Earlier this week, private sector lender Kotak Mahindra Bank Ltd. moved Bombay High Court after the Reserve Bank of India restricted it from reducing promoter holding using preference shares.

The petition came ahead of a Dec. 31 deadline given to the bank to reduce promoter shareholding from the current 29.7 percent to 20 percent. The bank was hoping to meet this requirement by issuing preference shares but the regulator said no. And so the lender took the unusual step of going to court and filing a petition against the regulator's decision.

However, Kotak is not just challenging the RBI's disapproval of the use of preference shares in reducing promoter shareholding. The petition, a copy of which has been seen by BloombergQuint, shows that the lender is challenging whether the RBI has the powers to dictate promoter shareholding. If successful, Kotak's petition could force a rethink of the ownership restrictions that have governed Indian banks for decades.

Voting Rights Vs Promoter Shareholding

The petition argues that there is no provision in the Banking Regulation Act, 1949, which makes a reference to the level of promoter shareholding allowed in a bank.

Based on Section 12 and 12(b) of the Banking Regulation Act, the central bank is not empowered to “issue directions to banks to reduce their promoter shareholding or otherwise contemplate reduction of shareholding of any person in a bank,” the petition said.

The Act, the petition noted, restricts the concentration of power in the hands of promoters by curtailing their voting rights to a maximum of 26 percent in private banks, irrespective of the quantum of their shareholding.

Since the Act itself restricted voting rights and not the ownership of shares, “such ownership of shares cannot be curtailed through any delegated legislation or by any rule making power,” the petition adds.

Control of voting rights is through separate provisions and not through provisions of dilution and the RBI cannot conflate shareholding with voting rights.Kotak Mahindra Bank's Writ Petition Filed On Dec. 10

Acquisition Of Shares

The petition also argues that the Banking Regulation Act “separately and distinctly” regulates acquisition of paid-up share capital and voting rights. It defines the requirements that need to be fulfilled by a person to acquire over 5 percent stake in a bank.

The power of the RBI, as per the Act, is limited to assessing whether a person is ‘fit and proper' to acquire shares and voting rights in excess of 5 percent of the paid-up share capital of a bank. If the central bank deems a shareholder unfit, it can limit his/her holding to 5 percent, after giving the person a fresh opportunity to be heard.

Based on these provisions, the bank said that the requirement of RBI's prior approval does not operate “retrospectively” as it is “concerned with imposing restrictions on fresh acquisitions of shares and not on existing holdings.” In taking this line, the bank is suggesting that the RBI cannot curtail the right of an existing shareholder, who is deemed fit and proper by the RBI, to hold more than the stipulated 5 percent.

Moreover, the Act itself seeks to regulate shareholding as percentage of “paid-up capital” and not “paid-up voting equity capital.” Paid-up capital of a company includes both preference shares and equity capital.

Web Of Shareholding Rules

The lender, fourth largest in the country by assets, also argues that the RBI has used different rules for different bank licencees.

There is truth to this.

