India is witnessing the return of a worrying trend of greater tolerance for loose lending and provisioning practices, which risks putting it on the same path that took Japan to the "lost decade" in the 1990s, former central banker Viral Acharya said.

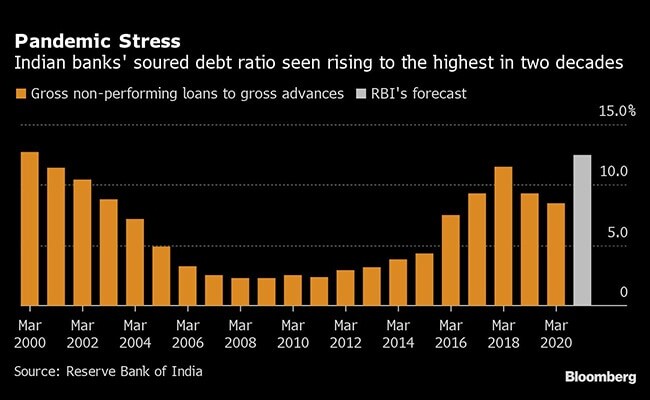

"Certainty with the Covid shock, and as highlighted in the RBI's financial stability report, the bad loans are likely to mount to 12-15 per cent region," Mr Acharya, who resigned last year as deputy governor of the Reserve Bank of India, said in an interview. "Given all that, Japanification is a serious concern and the way out of it is to raise capital in the financial intermediation sector. The time is now."

The ex-central banker was referring to Japan's experience in the 1990s when a weak banking and financial sector crippled activity and contributed to a lost decade of sub-par economic growth. The RBI sees the country's bad-loan ratio swelling to the highest level in more than two decades -- to 12.5 per cent by March 2021, the highest level since 1999. If macroeconomic conditions worsen, the ratio may jump to 14.7 per cent, among the highest in major economies.

The country's private banks have been racing to raise capital in recent weeks, while state-run lenders have been laggards. The government has infused Rs 2.6 lakh crore ($34.7 billion) into state-run banks in the last three financial years, more than double that in the previous nine years, but there is no provision for capital infusion in the budget this year.

"Potential output for the economy keeps changing and depends on the health of the financial system," Mr Acharya said. "The risk of forbearance in the banking sector is back on the horizon."

Mr Acharya, who had championed the autonomy of the central bank and health of the state-run banks during his time at the RBI, said the country needs to set its public finances in order by conducting big-ticket disinvestments including privatizing lenders, setting up an independent fiscal council to vet the accounts and boost spending on health and infrastructure by curtailing revenue expenditure.

He also said the inflation targeting mechanism had worked well for India. As such, there was no need to indulge in any "adventurism" by tweaking or refining the target especially given the fog of uncertainty that has enveloped the economy, he said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.