Not that long ago, Mohammad Sharif's tannery was thriving. Then came the cow vigilantes. An anti-pollution crackdown, a cash purge and the nationwide sales tax only made things worse.

Everything has changed, Sharif, 35, said at his 1,500-square-foot workshop in the Jajmau bylanes of suburban Kanpur. He runs the family's 30-year-old factory on alternate days and let more than half of his 20 workers go. In just a couple of years, his business in the leather hub of Uttar Pradesh, India's most populous state, has fallen by half.

“Earlier, hides were easily available and there wasn't much competition. As supply declined, prices shot up,” Sharif said, walking by piles of half-tanned sheets. An acrid chemical and leather stench is all-pervading.

“We can't compete anymore,” he said.

Spotting an opening, countries like Vietnam, Bangladesh and China flooded the market with cheaper leather, making exports from the world's second-largest supplier uncompetitive. The Goods and Services Tax further disrupted the $17-billion industry, comprising largely small businesses. And it came within a year of demonetisation that had left traders with no cash to pay workers or buy raw material.

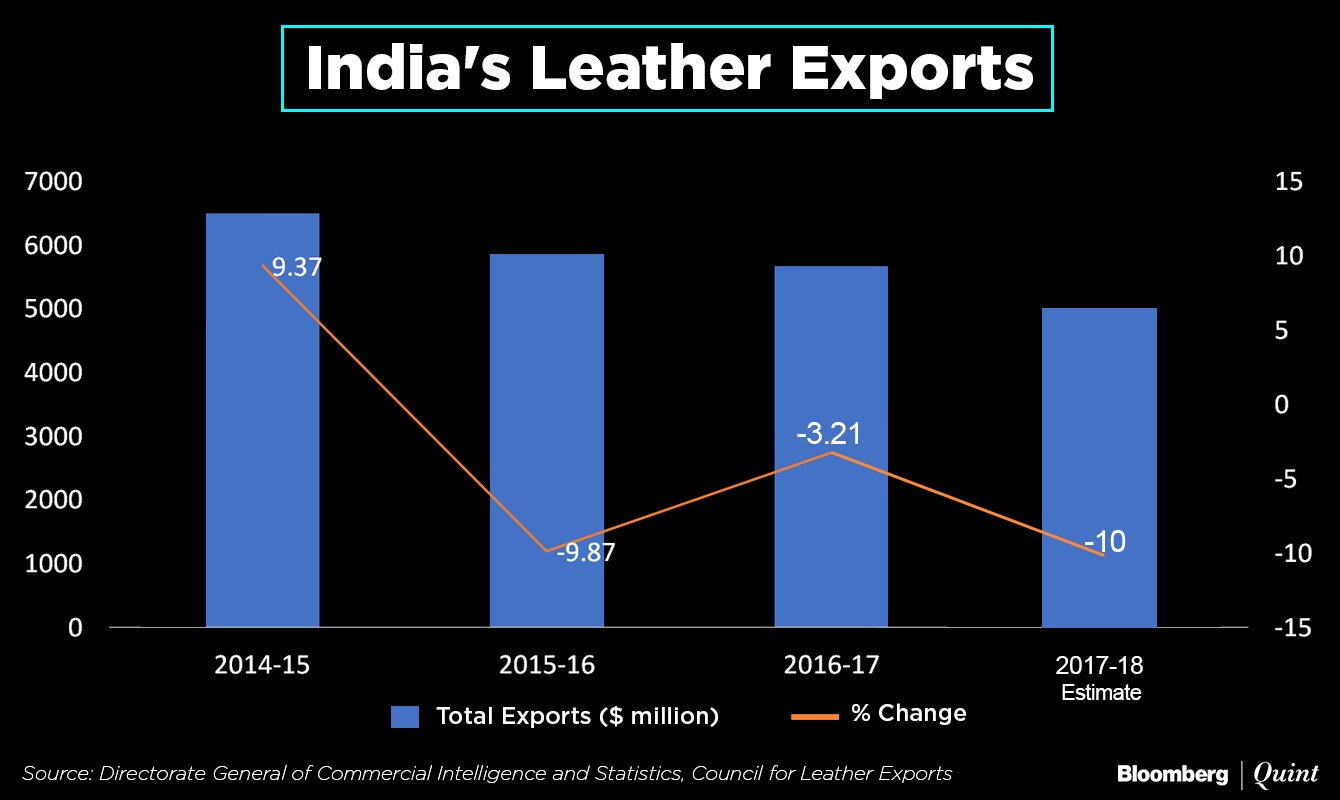

Shipments from India are expected to decline more than 10 percent to $5 billion this financial year, according to Mukhtarul Amin, chairman of the Council for Leather Exports. And about half of 402 registered businesses in the Kanpur-Unnao industrial cluster, contributing a third of India's leather exports, have shut shop, he said.

