(Bloomberg) -- China ramped up its support for the yuan via the daily reference rate, as market sentiment took a hit after Moody's Investors Service cut its credit outlook for the nation.

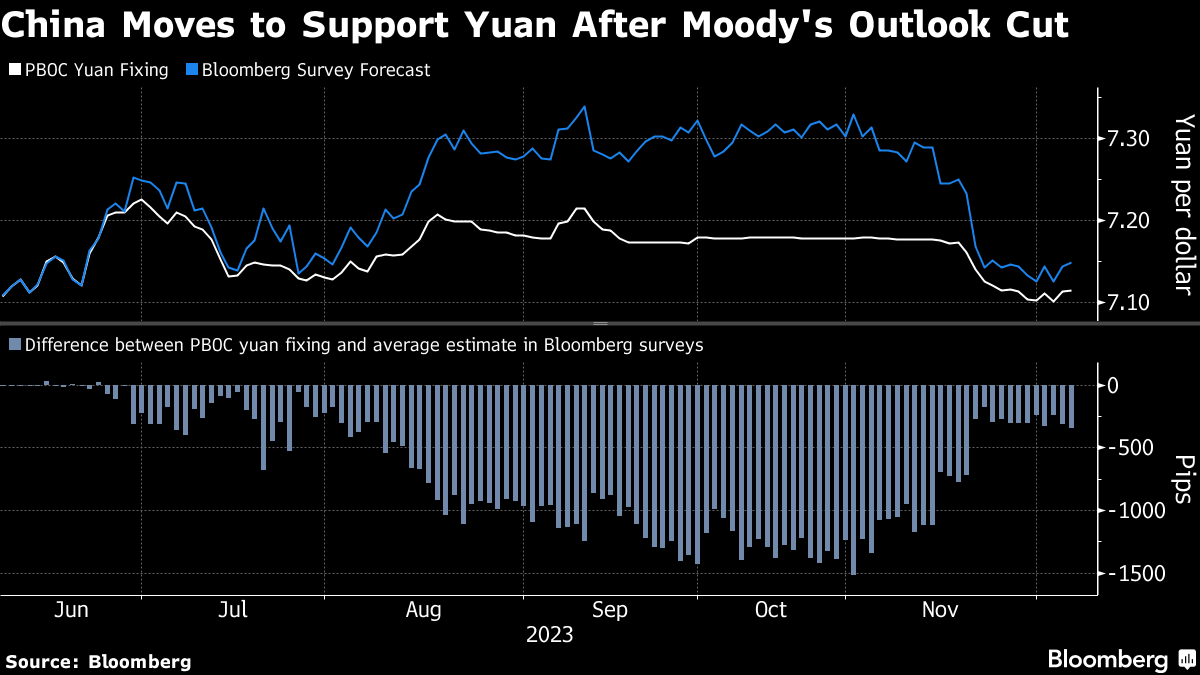

The PBOC set the daily reference rate at 7.1140 per dollar, versus an average estimate at 7.1486 in a Bloomberg survey with analysts and traders. The gap between the two was the largest in more than two weeks, a sign that Beijing is boosting its efforts to prevent declines in the Chinese currency.

“Policymakers just want to keep up with the same messaging of wanting a steady yuan and not let Moody's derail the policymakers' efforts,” said Christopher Wong, strategist at Oversea Chinese Banking Corp. The market “can't rule out policymakers stepping in if there is excessive volatility in yuan.”

Moody's Investors Service cut its outlook for Chinese sovereign bonds to negative on Tuesday, citing the nation's increased usage of fiscal stimulus and property market downturn. The yuan weakened in both onshore and overseas trading overnight amid fragile sentiment and a stronger dollar, even after some of China's state banks sold the greenback to bolster the local currency earlier.

In October, Chinese President Xi Jinping signaled that a sharp slowdown in growth and lingering deflationary risks won't be tolerated, as the government increased its headline budget deficit to the largest in three decades. At 3.8% for 2023, the deficit-to-GDP ratio is well above a long-adhered to 3% limit.

“Depreciation pressure on the yuan at least in the near-term will likely persist,” said Kiyong Seong, lead Asia macro strategist at Societe Generale SA in Hong Kong. While the fixing was stronger than the forecast, “the PBOC is not as aggressive as it was in the past months yet.”

Moody's Cuts China Credit Outlook to Negative on Rising Debt (1)

--With assistance from Qizi Sun.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.