As the famous adage goes, "If it looks too good to be true...it probably is".

These days, it seems that we are being inundated with daily news about an Indian economic "comeback" of sorts. The Sensex is hitting daily highs, the new RBI governor, Raghuram Rajan seems to have brought a sense of euphoria to the country through "sweeping" policy changes, and a continuous stream of positive economic data seems to suggest that the Indian market is undergoing a transformation.

Alas, I will be the first to admit that even I had fallen prey to the euphoria. My column from three weeks back, titled "Why the Indian Economy is primed to boom now", got its fair share of opinionated comments. I looked at India's historical stock market performance, GDP figures, inflation figures, and current account deficit (CAD) figures and compared them to India's BRIC (Brazil, Russia, India and China) counterparts. The conclusion was simple: despite weaker than expected numbers, India is showing signs of an economic turnaround based on these economic indicators.

However, it is one thing to look at the stock market and overall GDP as gauges for economic improvement, and an entire different approach to actually look at the country as a whole from a holistic standpoint to see where, and if, progress is truly being made. Since my previous column compared India to Russia, China, and Brazil, we can do the same here from a different perspective: taking the entire population into account.

India's population is the second largest in the world at 1.237 billion, right behind China's 1.351 billion population. India is expected to overtake China as the world's most populous country by 2025, and according to a UN Study report, this is a lot sooner that what was previously forecasted.

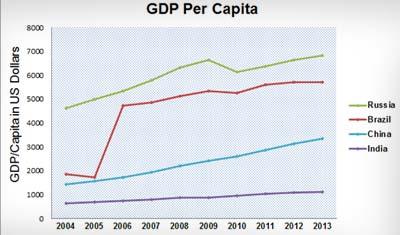

While it is perhaps easier to point to a country's overall GDP as a measure of economic progress, in order to truly get an apples to apples comparison, population numbers simply cannot be ignored. GDP per capita is an excellent way to measure a country's economic progress. It takes the entire GDP (Gross Domestic Product) of a country and divides it by the population of the country. In effect, it gives the GDP output per individual.

And, as it turns out, the numbers are quite shocking.

GDP Per Capita

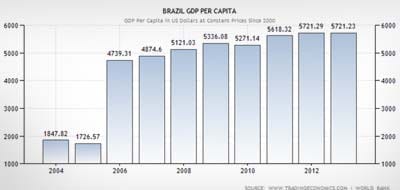

Here's Brazil's GDP per capita figures (measured in US dollars) from 2004-2013.

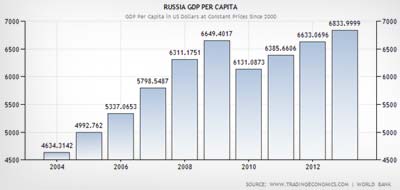

Here is Russia's.

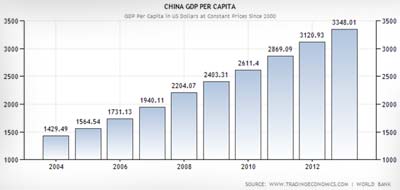

Here is China's.

And, finally, here is India's.

The numbers simply cannot be ignored, and the conclusion is simple: India's GDP per capita is lagging much behind its BRIC counterparts. Here is a graphical representation of all 4 countries in one graph:

We, as Indians, seem to enjoy comparing India's economy to China's economy on a seemingly continuous basis. But when one takes the above into account and also forecasts the next 7 years through 2020, the picture becomes even more bleak.

India's GDP is expected to marginally improve in 2013-2014 to 5.6 per cent from its current standing of 4.4 per cent (according to the International Monetary Fund), and India's population is expected to increase at 1.5 per cent for the foreseeable future. Assuming that India's GDP grows annually at a healthy 7 per cent through 2020 and that its population reaches 1.4 billion, since its current GDP is at $1.8 trillion, India's GDP per capita in 2020 is projected to be $2,250.

