Zee Entertainment Enterprises Ltd.'s promoters plan to sell upto half of their shareholding in India's largest broadcaster.

Over the Diwali weekend Subhash Chandra, the founder and chairman of the company, and his family met with advisors to undertake a strategic review of its businesses, said a promoter media statement filed by Zee with the stock exchanges on Nov 13.

The decision to divest upto 50 percent of promoter group Essel Group's holding to a global strategic partner will help transform Zee into a “global media-tech player” the statement added.

It is also expected to address “the Essel Group's capital allocation priorities”.

Essel Group has appointed Goldman Sachs Securities (India) Ltd. as investment banker and U.S. and Europe-based LionTree as an international strategic adviser for the stake sale.

Essel expects the outcome of the strategic review to be concluded by March/April 2019. We hope that this transaction will meet the objectives of the Essel Group as well as the minority shareholders of ZEEL.Essel Group Statement

Founded in 1992, Zee is a pioneer of private broadcasting in India and has grown from a single hindi language channel to 37 channels across 5 categories, including news and entertainment. Zee also has 39 channels in international markets, produces and distributes movies and music and recently launched ZEE5, a video-on-demand platform. In financial year 2017-18 the company, on a consolidated basis, turned a profit of Rs 1,477.8 crore on a revenue of Rs 6,685.7 crore.

Promoter Shares Pledged

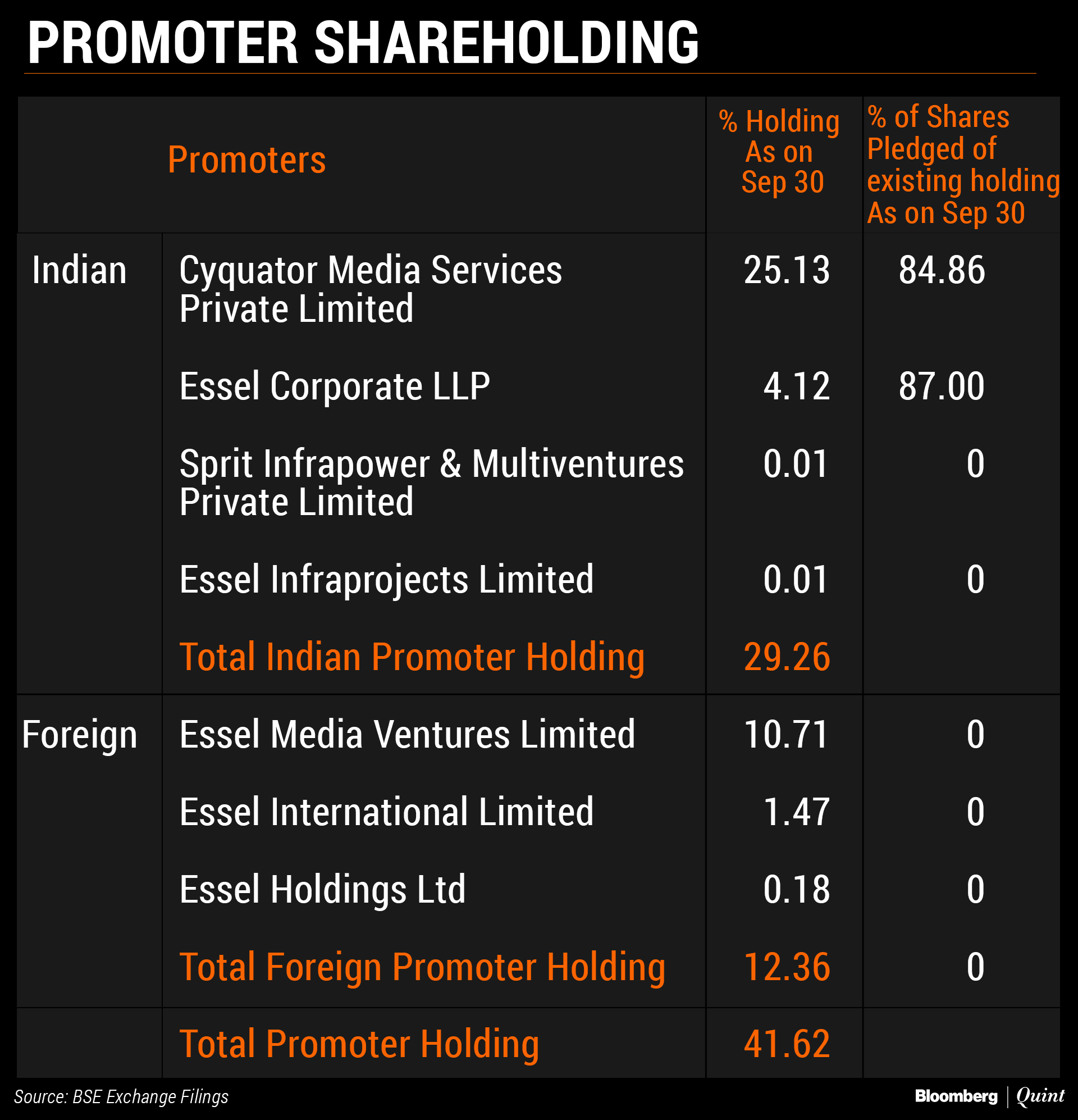

The promoters hold 41.62 percent stake in Zee Entertainment. At the current market price, that is worth Rs 17,513.5 crore.

