That Ola Electric Ltd. is India's largest electric two-wheeler maker isn't up for debate. It's nightmare of an aftersales experience is hard to ignore either.

Conversations with over a dozen Ola Electric customers in Mumbai and Bengaluru—two of the biggest EV markets in India—have revealed that Ola S1 scooters are plagued with malfunctioning hardware and glitching software. Spares are hard to come by, resulting in inordinate delays. Across India, service centres are overwhelmed with nearly a lakh complaints every month, according to some estimates.

That's resulted in a pile-up and a backlog.

Hundreds of Ola Electric scooters awaiting service and repairs at a stockyard in Thane. (Photo: Tushar Deep Singh/NDTV Profit)

At Thane's service centre, 3,500-4,000 Ola Electric scooters are awaiting repairs, according to people NDTV Profit spoke with at the location. In Vashi, Ola Electric is accepting service requests without generating a so-called job card. In Chembur, Manoj—an electrician by profession—has been making trips to the “experience centre” for months just to keep his scooter running.

“I spent more than Rs 1 lakh to purchase this electric scooter, hoping that it would help me save fuel costs. But I'm constantly making trips to get it fixed,” Manoj said. “Isse achha toh petrol gaadi hi tha (my petrol motorcycle was better than this).”

Manoj purchased his Ola scooter in January this year. The vehicle first went for repairs in February, then again in March, and twice in June to replace the motor under warranty. On Saturday, when NDTV Profit caught with him at Chembur, his scooter had stalled yet again.

Then, there's Mayur Bhagat at Ola's experience centre in Vashi.

His Ola S1 Pro has been plagued with problems from Day 1, as he claims. He purchased the vehicle in July this year. His is a software glitch—the app refuses to connect with the vehicle—which hasn't been fixed despite the company keeping the vehicle for nearly a month. He said he has no other option but to continue making trips to the service centre.

“That Ola Electric operates its own dealerships is the biggest problem. If the dealerships were handled by franchise partners, the issues would've been minimised,” he said.

Business Model

Ola Electric has a direct-to-consumer business model, where it owns and operates all of its 500+ “experience centres” and 430 service stations across the country. The service points, in turn, operate as hub-and-spoke: one large service centre in a city with all spare parts and smaller touchpoints within the experience centres. The large service centre has 10-15 technical engineers with capacity of 10-20 vehicles per day.

“Most service centres have a huge backlog of service requests, almost 5-10 times the capacity,” HSBC Securities and Capital Markets (India) Pvt. said in a Sept. 25 report. “The company did not invest enough servicing capacity compared to sales volume in the past two years.”

There is an acute shortage of skilled manpower and test equipment at most service centres. Maintenance itself is lacking.

At its core, however, the company's troubles are to do with its culture.

“This is essentially a service enterprise building a product,” the analyst, who has been tracking India's automobile industry for more than decade, told NDTV Profit on the condition of anonymity. An app can be rolled out in beta and improved upon over subsequent iterations. An automobile doesn't exactly work the same way.

“The learnings from building an app cannot be extrapolated into manufacturing a scooter.”

A one-room, one-person Ola Electric service centre inside a shopping complex in Vashi, Mumbai. (Photo: Tushar Deep Singh/NDTV Profit)

Sales vs Service

What the analyst cannot fathom is Ola Electric's ever growing sales despite a flawed product. CEO Bhavish Aggarwal's Twitter timeline often resembles a complaint box but people are still buying his scooters.

