Prestige Estates Projects Ltd.'s target price was hiked by HSBC despite the company reporting a 74% year-on-year decline in consolidated profit for the September quarter. This, due to reduced debt and new projects that positioned it as a pan-India developer.

Deferred tax of Rs 106 crore impacted the company's second-quarter net profit. The real estate developer's profit declined to Rs 234.6 crore in the quarter ended September 2024, compared to Rs 910.3 crore in the year-ago period, according to an exchange filing on Tuesday.

The company also reported lower bookings in the second quarter due to fewer launches than the previous year, HSBC said. "Approvals have been slower in various micromarkets due to election-related reassignment of duties for civil servants," the brokerage said while noting that collections were also weaker.

"Following the qualified institutional placement fund raise, the company's net debt is down to Rs 3,500 crore as of Sept. 30, 2024, with a net debt-to-equity of 0.22 times," HSBC said.

The brokerage raised the target price for Prestige Estates to Rs 1,800 apiece from Rs 1,270 apiece earlier, implying an upside of 9.8% from the previous close. "We value Prestige Estates using discounted cash flow with a weighted average cost of capital of 10.4% (previously 9.9%) based on HSBC's updated cost of equity assumptions," it said.

However, HSBC is among the brokerages with the lowest target price for the stock. The brokerage maintained its 'buy' rating as it incorporated the impact of the QIP raise and new projects. "Success in the NCR could make it into a pan-India developer, which would open up multiple avenues of potential growth... While the scale of growth is ambitious, Prestige Estates has one of the best track records in executing projects."

Downside risks to brokerage's call include delay in launch approvals, slow sales of large launches, and debt buildup from newer acquisitions.

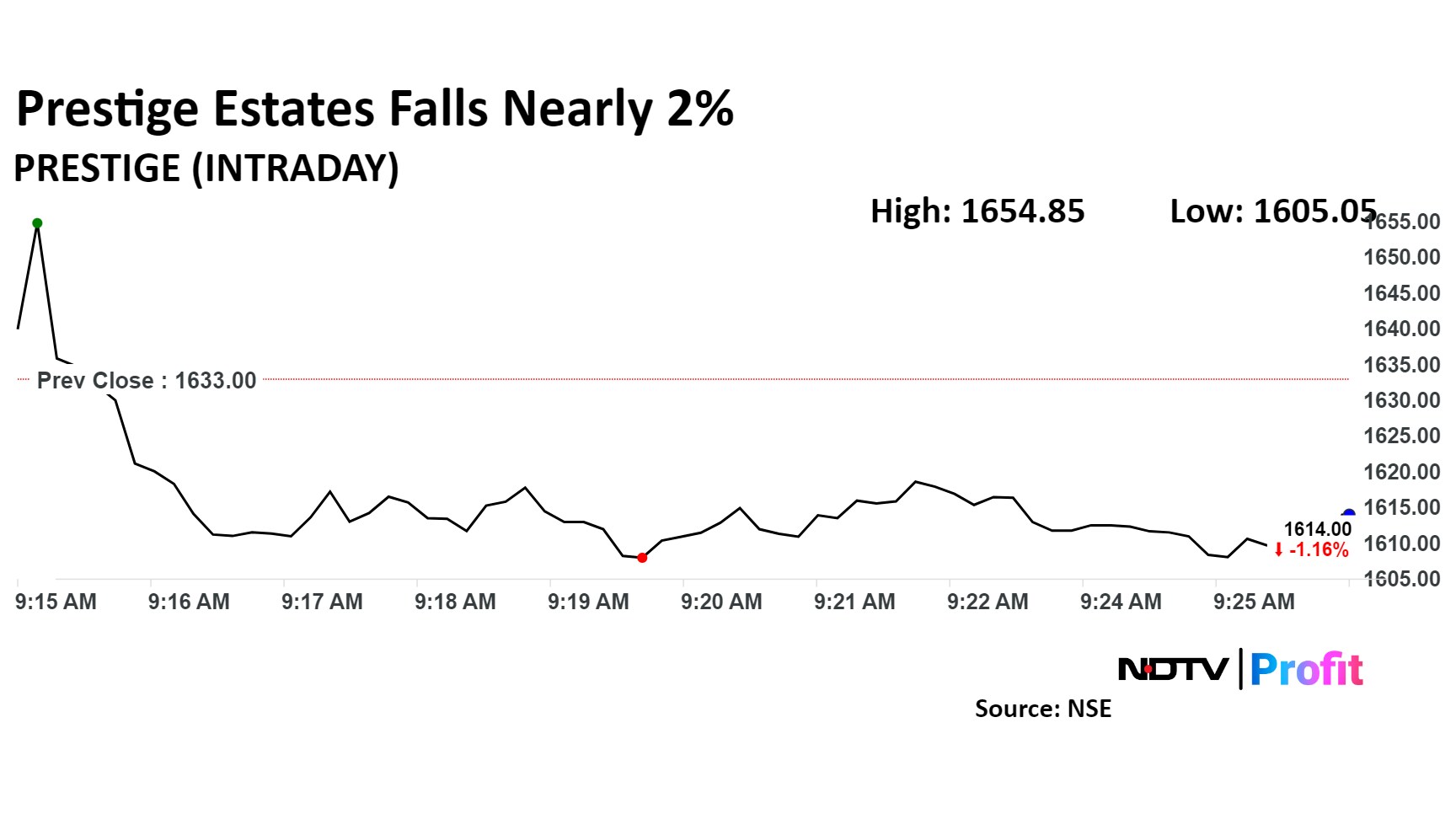

Shares of Prestige Estates fell as much as 2.12% to Rs 1,605.05 apiece, the lowest level since Oct. 31. The stock pared losses to trade 1.7% lower at Rs 1,611.80 apiece as of 9:28 a.m. This compares to a 0.9% decline in the NSE Nifty 50 Index.

The stock has risen 36.4% on a year-to-date basis and 60.37% in the last 12 months. Total traded volume so far in the day stood at 0.07 times its 30-day average. The relative strength index was at 33.43.

Out of the 19 analysts tracking the company, 16 maintain a 'buy' rating and three suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 19.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.