Meanwhile, China's population is only expected to grow at 0.4 per cent and will eventually stagnate to 1.4 billion by 2020, marginally due to China's one-child policy. China's GDP currently stands at $8.2 trillion. If China maintains its annual GDP growth of 8-10 per cent through 2020, China's GDP per capita in 2020 is projected to comfortably be above $10,000.

$10,000 versus $2,250. Is it really fair to compare India's economy to China's economy?

Poverty Levels

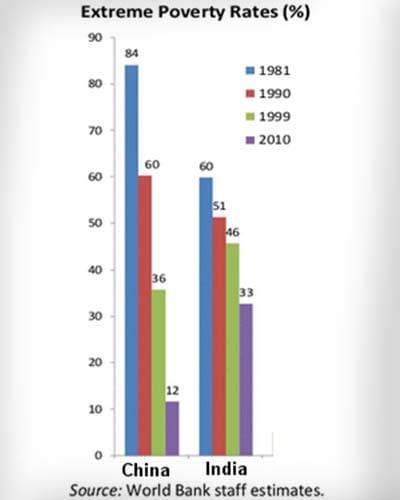

Take a moment a study the above chart that compares extreme poverty levels in China and India. Extreme poverty is measured as, according to the World Bank, living on less than $1.25 per day.

The first statistic that jumps out is that, without a doubt, poverty levels have drastically dropped in China and India over the years. While 81 per cent of Chinese and 60 per cent of Indians were living in extreme poverty in 1981, those figures have substantially gone down over the years.

That being said, it is impossible to ignore the glaring figure of 33 per cent of Indians living in extreme poverty (as of 2010). Furthermore, 68 per cent of our population lives on less than $2.00 a day. While there are plans to cut the extreme poverty figure to 22 per cent by 2015, it is difficult to see that China has managed to get extreme poverty levels to 12 per cent as of 2010.

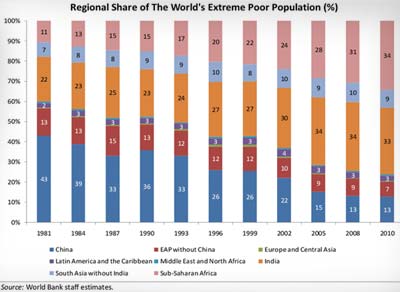

However, here is the biggest shocker. Although India has been able to bring its extreme poverty levels down significantly since 1981, when you look at what per cent of the world's population lives in extreme poverty, India's proportional percentage has risen over the years.

The orange figures represent India. As you can see, in 1981 India accounted for just 22 per cent of the world's extreme poor. However, as of 2010, India is accounting for 33 per cent of the world's extreme poor, with that percentage figure steadily rising through the years.

Conclusion

As with all circumstances, one needs to look at both sides of the coin when it comes to evaluating the state of affairs of our economy. Yes, the current account deficit is shrinking and our GDP is expected to grow in the coming years. RBI Governor Raghuram Rajan has done a tremendous job in stabilizing the markets by bringing the rupee under control and genuinely creating a sense of confidence in the markets by introducing liberalizing reforms. With the US economy treading uncertain waters and no tapering of its quantitative easing program in sight, FII's (Foreign Institutional Investors) will undoubtedly continue looking at India as one of the premiere markets to invest their funds for, at least, the medium term range.

But it is equally important to gauge our economy from a holistic perspective and to not be blindsided by facts that are impossible to ignore. Here's hoping that "BRIC" does not turn into "BRC" in the coming years.

Raghu Kumar is the co-founder of RKSV, a broking company. The opinions expressed here are the personal opinions of the author. NDTV is not responsible for the accuracy, completeness, suitability or validity of any information given here. All information is provided on an as-is basis. The information, facts or opinions appearing on the blog do not reflect the views of NDTV and NDTV does not assume any responsibility or liability for the same.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.