Mid-sized private sector lender RBL Bank Ltd. reported a sharp fall in net profit for the second quarter of the current financial year as bad loans surged.

Net profit fell 73.4 percent year-on-year to Rs 54.3 crore in the quarter ended September. Net interest income, or the core income a bank earns, rose 46.5 percent from the last year to Rs 868.7 crore.

The bank saw a significant deterioration in asset quality.

In absolute terms, gross bad loans rose 95 percent to Rs 1,539.10 crore from Rs 789.21 crore a year ago. Slippages, or fresh loans turning bad, stood at Rs 1,377 crore in the July-September quarter.

As a percentage of total loans, the gross non performing assets ratio jumped to 2.6 percent from 1.3 percent in the first quarter of the year.

As a result of the surge in stressed assets, the bank had to push up provisions. The lender set aside Rs 533.30 crore in provisions during the quarter compared to Rs 139.86 crore in the year ago period.

Post provisions, the net NPA ratio stood at 1.56 percent compared to 0.65 percent in the June 2019-ended quarter.

Operationally, the bank reported advances growth of 27 percent and a deposit growth of 31 percent. Net interest margins stood at 4.35 percent in the second quarter compared to 4.08 percent a year ago.

Bank's Credit Quality Challenges

Commenting on the bank's credit quality challenges, chief executive officer Vishwavir Ahuja said the deteriorating economic and corporate credit environment had impacted the lender more than expected. He added that poor coordination between lenders have delayed resolutions.

The credit challenges are around a “clutch” of companies and would be accounted for within the current financial year, Ahuja said in a conference call to discuss the bank's earnings.

According to the bank's investor presentation, the total pool of stressed assets / NPA is at close to Rs 1,800 crore. “This includes the four groups (East based group, diversified media group, south based coffee group and west based plastics group) plus a buffer,” the bank said without naming the firms.

Of this, in the current quarter, the bank has recognised Rs 800 crore in additional NPAs and provided Rs 350 crore against these bad loans. The provisions made are higher than the regulatory environment, Ahuja said. He added that the remaining portion of stressed assets will be recognised in next quarter and a “small tail” in the fourth quarter.

The bank disclosed the following exposure to sectors perceived to be stressed:

- Exposure to real estate at Rs 2,500 crore. None of these accounts are in the categories of loans overdue by more than 30 days. The largest single exposure to a real estate firm is at Rs 500 crore.

- Exposure to the construction segment stood at Rs 3,956 crore.

- Exposure to non-bank finance companies stood at Rs 4,100 crore, with housing finance companies accounting for Rs 900 crore of this.

- Overall, accounts overdue by 30-60 days (special mention accounts-1) make up 0.45 percent of the total loan book. Accounts overdue by 60-90 days add up to 0.39 percent.

The bank is not seeing any stress in its retail loan book but is tightening appraisal processes as a preemptive step given the weakness in the economy, said Ahuja.

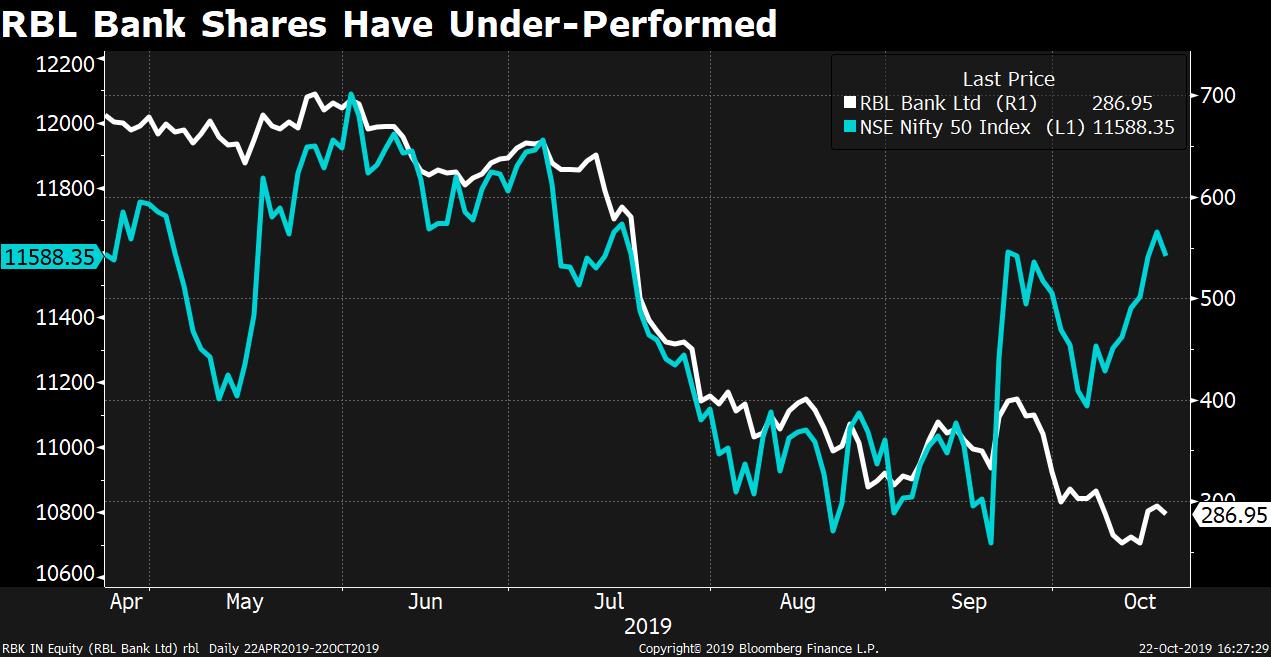

Stock Under-Performance

Shares of RBL have under-performed the markets since September due to asset quality concerns.

“For the full-year, we expect profits to be 75-80 percent of last year,” Ahuja said while giving guidance for the year. He added that the bank will start working towards a new round of capital raising before the end of the year. The bank's capital adequacy ratio stood at 11.88 percent at the end of September 2019.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.