NTPC Inks 50:50 Join Venture Deal With Rajasthan Government For Thermal Power Plant

NTPC will maintain management control of the plant and will have the authority to appoint key executive roles, including the CEO, CFO, and COO.

NTPC Ltd. has entered into a 50:50 joint venture agreement with the Rajasthan Rajya Vidyut Utpadan Nigam Ltd. (RVUNL) to own and operate the Chhabra Thermal Power Plant, located in Rajasthan. The deal, signed on Nov. 4, will see the two entities equally share ownership and operational control of the power plant, which has a total installed capacity of 2,320 MW.

The Chhabra plant comprises two stages: Stage-1 with four 250 MW units, and Stage-2 with two 660 MW units. According to the terms of the agreement, both parties have mutually agreed to form a JV company that will not only manage the existing plant but will also explore potential capacity expansion opportunities in the future.

As part of the JV agreement, both NTPC and RVUNL will have equal rights to appoint directors to the JV’s board. However, NTPC will maintain management control of the plant and will have the authority to appoint key executive roles, including the Chief Executive Officer, Chief Financial Officer, and Chief Operating Officer. Additionally, the agreement includes a right of first refusal to the other promoter in case of any share selling.

The partnership is not considered a related party transaction, and there are no conflicts of interest arising from the agreement. Neither of the parties has any shareholding in each other, nor does the agreement involve the issuance of shares.

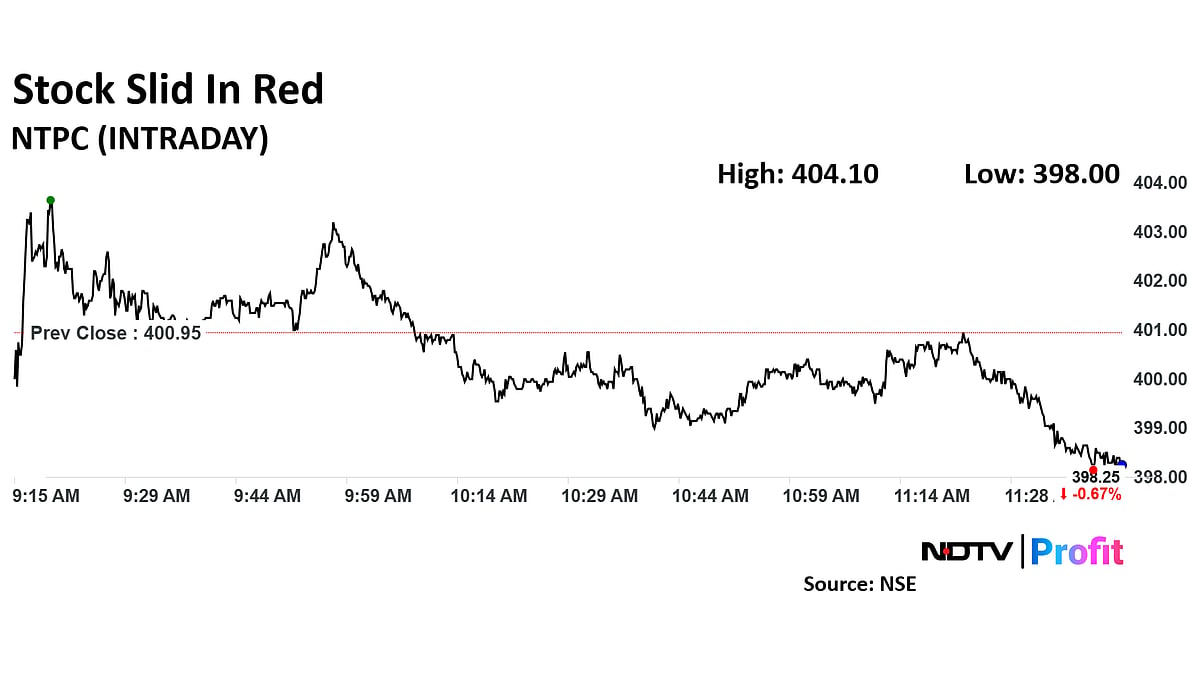

Shares of NTPC rose as much as 0.79% to Rs 404.10 apiece. The stock later gave up the gains to trade 0.46% lower at Rs 399.10 apiece as of 11:38 a.m. This compares to a 0.41% decline in the NSE Nifty 50 Index.

The stock has risen 69.22% in the last 12 months. Total traded volume so far in the day stood at 0.21 times its 30-day average. The relative strength index was at 39.

Out of 24 analysts tracking the company, 19 maintain a 'buy' rating, two recommend a 'hold,' and three suggest a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 11.1%.