The Reserve Bank of India has directed banks to disclose overdue loans to the Infrastructure Leasing and Financial Services group in their ‘notes to accounts' to avoid any underreporting of non-performing assets.

The RBI's directive followed an order by the National Company Law Appellate Tribunal asking banks not to tag loans to IL&FS and its group companies as NPAs without the court's permission. While the RBI is seeking to get that order modified, it is yet to succeed.

In the interim, the regulator has asked banks to release the following details separately:

- The loans outstanding to the IL&FS group.

- The loans overdue by more than 90 days but not marked as NPA.

- Provisions required as per the RBI's ‘Income Recognition and Asset Classification' rules.

- Provisions actually made against the accounts.

On Feb. 25, the NCLAT had issued an order stating that no financial institution will declare the accounts of the IL&FS group and its entities as NPA without prior permission of this Appellate Tribunal.

The RBI, represented by senior advocate Gopal Jain, told the NCLAT last week that it was the obligation of the banks to mark any loan as NPA after a default of 90 days, and they cannot be relieved from declaring bad loans from their account book. “The whole thing is to have a transparent and fair accounting system, so that the health of the institution is not affected,” Jain said.

However, since the order has not yet been modified, banks were left confused on how to classify overdue loans to IL&FS. The RBI's notification offers clarity and will lead to disclosure of bad loans linked to the group.

The IL&FS group began defaulting on its debt obligations in September, which promoted the central government to take over the infrastructure-financier under Sections 241 and 242 of the Companies Act, 2013.

The IL&FS group owes banks and other lenders around Rs 91,000 crore, and has 169 subsidiary companies, associate companies or special purpose vehicles incorporated in India.

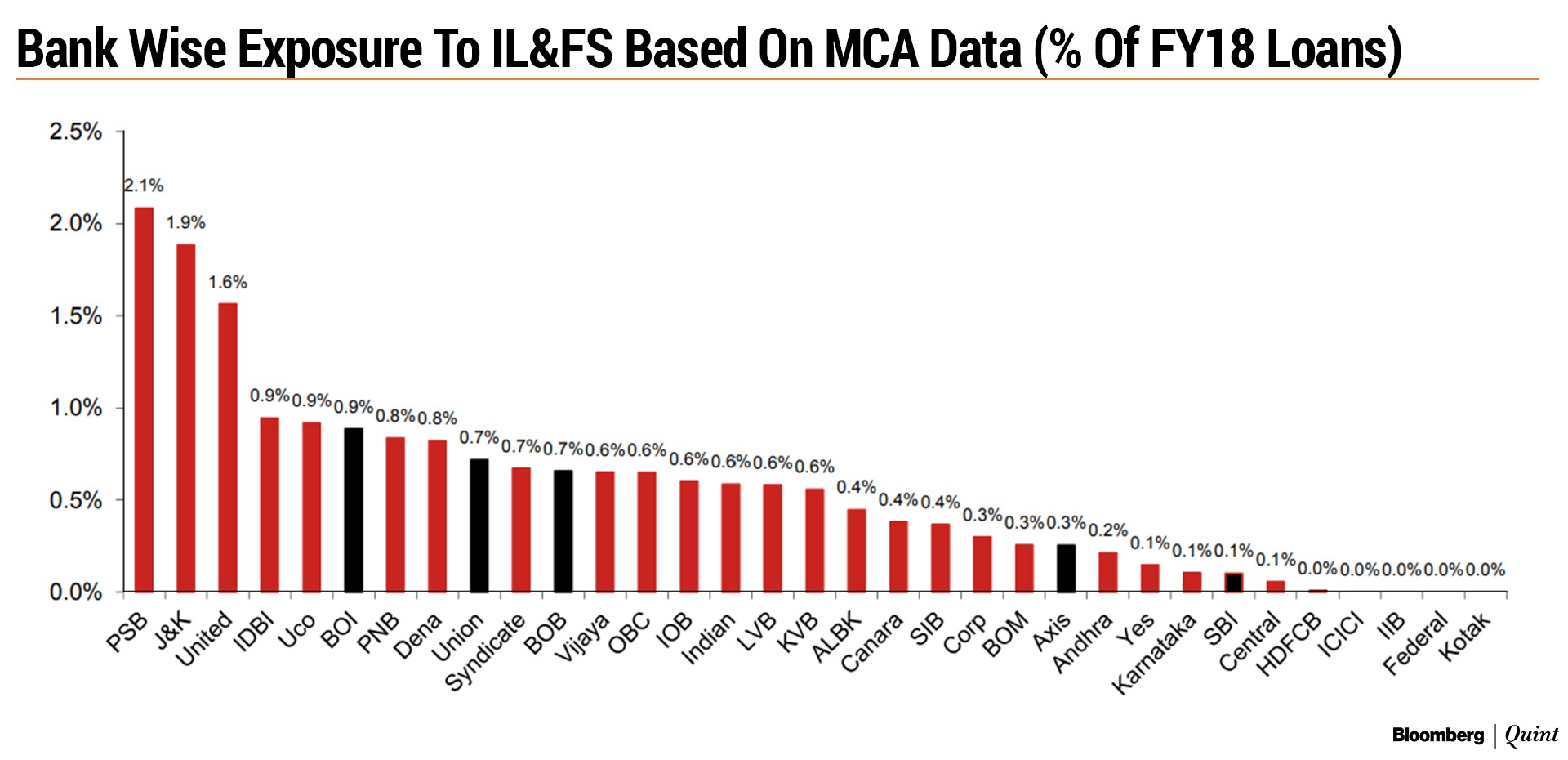

According an earlier report from Nomura Global Market Research, banks which have the highest exposure as a percentage of their assets include Punjab and Sind Bank, Jammu and Kashmir Bank and United Bank of India. To be sure, not all of these loans will turn bad. Loans to special purpose vehicles which are still servicing their debt may continue to be classified as standard.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.