(Bloomberg) -- Japan Tobacco International manufactured and shipped more than 531 billion combustible cigarettes last year, making it the only Big Tobacco firm among the top three to increase volumes.

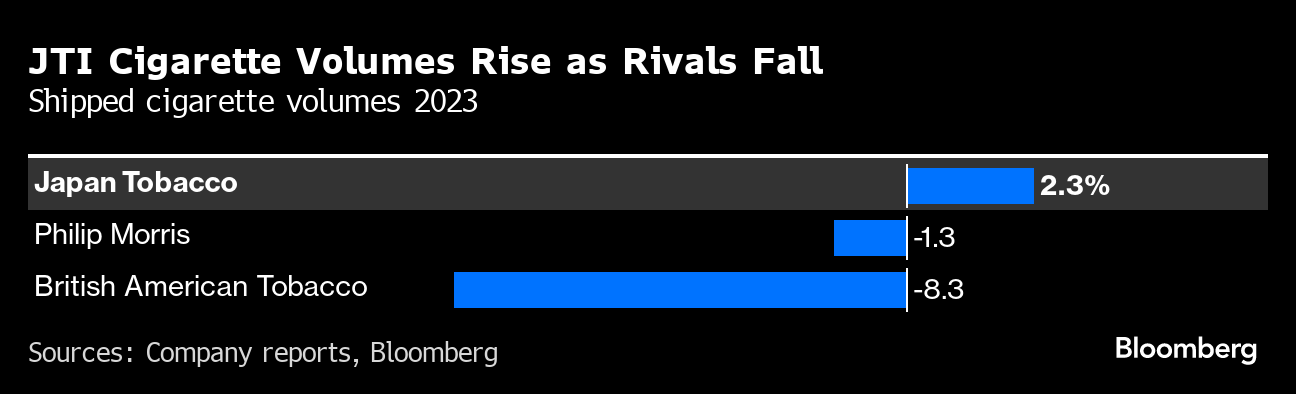

The maker of Winston and Camel cigarettes increased its total combustible cigarette volumes by 2.3% in 2023, Geneva-headquartered JTI said on Tuesday as its parent company Japan Tobacco reported its annual financial results.

For comparison, Marlboro-maker Philip Morris International Inc. shipped about 613 billion cigarettes in 2023, a decline of 1.3% from the year before. British American Tobacco Plc made and shipped about 555 billion cigarettes last year, a drop of 8.2% from 2022.

The volume variance underscores JTI's divergence in strategy and focus. As Philip Morris and BAT have shifted more research and marketing resources to alternative products including vapes, heated tobacco and nicotine pouches, JTI has leaned more to try and grow market share and volumes in traditional cigarettes.

“It has to do with our posture for many years now, and with the transition of some of our competitors into the new categories with more focus,” JTI Chief Financial Officer Vassilis Vovos said in an interview before the annual accounts were disclosed.

By focusing on its Winston and Camel cigarette brands “as a result, we now have two of the top five brands,” he said.

JTI has embraced alternatives that it calls reduced-risk products such as its Ploom heated tobacco device and Nordic Spirit nicotine pouches at a slower pace than rivals. Volumes rose 11% while revenue from reduced risk products rose by 8.3% in 2023 at JTI. Smoke-free revenue increased by 12% at Zyn-nicotine pouch-maker PMI during the same period.

PMI already gets about one third of its revenue from smoke-free alternatives and wants to get half by 2025. It touted in its recent annual results report that net revenue from its IQOS heated tobacco product had overtaken its flagship Marlboro cigarette brand in the fourth quarter.

There are still more than 1 billion cigarette smokers in the world but their numbers are declining, particularly in countries where governments and health officials have implemented reduced risk policies such as the UK which has offered smokers vape kits to kick the habit.

JTI's volumes dropped almost 19% in the UK, where it sells the Benson and Hedges brand. The company said “a large industry volume contraction, resulting mainly from excise tax-led price increases” and the end of a trend in increased smoking rates and domestic buying that began during the pandemic, were to blame.

Bloomberg Intelligence analyst Duncan Fox said Japan Tobacco's alternative products must “take up the baton” to drive long-term growth. Increasing investment in Ploom “makes sense but may be too late to overcome well-established competition,” he said in a report, noting that Japan Tobacco forecasts operating profit to fall in 2024 while Ploom is expected to be profitable by 2028.

BAT has disclosed in its annual results that its alternative products, which include Vuse vapes and Velo nicotine pouches, are now making money, which is sooner than previously expected.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.