(Bloomberg) -- The frenzy to buy Indian bonds ahead of their entry into a key global debt index is set to pause if China's experience is any guide.

Indian government bonds have beaten all of their emerging market peers except Argentina so far this year. While prudent government borrowing and the benchmark interest rate at a six-year high are helping, the market is also buoyed by expectations of as much as $40 billion of inflows from index inclusion.

Once India joins JPMorgan Chase & Co.'s gauge on June 28, the focus will likely shift back to fundamentals as happened in China's case. Investment decisions will more likely be guided by the broader sentiment toward emerging markets, macroeconomic factors and fiscal policies of the government.

The inclusion trade is typically done before the addition of bonds to global indexes and then investors go back to normal market dynamics, said Rajeev De Mello, a senior portfolio manager at GAMA Asset Management SA. “Then you usually have some kind of pause in the market momentum, some kind of selloff.”

When Chinese bonds joined global indexes in 2019, the initial euphoria fizzled out after the fact. Yields rose and the scale of inflows that eventually materialized was just about 10% of the analysts' projections in 2021.

Foreign investors are increasingly showing a preference for India's sovereign debt over China's to reap gains from the nation's faster economic growth. Doubts over the sustainability of a recent rally in Chinese government bonds and persistent concerns over geopolitical tensions further tilt allocations in India's favor.

Overseas funds have already poured in nearly $9 billion into India's index-eligible bonds since JPMorgan's September announcement, helping lower yields.

Some procedural hurdles may also break the momentum in inflows. While China provided concessions such as exempting investors from taxes and extending trading hours, Indian authorities have been reticent to make any changes. They rebuffed requests for tax concessions that would have helped list Indian bonds on Euroclear, a clearing platform favored by investors.

Read More: What India's Addition to JPMorgan's Bond Index Means: QuickTake

It will be a one- to two-year process for everything to settle down in terms of the index flow, internal setup and opening accounts, said Lei Zhu, head of Asian fixed income at Fidelity International. She sees the inflows making a bigger splash in India than China due to a potentially larger foreign ownership of the market.

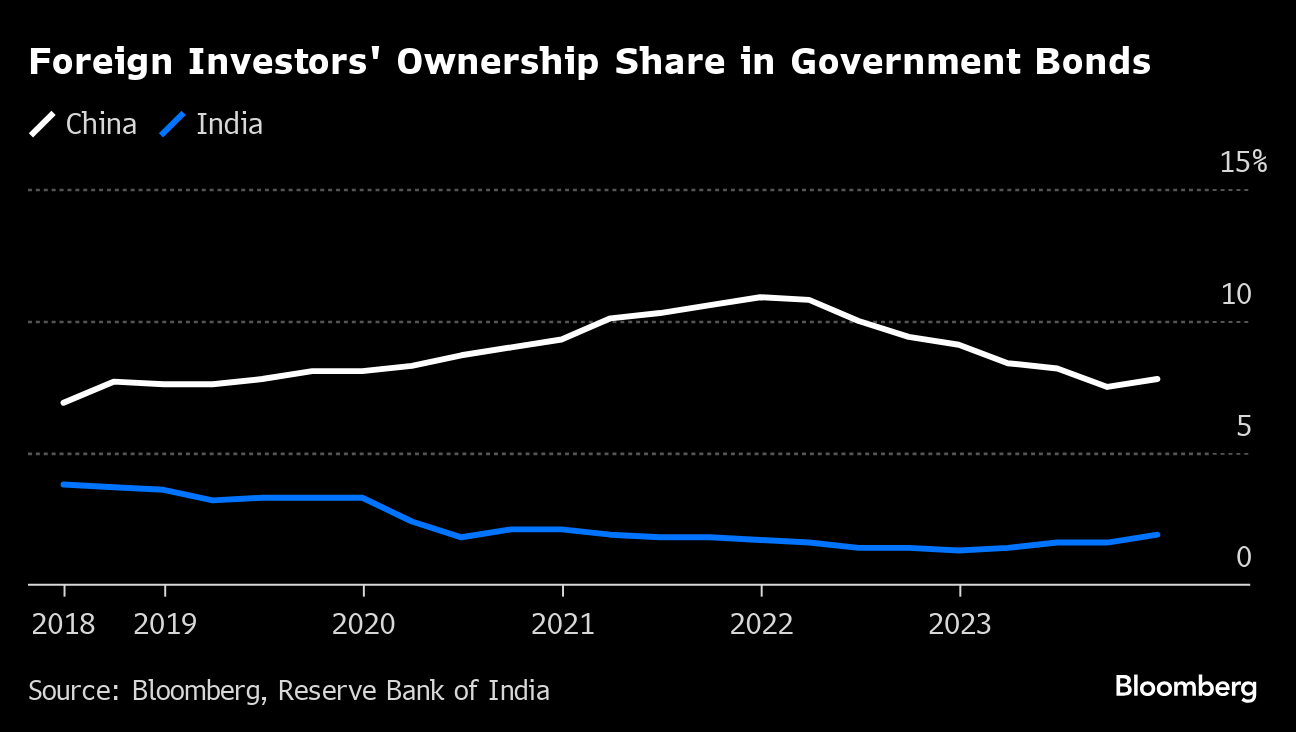

China's government bond market is more than double of India's $1.7 trillion sovereign debt. While overseas investors' participation is at 7.5% in China's government bonds, foreign holdings in India's state debt is currently less than 2%.

Both Fidelity and GAMA Asset see the Indian rupee and dollar-denominated corporate bonds benefiting from the inclusion due to the spreads they offer, mimicking China's experience.

The bond rally may stabilize after the inclusion as investors try to front-run the inflows and take profits as the trade plays out, said Zhu. “But eventually it will bring in more stable flows as the investor base broadens up.”

Bloomberg Index Services Ltd. will also start including India in its emerging-markets index from January. Bloomberg LP is the parent company of Bloomberg Index Services, which administers indexes that compete with those from other providers.

--With assistance from Wenjin Lv.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.