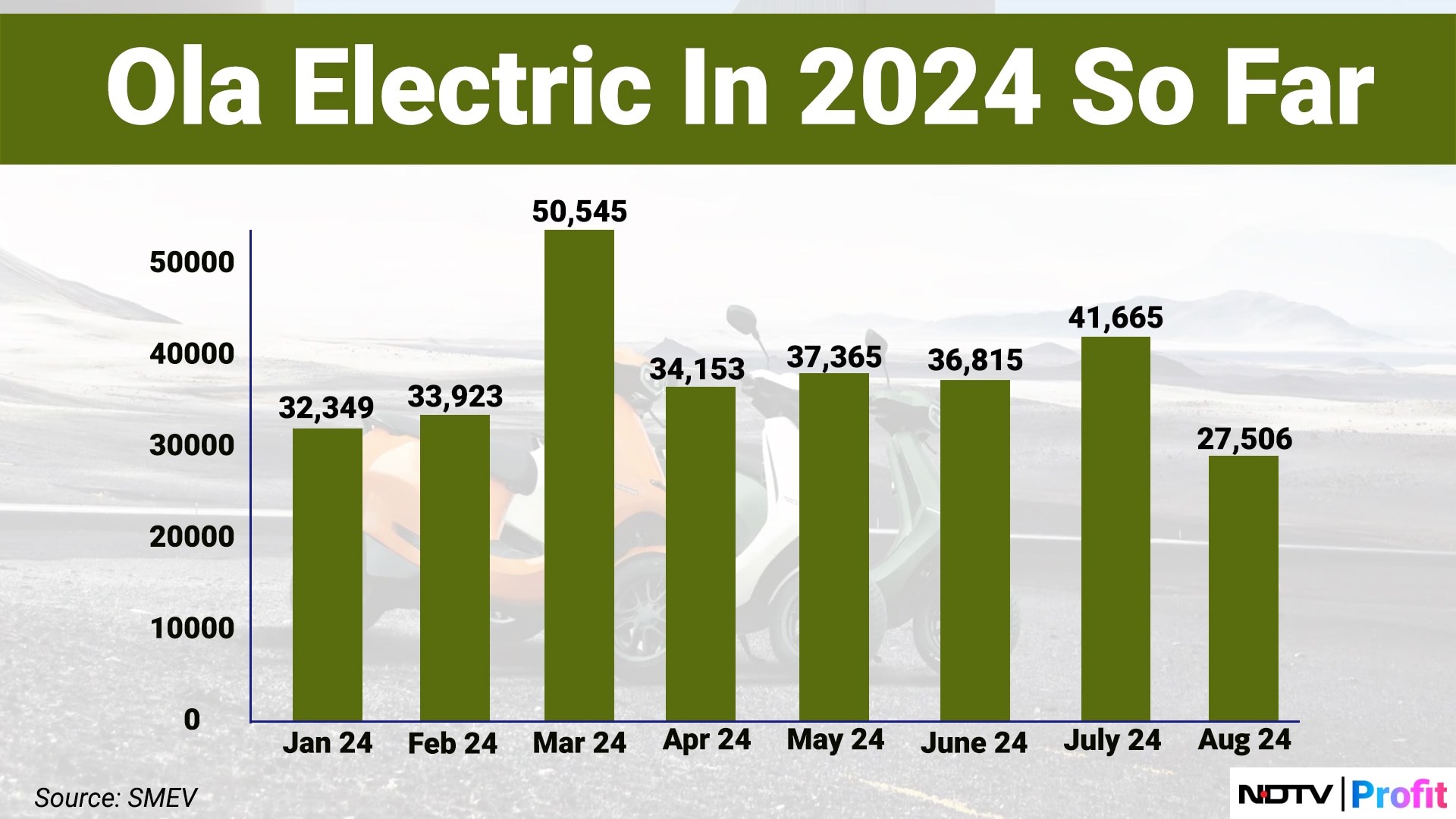

Ola Electric Ltd. has clocked its lowest monthly sales so far this year, even as rivals Bajaj Auto Ltd. and TVS Motor Co. caught up—in terms of volumes as well as market share.

Electric two-wheeler sales of the Bengaluru-based company rose 47% year-on-year, but fell 34% sequentially to 27,506 units, according to vehicle registration data available on the central government's VAHAN portal. In comparison, TVS iQube sales increased 13.28% year-on-year to 15,484 units. Bajaj Chetak sales surged 154% year-on-year to 16,699 units.

As on Aug. 31, Ola Electric had a market share of 31% in India's electric two-wheeler market as against 20% and 19% for TVS and Bajaj Auto, respectively.

To be sure, the electric two-wheeler industry itself grew in August, as a two-month extension in Electric Mobility Promotion Scheme 2024 supported volumes.

According to VAHAN data, 88,451 electric two-wheelers were registered in August 2024, as against 62,767 units in the year-ago period—a growth of 41% year-on-year. Sequentially, however, the industry shrank 41.5%.

The surge in volumes of the TVS iQube and Bajaj Chetak can be attributed to the newer, cheaper models introduced by the incumbents.

While the Chennai-based automaker retails five variants of the electric scooter at price points rivalling Ola Electric's offerings, Bajaj Auto has breached the Rs 1-lakh mark with the 'Chetak 2901' model. Additionally, the electric scooter is now available at more than 500 outlets, as against just 200 a quarter ago.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.