India's Monetary Policy Committee decided to keep interest rates unchanged, extending a pause in its monetary easing cycle which was described as temporary in December. The committee reiterated that its monetary policy stance remains 'accommodative' for as long as it is necessary to revive growth, but decided to maintain a status quo on policy rates amid elevated inflation.

Concluding its three-day meet, the committee voted to keep the repo rate unchanged at 5.15 percent. The committee has pared rates by 135 basis points in the current cycle.

"The MPC recognises that there is policy space available for future action. The path of inflation is, however, elevated and on a rising trajectory through Q4 2019-20. The outlook for inflation is highly uncertain at this juncture. On the other hand, economic activity remains subdued and the few indicators that have moved up recently are yet to gain traction in a more broad-based manner. Given the evolving growth-inflation dynamics, the MPC felt it appropriate to maintain status quo," the committee's resolution said.

The MPC decision was in-line with market expectations. All 36 economists polled by Bloomberg had forecast a status quo in rates.

Key Highlights - Monetary Policy

- MPC keeps repo rate unchanged at 5.15%

- MPC keeps reverse repo rate unchanged at 4.9%

- MPC keeps monetary policy stance unchanged at accommodative

- MPC votes 6-0 to keep rates unchanged

- MPC pegs FY21 growth at 6%

- MPC sees Q4 FY20 inflation at 6.5%; H1 FY21 inflation at 5.4-5%

Key Highlights - Liquidity Framework

- RBI accepts recommendations of committee on liquidity management

- Weighted average call rate to remain operating target

- RBI to ensure adequate liquidity as warranted "unrestricted by quantitatve ceilings"

- RBI to introduce Long Term Repo Operations for one and three year tenures. These will not replace open market operations.

Key Highlights - Incentives For Credit Flow

- RBI provides incentive to spur credit flow for auto, residential housing, MSME loans

- Banks will not need to set aside CRR against incremental lending to these segments

- Restructuring scheme for MSME loans extended by a year

- Floating rate loans to medium enterprises to be linked to external benchmark

- No asset classification downgrade for one year for certain delayed commercial real estate projects

Inflation Outlook

The pause in a nearly year-long rate cutting cycle in 2019 came after a surge in retail inflation, which rose to 7.35 percent in December from 5.54 percent in November. The surge in inflation was led by a 12.6 percent rise in food and beverage inflation. Apart from vegetables, other food items, such as cereals, meat, fish, milk and milk products, are also seeing higher prices. However, core inflation, which is a better indicator of demand conditions, remains low at under 4 percent.

The MPC now expects retail inflation at 6.5 percent in the fourth quarter of FY20 and at 5.4-5 percent the first half of FY21. Inflation is seen falling to 3.2 percent in the third quarter of next year.

"The MPC anticipates that the combination of these factors may keep headline inflation elevated in the short-run, at least through H1:2020-21. Overall, the inflation outlook remains highly uncertain. Accordingly, the MPC will remain vigilant about the potential generalisation of inflationary pressures as several of the underlying factors cited earlier appear to be operating in concert," the committee said.

Growth Outlook

Growth indicators, while weak, have not deteriorated further between the December and February MPC meetings.

GDP growth is seen falling to 5 percent in FY20. Both consumption and private investment have weakened, leaving government spending as the only support for the economy. In its Union Budget presentation, the government said its budget gap rose to 3.8 percent in FY20. It is targeting to bring this down to 3.5 percent in FY21.

Despite the projected fall in the headline fiscal deficit, the budget does build in some fiscal support to growth, economists said after the budget announcement. Ahead of the budget, RBI Governor Shaktikanta Das had called for fiscal support and structural reforms to aid a durable growth recovery. Monetary policy, Das said, has its limitations.

The MPC is forecasting GDP growth at 6 percent in FY21, similar to an estimate of 6-6.5 percent put out by the Economic Survey.

Noting the Union Budget's fiscal targets, the MPC noted the need for adjustment in interest rates on small saving schemes. However, it added that the external benchmark system has strengthened monetary transmission and should aid growth going forward.

Pushing Credit Flow

While the MPC decision may have been discounted, “don't discount the RBI”, said Governor Shaktikanta Das while speaking at a press conference after the policy. “The RBI has many tools at its disposal,” he added.

The words summed up a return to more a more active ‘credit policy' by the full-service service central bank, which is also the banking regulator. The RBI on Thursday announced a series of measures to incentivise credit flow and reduce risk aversion in the sector.

- Banks have been provided incentives to lend to retail segments like auto, housing and to small businesses

- The incremental lending to these segments will not be counted to calculate net demand and time liabilities and will be exempt from CRR.

- The RBI has also extended the scheme for restructuring of MSME loans.