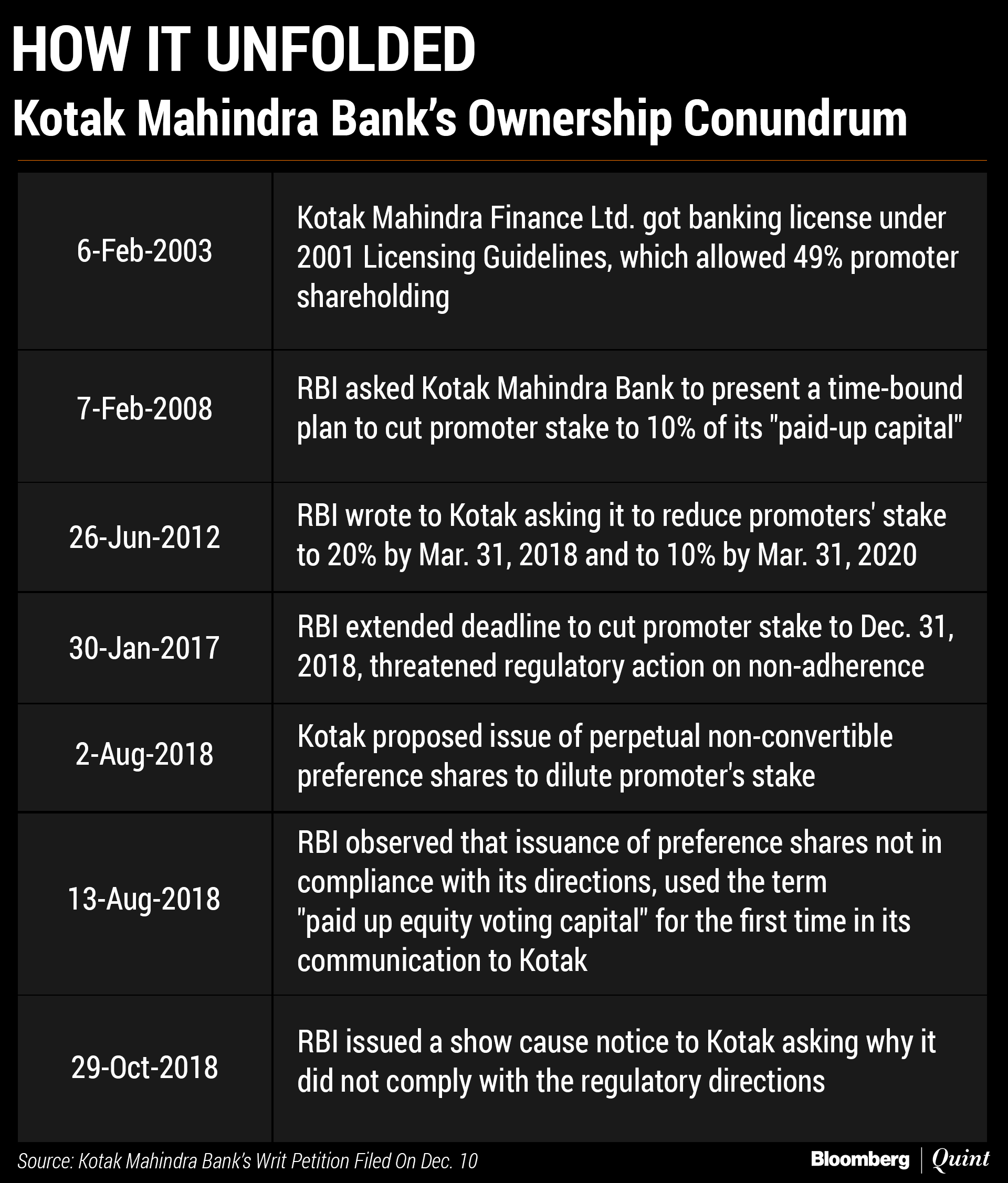

For instance, when Kotak Mahindra Finance Ltd. was granted a banking licence in 2001, the rules said that promoters needed to hold a minimum of 49 percent of the paid-up capital in the bank at any point in time. It was only in 2008 that the bank was first told that it would need to reduce promoter holding to 10 percent of “paid-up capital”. The direction was based on the new rules on ownership and governance for private sector banks issued in 2005, which mandated such reduction in promoter shareholding to ensure a diversified ownership of banks.

The change in ownership rules, according to the petition, were retrospective as the bank was governed by licensing rules of 2001, which did not require dilution of promoter shareholding.

In 2012, the RBI issued another letter to the bank directing it to reduce its promoter stake to 20 percent of paid-up capital within 10 years and to 15 percent within 12 years from the date of licensing. This was based on the draft new banking licensing guidelines. The final licensing guidelines, issued in 2013, were applicable to all new banks applying for a license, and used the phrase “paid-up voting equity capital” in relation to promoter shareholding.

The same phrase was also used in 2016 ‘On Tap Licensing Guidelines', which changed the condition for promoter holding reduction to 30 percent of “paid-up voting equity capital” within 10 years and to 15 percent within 12 years of commencement of a bank's business.

Another set of rules was issued in 2016 under the ‘Ownership Master Directions'. However, as a footnote in these directions, the RBI said the existing conditions applicable to individual licencees at the time the licence was granted would remain applicable. This suggests that Kotak's promoters were eligible to hold 49 percent of its paid-up capital, the lender argued.

The constant change in policy, its retrospective and inconsistent application, and moving of the ‘goal post' without any basis is reflective of the unreasonable and arbitrary application of its policy by the RBI to Petitioner No. 1 (Kotak Mahindra Bank).Kotak Mahindra Bank's Writ Petition Filed On Dec. 10

An ‘Indian' Bank

Kotak takes its arguments a step further and says that forcing such large promoter equity dilution will only be beneficial to foreign investors.

It explains that if Kotak has to cut its promoter holding to 15 percent of its paid up equity voting capital by March 2020, it will have to do so by issuing fresh equity in two tranches of Rs 1.10 lakh crore each.

The petition argued that divestment of shares at such a large scale, and within a short period of time, could only be achieved by sale of shares to foreigners, as such large pools of capital are not available domestically.

Consequently, the lender, which is one of the few banks owned by Indian promoters, will become majority owned by foreign entities.

Most of India's other top private banks -- ICICI Bank Ltd., Axis Bank Ltd., HDFC Bank Ltd. and IndusInd Bank Ltd. -- all have foreign shareholding of over 50 percent. The foreign investment limit for Indian private banks is currently set at 74 percent.

Relief Sought By Kotak

Through its petition, Kotak is seeking the quashing of all of RBI's communication pertaining to the reduction of promoter shareholding in the bank. As an alternative, it has requested that the central bank either withdraws all such communication or declares that its promoters, in order to comply with RBI's directions, could reduce their stake as a percentage of bank's paid-up capital.

Till such time the decision is made, the lender has requested for a stay on the “effect, operation or implementation of RBI's communication” that requires its promoters to dilute their shareholding to below 20 percent of paid up equity voting capital by Dec. 31.

It also asked the court to restrain RBI, its officers and its employees from taking any penal action against the bank, until the final order.

Kotak Mahindra Bank declined to comment any further beyond the statement that it sent to the stock exchanges on Monday. An email sent to the RBI on Monday remains unanswered.

Also Read: Kotak Mahindra Bank Fracas Revives Bank Ownership Debate

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.