Jefferies has initiated on PB Fintech Ltd., the parent company of Policybazaar and Paisabazaar, with a 'buy' rating and the highest target price among the analysts tracking the stock. The rating reflects the digital broker's gains from rising insurance penetration and customer shifts to online channels, it said.

Dominant competitive positioning, an asset-light model and lower risks from industry headwinds drive PB Fintech's rich valuations, the research firm said.

The research firm has set a target price of Rs 1,150 apiece, implying an upside of 23%. This is the highest target price among the analysts tracking the stock, with Citi setting the same target price.

Large digital intermediaries benefit from industry-leading growth driven by consumer shifts to online channels, a diversified product base (life and non-life) to ride market cycles, growing negotiating power with better quality business and a large premium base, and improving profitability on the back of stable fee rates and economies of scale. Also, they are less impacted by potential sector disruptions like composite licencing, according to Jefferies.

PB Fintech's revenue is expected to grow at a CAGR of 27%, while Ebitda would jump five times over FY23–27E. The growth is driven by a doubling of Ebitda margins in the online business segment, which constitutes 70% of revenues, rising to +30%, the research firm said in a Feb. 11 note.

Factors contributing to this include higher renewal revenue, operational leverage, and the EBITDA break-even of new initiatives, coupled with a reduction in ESOP costs.

"Even with the normalised base in FY25E, Ebitda should jump exponentially by times over FY25–27E," the research firm said.

Policybazaar To Gain Market Share

Policybazaar, PB Fintech's insurance web-aggregator, currently dominates the online channel with over 90% share. The company's focus on high-growth segments such as retail protection (health and term life) and savings (capital guarantee) is anticipated to drive a 31% CAGR in premiums from FY24 to FY27, and this should drive twice as much industry growth in premiums.

This strategic will increase Policybazaar's market share in the overall systems and private sector commission pool by 150 basis points to 4% and 7%, respectively.

Paisabazaar Growth To Moderate Post RBI Measure

Credit origination (loans and cards) make up 17% of revenue, and with the recent RBI measure on unsecured loans, Jefferies expects moderation in revenue growth of 22% CAGR over FY24–27E (vs. 31% in FY24E).

Profitability will improve with operating leverage, and Ebitda margins are on track to touch 20% by FY27E.

According to Jefferies, the key risks, including fintech regulation, are still evolving in India and remain the key risk across players. Besides this, business risk arises from the emergence of strong competitors.

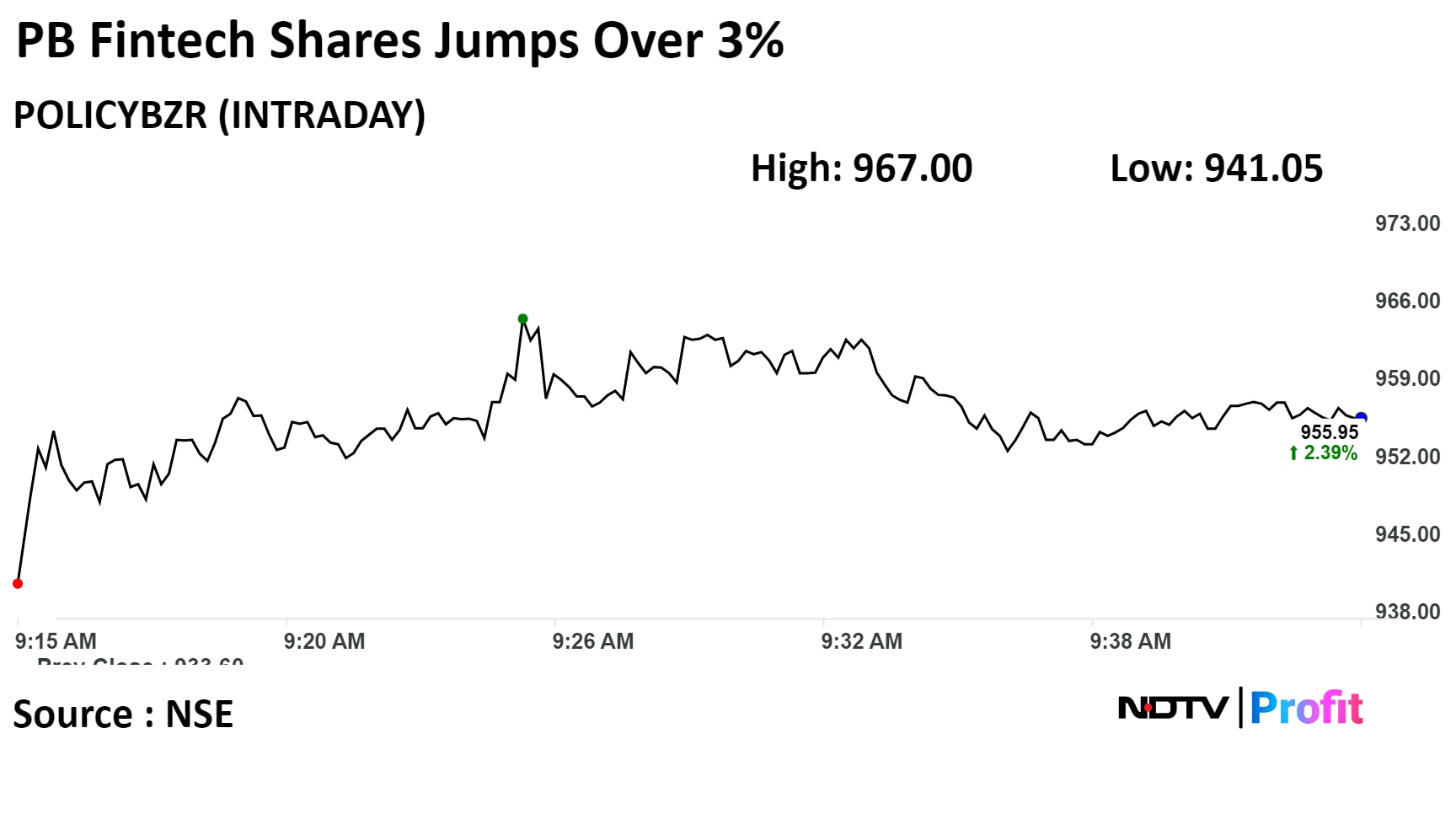

Shares of PB Fintech rose as much as 3.58% to Rs 967. It is trading 2.58% higher at Rs 957.65 at 9.42 a.m. This compares to a 0.15% decline in the NSE Nifty 50.

Of the 18 analysts tracking the company, 12 maintain a 'buy', three recommends a 'hold,' and three suggests a 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 2%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.