.jpg?downsize=773:435)

A year after it was declared a winning bidder, JSW Steel Ltd. has finally been allowed to take over insolvent Bhushan Power & Steel Ltd. But since then, the Sajjan Jindal-led steel mill's debt has gone up and domestic demand for the alloy has declined amid a slowing economy.

The National Company Law Appellate Tribunal on Monday allowed JSW Steel to acquire Bhushan Power & Steel for Rs 19,700 crore by providing it immunity against future litigations after the insolvent company was named in alleged accounting fraud. The investigative agencies can't seize the assets of Bhushan Power & Steel in absence of required evidence.

Bhushan Power & Steel was one of the 12 large corporate accounts identified by the Reserve Bank of India in June 2017 for resolution under the Insolvency and Bankruptcy Code.

Here's a look at what Bhushan Power & Steel's acquisition means for JSW Steel:

Higher Capacity

JSW Steel's capacity currently stands at around 18 million tonnes per annum, including Monnet Ispat's 1.5-mtpa capacity that it acquired in 2019. The steelmaker's capacity is expected to rise to about 26 mtpa, factoring in its 5-mtpa capacity expansion at Dolvi unit and 3.5-mtpa capacity of Bhushan Power & Steel, in the next six-eight months, according to ratings agency ICRA Ltd.

“The company's focus will now be on quick ramp-up of operations at Bhushan Power & Steel. So, JSW Steel's scale will increase by almost 7-8 million tonnes in the next six months, assuming it can take control of Bhushan Power & Steel by that time,” Jayanta Roy, AVP (research) at the rating agency, told BloombergQuint.

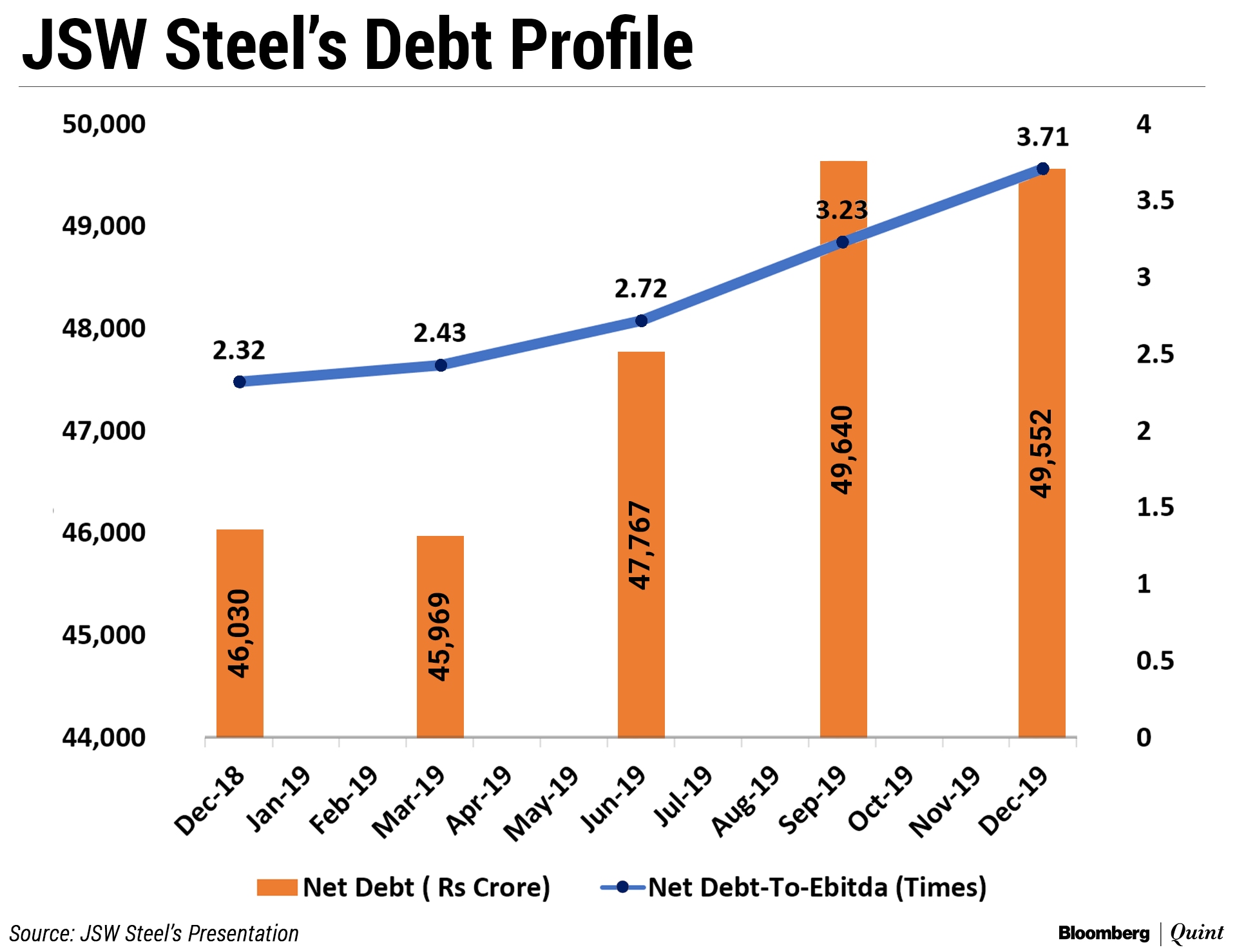

Debt Rises, Promoter Pledge Falls

JSW Steel's consolidated net debt-to-Ebitda stood at 3.71 times as of December 2019 from 2.3 times a year ago, according to the company's third-quarter presentation. That's close to JSW Steel's near-term debt-to-Ebitda target of 3.75 times. The steel maker's leverage rose because of a decline in per tonne earnings before interest, tax, depreciation and amortisation, and outflows on account of debt-led capital expenditure.

Brokerages, including Emkay Global, view Bhushan Power & Steel's takeover as “widely negative”, given JSW Steel's high debt level when domestic steel prices have already started retreating.

Also Read: JSW Steel Q3 Results: Most Analysts Maintain Rating, But...

Still, the percentage of stake offered as collateral by controlling shareholders of JSW Steel fell in the last one year.

Recoveries For Banks

The takeover of Bhushan Power & Steel will aid banks' recovery of debt at a time Indian lenders are saddled with the world's worst bad loan ratio.

Bhushan Power owes its lenders more than Rs 47,000 crore and over Rs 780 crore to operational creditors. JSW Steel bid Rs 19,700 crore, which is entirely for financial creditors, said Mahendra Khandelwal, resolution professional for Bhushan Power & Steel. That, he told BloombergQuint, would mean a recovery rate of 41.79 percent. The closure of the bid, Khandelwal said, will happen within 30 days.

In the third quarter of the financial year ending March 2020, banks benefited from recoveries of Essar Steel Ltd., Ruchi Soya Industries Ltd., Prayagraj Power Generation Company Ltd., among others. In case of Essar Steel, financial creditors recovered more than 90 percent of their Rs 49,000-crore claims.

Also Read: Grab What You Can in India's Bad-Loan Melee

On Monday, JSW Steel shares fell 0.40 percent to Rs 288.00 apiece on the NSE while the benchmark Nifty 50 shed 0.56 percent to end the day at 12,045.80 points.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.