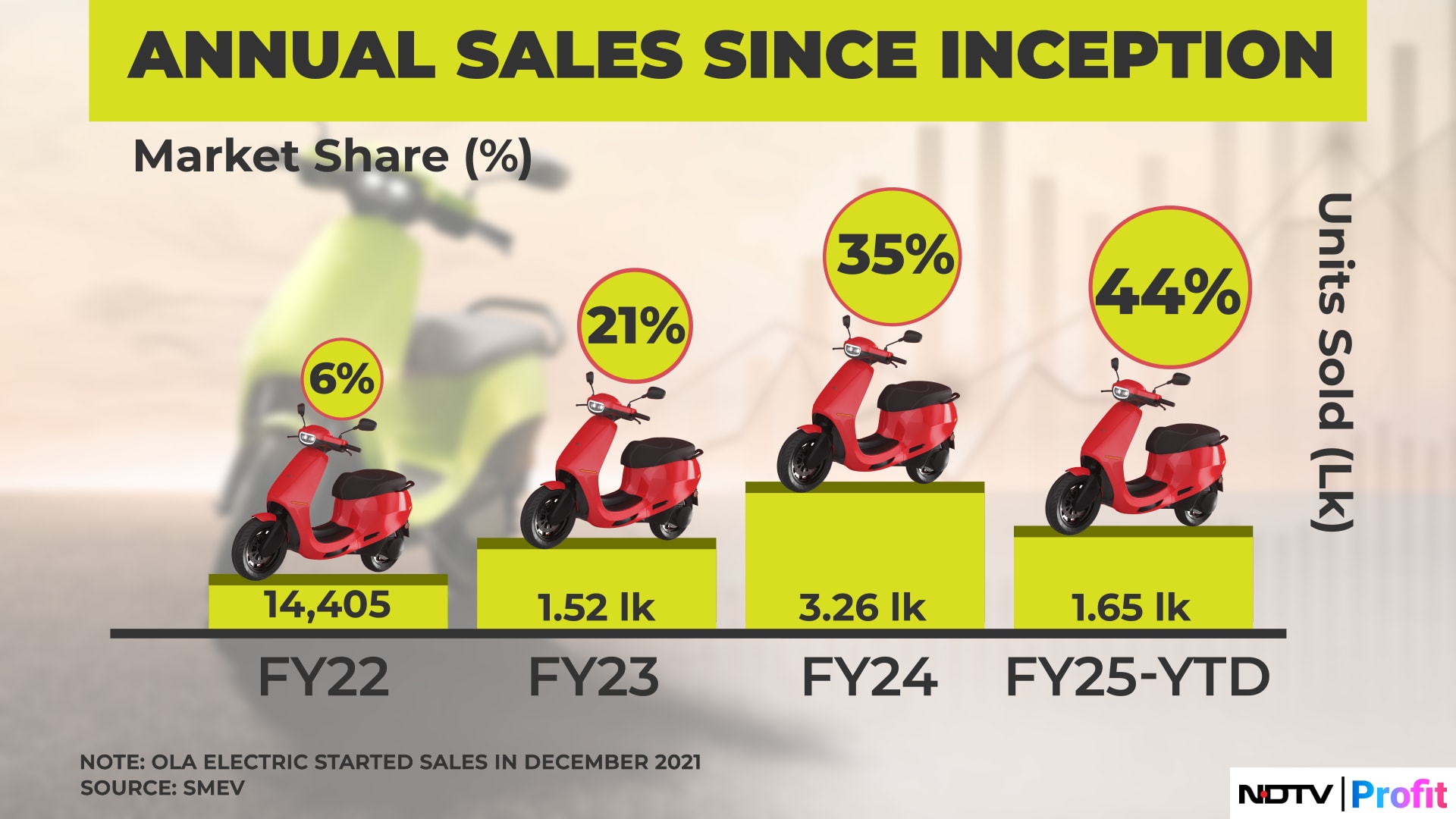

In less than five years of operations, Ola Electric has sold nearly seven lakh electric scooters, cornering nearly a third of the nascent, but fast-growing, electric two-wheeler industry in India. The company averages 35,000 units per month—outpacing incumbents and upstarts alike.

That tearaway growth was capped by an initial public offering in August this year and a rallying stock that's emerged as a favourite among analysts.

Ola Electric CEO Bhavish Aggarwal (centre left) and other dignitaries at the company's listing ceremony at the National Stock Exchange in Mumbai on 9 August 2024. (Photo: Tushar Deep Singh/NDTV Profit)

“Ola Electric leads the electric two-wheeler segment with highest margin and strong path to profitability,” Bernstein analysts Venugopal Garre and Ankit Agarwal said in a Sept. 25 note titled ‘India Electric Vehicles: Unit Economics Of Electric Bikes'.