Saddaqat Ali's belt business has taken a hit. Worried that more factories will wind up and not complete orders, foreign buyers are staying away, he said as a worker polished leather strips at his crammed workshop. He slashed the output by 90 percent to 50 belts a day and reduced employees from 10 to three. “Hide prices have risen 75 percent to Rs 1,400 per square feet. I had to even cut the salary of the remaining workers by 20 percent to Rs 200 a day.”

Job Losses

The leather units, directly or indirectly, employ about 30 lakh people, mostly coming from India's poor and marginalised communities, according to the council, which represents more than 3,500 such businesses. Units BloombergQuint spoke to had laid off around 20 percent of their workforce on an average.

Qazi Naiyer Jamal of the local Leather Industries Welfare Association said the overall job cuts were much higher. His estimates suggest that out of five lakh direct and indirect workers in Kanpur, about two lakh have lost jobs in the last couple of years.

“Most of them were migrants,” Taj Alam, vice president at Uttar Pradesh Leather Association, said. “As orders declined and tanneries started closing, they went back,” he said at his factory that makes everything from cured hides and shoes to saddles.

More pain is likely ahead. Orders are down by up to 20 percent this year, said Amin who employs around 400 people at his shoe unit. “The orders can fall 30 percent in the next season.”

Vigilantes, Slaughterhouse Ban

Tanneries ran out of leather after several unauthorised slaughterhouses were shut in a recent crackdown by the Bharatiya Janata Party government in Uttar Pradesh. The party's central government banned the sale of cattle for slaughter earlier this year, an order that was overturned by the Supreme Court.

Since leather units source raw skins from abattoirs, supply plunged, said Alam.

Yet, that's only part of their worries. The fear of cow vigilantes has made cattle trade risky, some of the traders told BloombergQuint—none wanted to be identified out of safety concerns. People are scared of even selling buffaloes, a major source of leather in the country, they said.

Cow-related violence has spiked in India since 2014, data collected by IndiaSpend show. Alleged lynchings are regularly reported around the country. No less than Prime Minister Narendra Modi sought to end the violence, calling killing in the name of cow “unacceptable”.

Then there's the crackdown by the National Green Tribunal. Last year, it banned several tanneries for dumping effluents into the Ganga. The state is also planning to shift all leather units away from the riverbanks.

“Such stringent regulations have hurt us,” said Alam. The problem is not with the units, he said. Tanneries divert their refuse to the common treatment plant set up by the civic authorities. “It's the government's plant that needs upgrade.”

GST's Double Whammy

India's move to the Goods and Services Tax that mandates three-dozen online filings a year has been the worst disruption for export-driven sectors. Like other small businesses, most leather units in Kanpur are finding it difficult to take the digital leap.

Not only that. The new levy taxes every level of the supply chain and allows refunds or tax credits that can be set off against future liabilities. The refunds have been delayed, leaving small firms short of cash. “Whatever is being paid as GST is blocking our working capital,” said Alam.

The drawback, or the rate at which exporters get refunds on taxes paid on imports, was also reduced from 7.5 percent to 2 percent. Amin said that significantly reduced their profits.

The government reduced GST rates on some leather products to ease the burden, besides relaxing deadlines to file returns. Still, there is a mismatch between taxes on raw materials and finished products, according to Gaurav Tripathi, who works in a factory in Jajmau.

Even small shoemakers are struggling. There are hardly any customers, said Rajiv Kuril, who has been making and selling shoes for 30 years. “I can't afford to pay workers after the note ban and GST has hurt margins,” he said. “At times, not even a single buyer visits in 10 hours.”

The leather industry was identified in the 2016-17 Economic Survey as the one that can create maximum jobs, along with apparel. India's Chief Economic Adviser Arvind Subramanian wrote that nearly every successful economic growth spurt in post-war history in East Asia has been associated with rapid expansion in clothing and footwear exports in the early stages. And they offer the “bang-for-buck in terms of jobs created relative to investment”.

Not surprising then that leather is among the sectors chosen for Prime Minister's ‘Make in India' push. The country consumed $12 billion and exported $5.8 billion worth of leather products in the year to March. The government wants to increase domestic demand to $18 billion by 2020.

But for Sharif, that's just a promise. “You have been left to fend for yourself,” he said. “I don't know for how long will the industry survive. We will definitely not bring our children into this business.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.