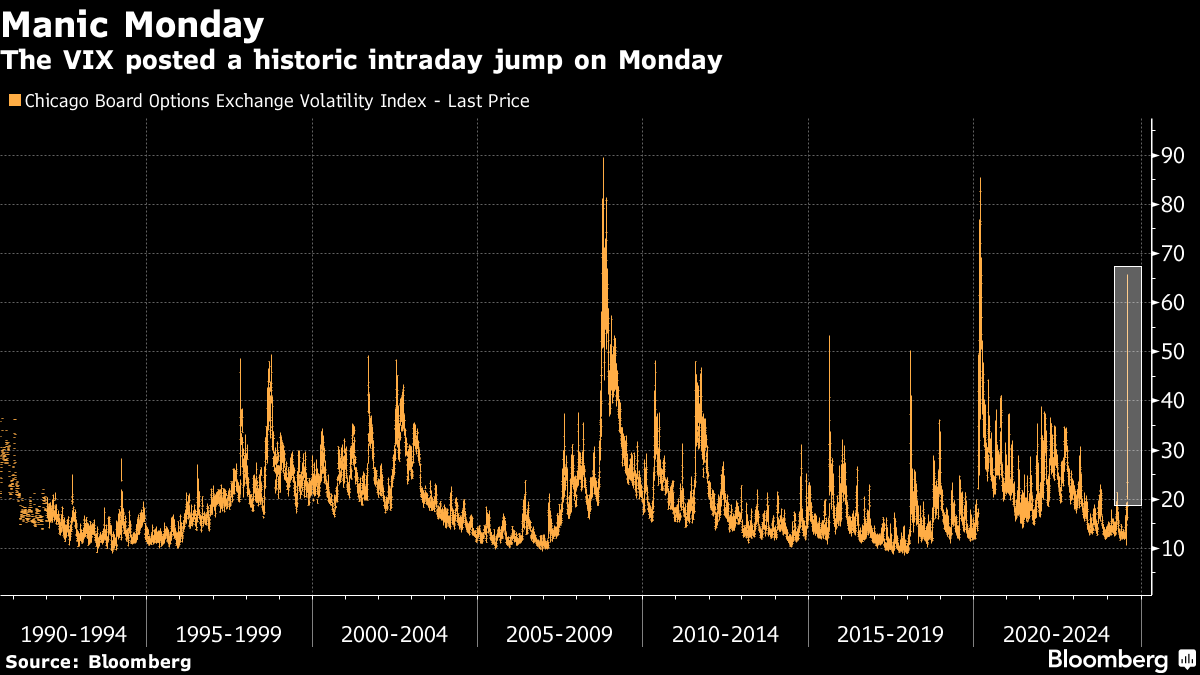

That test has now arrived. As stocks slid on Monday, the Cboe Volatility Index — Wall Street's famous “fear gauge” that tracks options on the S&P 500 Index — surged as much as 42 points in the biggest one-day spike in data going back to 1990. It was up 10 points at 12:14 p.m. in New York at the highest on a closing basis since 2021. The benchmark equity index itself dropped as much as 4.3%.

While US stocks have been on a downward trajectory recently amid concern over the American economy, the scale of the moves is raising the specter that extreme options positioning could be compounding the drop.

“You have more options, more exposure, more people trading it, and more of a lean toward a short-volatility application,” said Kris Sidial, co-chief investment officer at Ambrus Group LLC, which offers hedging strategies. “When you get these de-leveraging effects, they're going to be much more volatile than what we've historically seen.”

Compounding Declines

Short-vol trades have ballooned since Covid as the options market overall has tripled in size. By effectively offering stock insurance, sellers have been able to easily pick up premiums for years as Federal Reserve rate hikes failed to spur any big spikes in volatility.

With swings now taking hold, there are several channels through which those strategies might exacerbate declines.

One path is via market makers, who generally take the other side of short-vol trades. These dealers need to hedge their positions in order to stay neutral, and in calm markets that helps dampen any stock swings.

But if volatility selling now shrinks and investors snap up more hedges, market makers will be in the opposite position, as seen during the Covid crash. Their new hedging needs could amplify daily moves, True Partner Capital wrote in a note last week.

“Such a capitulation moment would trigger additional sales of the underlying index,” the volatility hedge fund wrote. Market makers' exposure also tends to change more quickly than in the past, the team said.

Another channel is via a popular subset of short-vol called the dispersion trade, which buys an array of single-stock options and sells similar contracts on the equity index. It is effectively a bet on different shares dancing to their own beat – or correlation staying low – which keeps a lid on the benchmark's overall volatility as they cancel each other out.

Citigroup Inc. estimated earlier this year assets in the strategy have doubled or possibly even tripped over the last three years. But in a sign of growing pressure, Cboe's three-month implied correlation index rose nearly nine points last week, its biggest surge since 2022, having fallen to the lowest since at least 2006 just a month ago.

“This can hurt dispersion positions where you're long volatility but also short this correlation,” said Matthew Yeates, deputy chief investment officer at Seven Investment Management, which invests in a dispersion fund.

The exact performance of a trade will depend on its set-up, but the key point is that the market has moved against this approach. And anyone looking to unwind their exposure will likely have to buy index volatility, contributing to the turmoil.

Whether these kinds of money flows are trumping fundamentals is a debate as old as Wall Street, and the two are ultimately impossible to disentangle.

Yet the strength and speed of this selloff – just two weeks after US economic output soundly beat expectations – looks set to add fuel to the view that the mechanical effect of certain strategies is swaying modern markets more than ever before.

“The VIX surge (as we write it is now above 50) we suspect has been enhanced by some short volatility trades getting closed out,” Michael Purves, founder at Tallbacken Capital Advisors, wrote in a note. “We need to distinguish between trading leverage moving markets and what is happening fundamentally in the economy and with corporate earnings.”

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.