Ola Electric enjoys a gross margin of 18.4% as compared to rivals TVS Motor Co. Ltd., Bajaj Auto Ltd. and Ather Energy Pvt. Ltd. with 14%, 12.3% and 7%, respectively. That's despite Ola Electric pricing its scooters 10-25% cheaper than competition.

India's first listed pureplay EV maker is inching closer to operational profitability as well. In the quarter ended June 30, the company had an EBITDA margin of -2% while TVS, Bajaj Auto and Ather Energy trailed behind at -7.9%, -10.4% and -37%, respectively.

But the mounting service troubles are seemingly starting to rub off on monthly sales.

Recently, Ola Electric clocked its lowest monthly sales so far this year, even as Bajaj Auto and TVS Motor caught up—in terms of volumes as well as market share.

Unit sales of the Bengaluru-based company rose 47% year-on-year, but fell 34% from the previous month, to 27,506 units in August, according to vehicle registration data available on the government's VAHAN portal. TVS iQube sales increased 13.28% year-on-year to 15,484 units. Bajaj Chetak sales surged 154% year-on-year to 16,699 units.

As on Aug. 31, Ola Electric enjoyed a market share of 31% as against 20% and 19% for TVS Motor and Bajaj Auto, respectively.

Diversification Plans

At Sankalp 2024, Ola Electric's annual event on Aug. 15, CEO Bhavish Aggarwal unveiled the company's Roadster range of motorcycles likely to go on sale in 2025. Additionally, he showcased the indigenously develped ‘Bharat 4680 Cell' that will power the S1 scooters from the first quarter of Fiscal 2026.

The idea is to become self-reliant, as far as battery needs are concerned, Aggarwal had told NDTV Profit in June 2024. That, in turn, brings a cost as well as competitive advantage.

Ola Electric CEO Bhavish Aggarwal unveils the company's Roadster range of motorcycles at an event in Bengaluru on 15 August 2024. (Photo: Rishabh Bhatnagar/NDTV Profit)

Ola Electric is the biggest beneficiary of the government's production-linked incentive scheme for manufacturing of advanced chemistry cells in India. The company is building a 20 GWh Gigafactory close to its Futurefactory in Krishnagiri, Tamil Nadu. It plans to invest $100 million in the first phase to build a 5 GWh production capacity—enough to power 1.2 million electric scooters.

“The biggest, costliest component in electric vehicles is the battery, and that's where we started focusing on building our cells four years ago,” Aggarwal had said then. “So, we built a lab (Battery Innovation Centre in Bengaluru) to prove our technology. The next step was the Gigafactory, where trial production started a few weeks ago.”

“When we complete Phase 1, through all of next year, we will have enough capacity to serve ourselves by that time, as well as potentially sell to other automakers.”

The Overhang

Ola Electric CEO Bhavish Aggarwal. (Photo: NDTV Profit)

But before Ola Electric diversifies, its core business of electric scooters needs an immediate fix. Irate customers have moved on from venting their ire on Aggarwal's Twitter timeline to parading their defective scooters and torching showrooms. Harish Thombre, an advocate and disgruntled Ola Electric customer, has warned of legal action to stall manufacturing until the service issues are fixed.

On Monday, Sept. 23, NDTV Profit sent an email to Ola Electric to know their side of the story. The email included the following questions:

How many Ola electric scooters are awaiting service at Ola service centres?

What is monthly average backlog like at Ola's service centres across India?

What is Ola Electric doing to address the aftersales/service-related complaints?

Is there a delay in parts availability at Ola service centres? If yes, by how much?

On Wednesday, after NDTV Profit aired its ground report, the company declined comment.

To be sure, Ola Electric has started taking corrective measures. According to the HSBC Securities report, the company is hiring more service staff with an aim to attend to five-seven vehicles per day, per employee. Availability of spare parts has improved significantly over the past couple of months. But an improvement in service quality—on par with those of rivals—is critical before the electric motorcycles go on sale next year.

Ola Electric believes the future is electric, it's quite rightly so, but these existing aftersales issues are beyond teething troubles. After all, a market leader has to set the standard. A vehicle's ownership begins after it leaves the showroom floor, and that's where the Ola experience is broken.

WATCH | The Ola Service Shocker

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.