- For incomplete real estate projects, the RBI has allowed a year of delay in the date of commencement of commercial operations before banks downgrade the asset classification of the project.

Responding to these decisions Jaideep Iyer, head of strategy at RBL Bank said it was quite critical to have some policy measures to ensure banks overcome some risk aversion.

Firstly, the regulator is giving a message that they would want encouragement of credit transmission to specific sectors. Secondly, they have given absolute benefit in terms of incentivising banks by exempting them from Net Demand and Time Liabilities (NDTL) requirements for incremental lending. That's a reasonably significant move as it would result in a percentage point benefit to banks.Jaideep Iyer, Head - Strategy, RBL Bank

Liquidity Framework

The RBI separately said that it is accepting an internal committee's recommendations on the liquidity framework.

As per the new framework:

- The weighted average call rate (WACR) will continue to be its operating target.

- The liquidity management corridor is retained, with the marginal standing facility (MSF) rate as its upper bound (ceiling) and the fixed rate reverse repo rate as the lower bound (floor), with the policy repo rate in the middle of the corridor.

- With the WACR being the single operating target, the need for specifying a one-sided target for liquidity provision of one percent of net demand and time liabilities (NDTL) does not arise.

- However, the Reserve Bank will ensure adequate provision/absorption of liquidity as warranted by underlying and evolving market conditions - unrestricted by quantitative ceilings - at or around the policy rate.

The combined impact of the MPC and RBI decisions indicate that liquidity will remain in surplus and rates pointed downwards, said Arvind Chari, head of fixed income at Quantum Advisors

What is more critical now is there is no quantitative target of how they will manage liquidity. Initially, we used to work in that +1/-1 percent of Net Demand And Time Liabilities (NDTL). And, going along with that statement is the stance where they will remain accommodative as long as it is possible to revive growth. These two statements should be read together to say that liquidity will remain in surplus. This means short term rates and short term deposits will have the pressure to keep coming down.Arvind Chari, Head- Fixed Income, Quantum Advisors

The banking regulator also announced long term repo operations to ensure comfortable liquidity conditions. The RBI will be conducting these operations for term repos of one-year and three-year tenors of appropriate sizes for up to a total amount of Rs 1 lakh crore at the policy repo rate. These operations will be conducted from the fortnight beginning February 15, the RBI said in its statement on developmental and regulatory policies.

These long term repo operations will not replace open market operations, clarified RBI deputy governor Michael Patra.

Chari likened RBI Governor Shaktikanta Das' actions to that of former European Central Bank President Mario Draghi. “It is similar to what ECB had done to 1-3 years Long Term Refinancing Operations (LTROs). It is a significant move. So bankers will get 1 or 3 year-dedicated money at 5.15 percent. This is a big benefit for NBFC space as a few players were struggling to get money from the bond market. They might be able to access the banking sector through this route.”

The MPC has expectedly kept the policy rate and stance unchanged given the inflation trajectory overshooting beyond the upper level of the target band of the committee. Very aptly, the MPC has addressed the growth concerns through pushing transmission via tweaking the liquidity framework, providing LTROs and incentivising credit to select sectors. We expect these measures to aid transmission with the shorter end of the yield curve expected to rally meaningfully. These measures should help availability of funds at lower costs and aid sectors in stress.Upasna Bhardwaj, Sr. Economist, Kotak Mahindra Bank

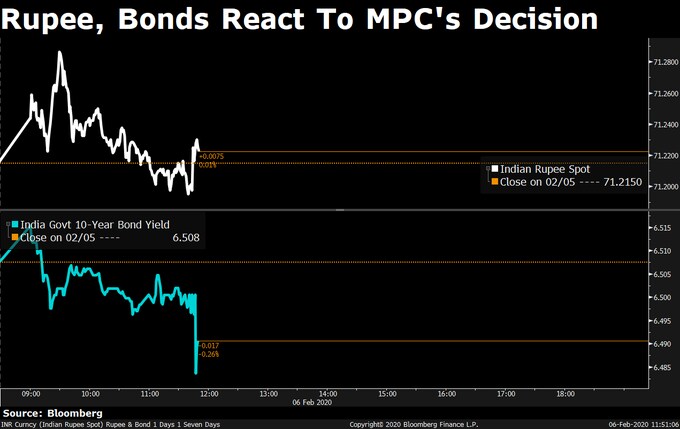

Market Reaction

The 10-year bond yield fell 4 basis points but short term bond yields fell sharply.

Equity markets responded positively to the MPC announcement, with benchmark indices gaining half a percent each and the Nifty Bank doing even better.

Watch | Live Analysis Of MPC Decision To Hold Rates

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.