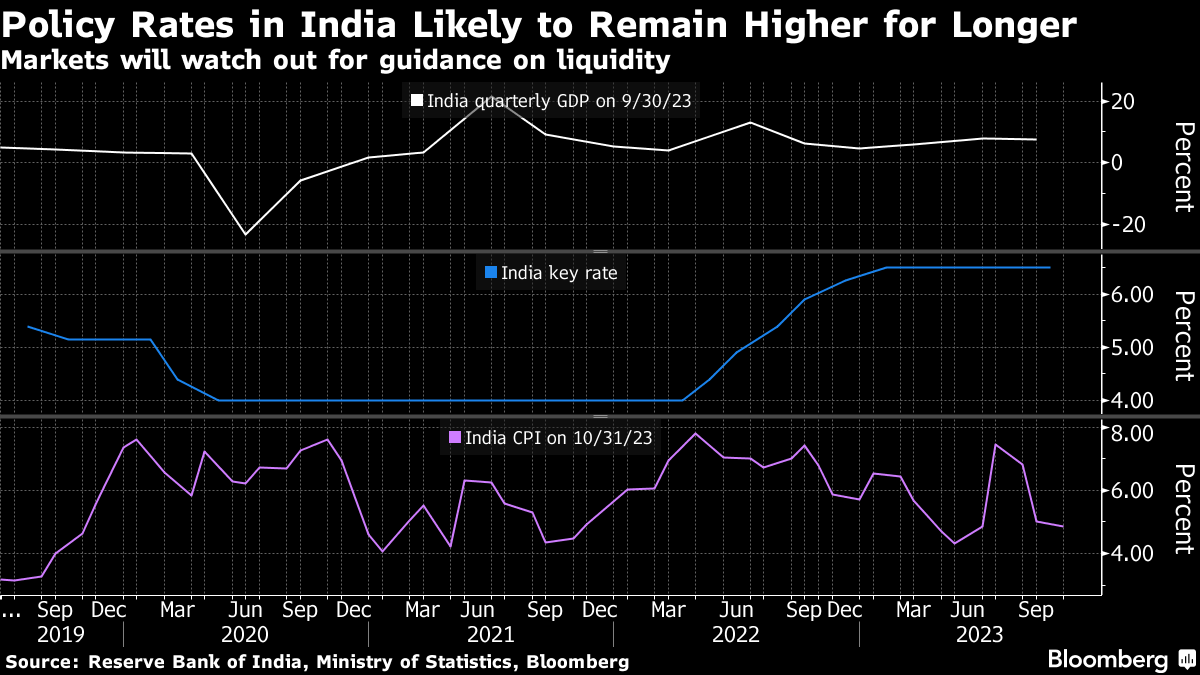

(Bloomberg) -- India's central bank will likely stick to its hawkish policy stance as strong economic growth and a state election victory for Prime Minister Narendra Modi gives policymakers little reason to consider interest rate cuts just yet.

The Reserve Bank of India's six-member monetary policy committee is expected to keep the repurchase rate unchanged at 6.5% on Friday for a fifth consecutive meeting, according to all but one of the 44 economists surveyed by Bloomberg. It's also likely to retain its policy stance as “withdrawal of accommodation,” indicating rates would remain higher for longer.

Governor Shaktikanta Das said in October he wants to see inflation settle near the 4% target on a sustainable basis, but rising food prices means that's unlikely to happen until late next year. India's growth last quarter was also much faster than the RBI had predicted, keeping policymakers on guard. And with Modi's party now in a strong position to return to power next year, there's less pressure on authorities to try to juice growth by loosening policy too early.

“The next two inflation readings could be close to 6%,” said Pranjul Bhandari, an economist with HSBC Holdings Plc. Until food prices ease “the RBI may want to err on the side of caution in its treatment of rates.”

Aastha Gudwani of Bofa Securities India Ltd. was the only economist in the Bloomberg survey who predicted a rate hike of 25 basis points.

In the absence of any rate action on Friday, the focus will remain on the RBI's liquidity strategy. Das signaled in October the RBI may sell bonds in the open market, a move that would drain liquidity and boost short-term interest rates. Bond investors are watching closely for any hints the RBI will follow through on that call.

The rupee was little changed at 83.3425 a dollar as of 2:30 p.m. in Mumbai on Thursday, while bonds edged higher and stocks slipped ahead of the policy announcement.

Here's a look at what's expected from the RBI Governor when he announces the rate decision at 10 a.m. on Friday:

GDP growth forecast to be raised

Gross domestic product surged 7.6% last quarter from a year ago, far higher than the 6.5% predicted by the RBI, showing the economy's resilience despite 250 basis points of rate hikes. That prompted economists from Barclays Plc and Citigroup Inc. to raise their growth projections for the fiscal year to 6.7%.

The RBI is likely to raise its full-year estimate to 6.8% from 6.5%, said Kaushik Das, an economist with Deutsche Bank AG, while probably retaining its inflation forecast at 5.4%.

Last quarter's growth burst likely won't unduly worry policymakers as the lagged impact of monetary policy tightening and weaker global growth weighs on the economy, he said. The post-pandemic pent-up demand is also expected to fade, he said.

On the inflation side, crude oil prices have slumped about 13% since the last MPC meeting on Oct. 6, giving policymakers some comfort despite rising food costs.

RBI to stick to hawkish policy tone

The central bank will likely maintain a hawkish tone to indicate rates will remain high. Even though the RBI says its monetary policy is independent of the US Federal Reserve's, currencies in emerging markets such as India are closely tied to what the Fed does. The RBI is unlikely to shift policy until the world's largest economy moves first toward easing.

“With the rate gap with the US the narrowest on record, we doubt the RBI will pivot to easing until after the Federal Reserve starts to lower rates,” said Abhishek Gupta of Bloomberg Economics. “That will avoid spurring capital outflows and hurting the rupee.”

Analysts differ widely on when the RBI is likely to cut interest rates. Morgan Stanley predicts the central bank will move in the second quarter, while Goldman Sachs Group Inc. only sees easing by the final three months of next year.

Financial stability is a concern

Governor Das may address financial stability concerns again after the central bank last month tightened restrictions on unsecured consumer loans. Das warned banks to avoid “all forms of exuberance” after recent data showed credit card debt reached a record high in August.

The RBI will likely aim for a “targeted approach via macroprudential measures to check excesses,” said Radhika Rao, an economist with DBS Bank Ltd.

Keeping liquidity tight

Cash remains tight in the banking system with the weighted average call rate — a measure of overnight interbank rate that the central bank closely monitors — running above the RBI's emergency funding rate of 6.75% for most part of the past month.

The RBI may want to keep overnight rates above the policy rate “to facilitate faster transmission from the short end of the curve,” said Rahul Bajoria, an economist at Barclays Plc. “Still, we do not think the RBI is looking to tighten liquidity excessively, lest it hinder growth.”

While bond yields have eased since October, investors remain worried the central bank will resort to bond sales in the open market, as flagged by Governor Das in the last policy meeting. By selling bonds, the RBI's action would suck liquidity out of the market, boosting interest rates.

Puneet Pal, head of fixed income at PGIM India Mutual Fund, said the RBI is likely to give “neutral guidance both on liquidity and OMO sales” since crude oil prices have fallen along with global bond yields. “They will reiterate their earlier stance but will sound more balanced,” he said.

--With assistance from Ronojoy Mazumdar and Tomoko Sato.

(Updates with rupee's move.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.