More than half the promoter holding is pledged, amounting to a 24 percent stake in the company, according to stock exchange data.

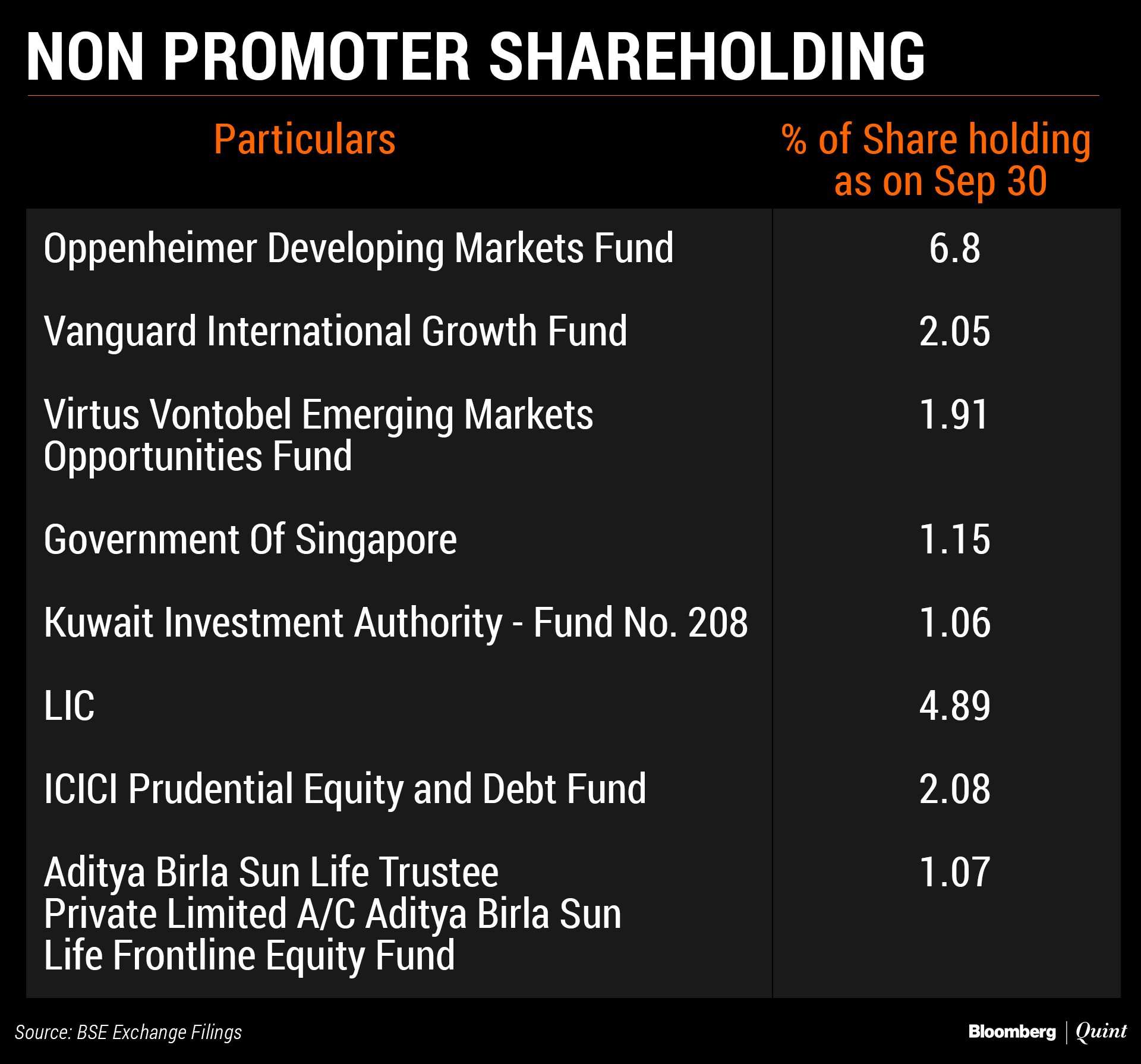

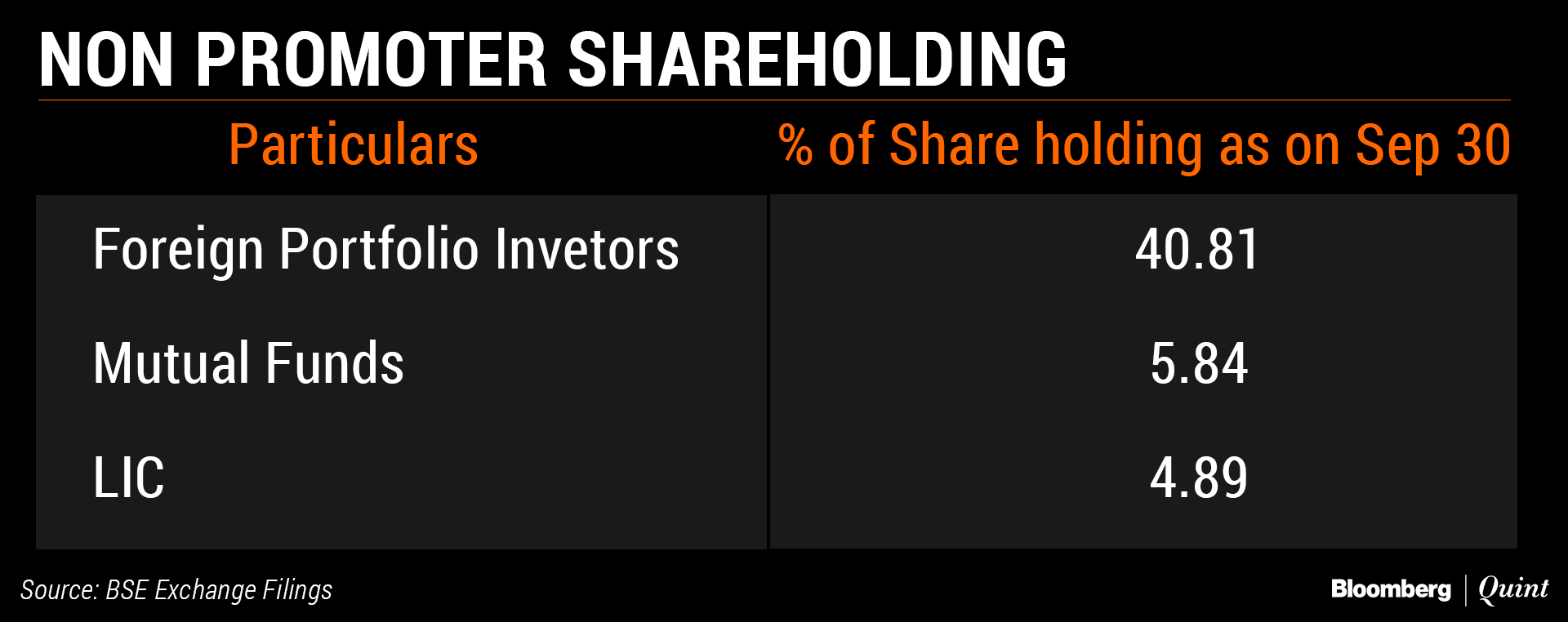

Foreign portfolio investors constitute the second largest shareholder group at Zee with 40.81 percent shareholding. Notable among them are Oppenheimer Developing Markets Fund, Vanguard International Growth Fund, Virtus Vontobel Emerging Markets Opportunities Fund, Government Of Singapore and Kuwait Investment Authority.

Indian mutual funds own just under six percent and Life Insurance Corporation five percent.

The promoter statement was filed with stock exchanges late evening on Nov. 13. Earlier in the day Zee's shares closed flat for the day at Rs 438 a piece. The market capitalisation of the industry leader has fallen by 24.70 percent from Rs 55,879.1 crore to Rs 42,078 crore on a year-to-date basis. The NIfty Media index has fared worse with a 30 percent decline whereas the diversified benchmark index, Sensex, is up some 3 percent in the same period.

Here's what brokerages made of the Zee promoter's move:

Macquarie

- Maintained ‘Outperform' with a price target of Rs 556.

- Expect a large global strategic partner to enter India media/content opportunity.

- Deal could help plug gaps w.r.t ZEE's media-tech prowess.

- Deal raises concerns on promoters' view on longevity of company's business model.

JPMorgan

- Maintained ‘Neutral' with a price target of Rs 530.

- Strategically positive development.

- Will allow Zee to leverage its content strength to transform into a Tech-Media company.

- Induction of global partner to address investor concerns of Zee's ability to be well positioned in changing media landscape.

Morgan Stanley

- Maintained ‘Underweight' with a price target of Rs 410.

- Any strategic partner that will invest would like to have significant control.

- Possibility of an open offer cannot be completely ruled out.

- Right strategic partner could help Zee to achieve leadership.

- Path to leadership is long and time consuming and requires significant investments.

Watch the full interview with Punit Goenka, MD and CEO of Zee Entertainment here:

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.