IndusInd Bank Ltd.'s third-quarter loan growth was healthy, supported by growth in retail deposits, according to brokerages.

The lender's loan growth was 20% year-on-year and 4% quarter-on-quarter in the December quarter. This growth, though within its guided range of 18–23%, was lower than in the September quarter, according to Citi.

Deposit growth is 13% year-on-year, as the bank used surplus liquidity and refinance lines in the quarter, the brokerages said.

IndusInd Bank reported a 13% year-on-year surge in deposits, reaching Rs 3.69 lakh crore, marking a 3% increase from the preceding quarter, according to a Jan. 2 business update. The lender disclosed that advances amounted to Rs 3.27 lakh crore, reflecting a 4% sequential uptick and a substantial 20% year-on-year growth.

Here's what analysts have to say

Jefferies

Has a 'buy' rating on the stock with a target price of Rs 2,070. IndusInd is a top pick.

Retail deposits were 90% of incremental deposits, and their share overall is now at 45%.

CASA growth was slow at 4% year-on-year (on expected lines) as the switch to term deposits continued.

Healthy growth and stable NIMs will aid earnings.

Morgan Stanley

Morgan Stanley has an 'overweight' rating, with a target price of Rs 1,850, implying an upside of 17%.

Net loan growth remains healthy at 20% year-on-year versus 21% year-on-year last quarter.

On a sequential basis, loan growth moderated to 3.6% versus +4.7% last quarter.

On a YoY basis, growth was 13.4%, as against 13.9% last quarter, and was broadly in line with system deposit growth of 13.3% YoY as of Dec. 15, 2023.

Risks to Upside

Acceleration in the share of higher-yielding retail loans.

Strong traction in retail liability franchises.

Lower-than-expected asset quality stress.

Potential RBI approval for the promoter stake hike.

Risks to Downside

A sharp slowdown in economic growth is weighing on loan growth and resulting in higher NPLs.

Sharper-than-expected increase in funding costs and/or moderation in fees.

Citi

Bank's advances growth at 19.8% year-on-year/3.6% quarter-on-quarter, though within its guided range, was slightly slower than the brokerage's estimates and below Q2 FY24 growth rate of 21.5% year-on-year/4.5% quarter-on-quarter.

Retail advances and the small/mid-corporate segments are estimated to have led the growth, and within retail, MFI, credit cards, PL/BL, and affordable housing would be the key drivers.

The second quarter had an element of corporate slippage, which Citi doesn't expect to repeat, though retail may remain sticky at 2.8–3%.

"With no buffer utilisation, credit costs are expected to remain at the upper end of guidance at 1.3%."

On a high base of Q2, Citi expects some moderation in the sequential rise in opex, though year-on-year it is estimated at 23%, due to the scale up of retail, investment in franchise expansion, and technology initiatives.

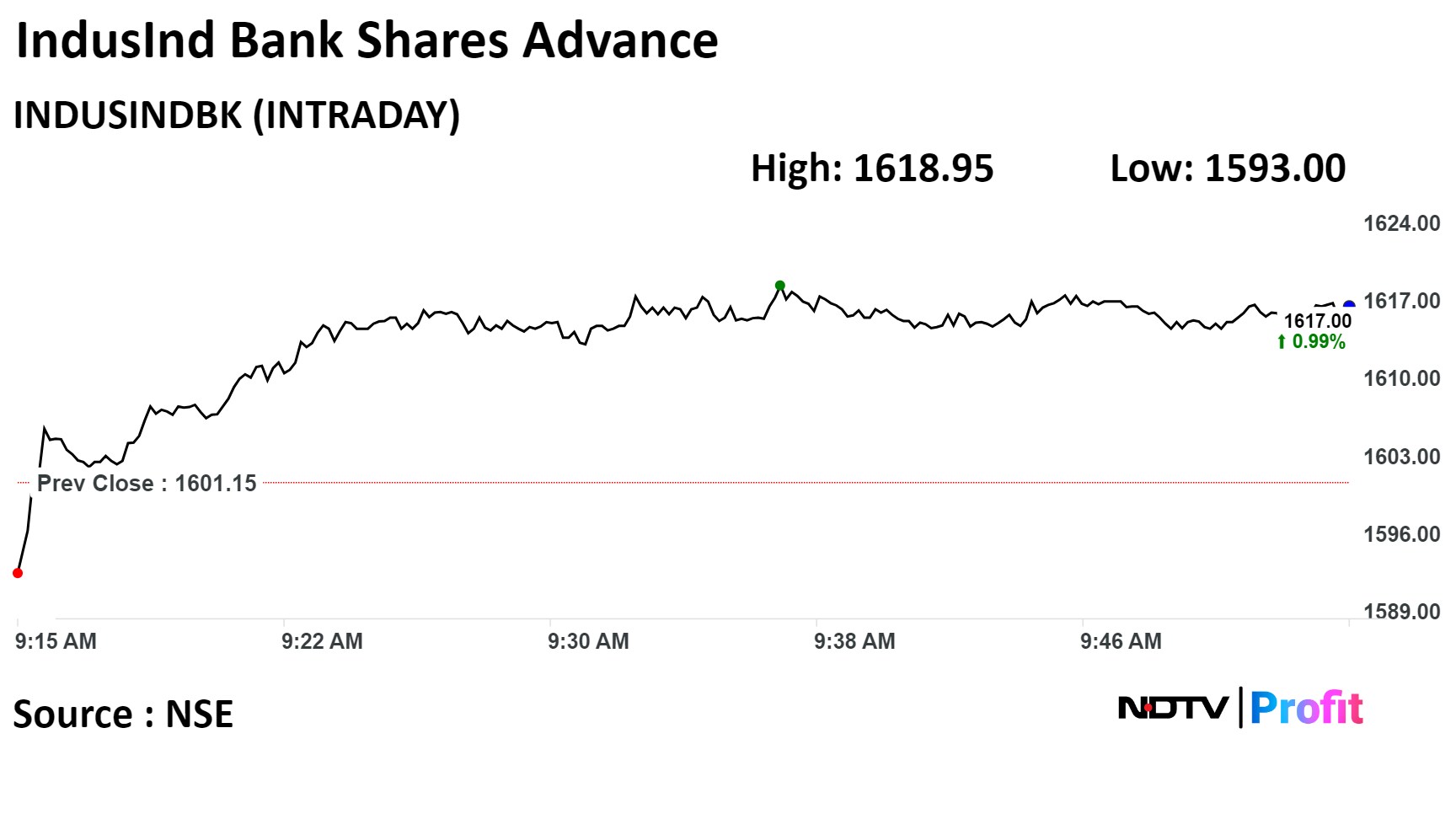

Shares of the company rose 1.11%, before paring gains to trade 0.91% higher at 9:53 a.m. This compares to a 0.37% advance in the NSE Nifty 50.

Total traded volume so far in the day stood at 1.6 times its 30-day average.

Of the 48 analysts tracking the company, 45 maintain a 'buy' rating, two recommend a 'hold,' and one suggests a 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 6.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.