(Bloomberg) -- Energy security is set to dominate a gathering of international executives and government officials in India this week, as the world's third-largest oil importer juggles the impact of Red Sea tensions, tighter sanctions against Russia and a looming general election.

The event, which starts Tuesday, is an opportunity to showcase Prime Minister Narendra Modi's progress on renewable electricity and, for a domestic audience, to highlight existing efforts to keep power prices under control. But it will also be a chance to further other ambitions — in particular resolving hurdles in trade with Russia that have contributed to a drop in flows of discounted oil.

Russia hasn't provided details about the makeup of its delegation, though Indian media have reported Rosneft Oil Co. PJSC Chief Executive Igor Sechin is expected to attend. Last year's hefty Russian presence included Sechin and other high-profile figures like Novatek PJSC Chairman Leonid Mikhelson.

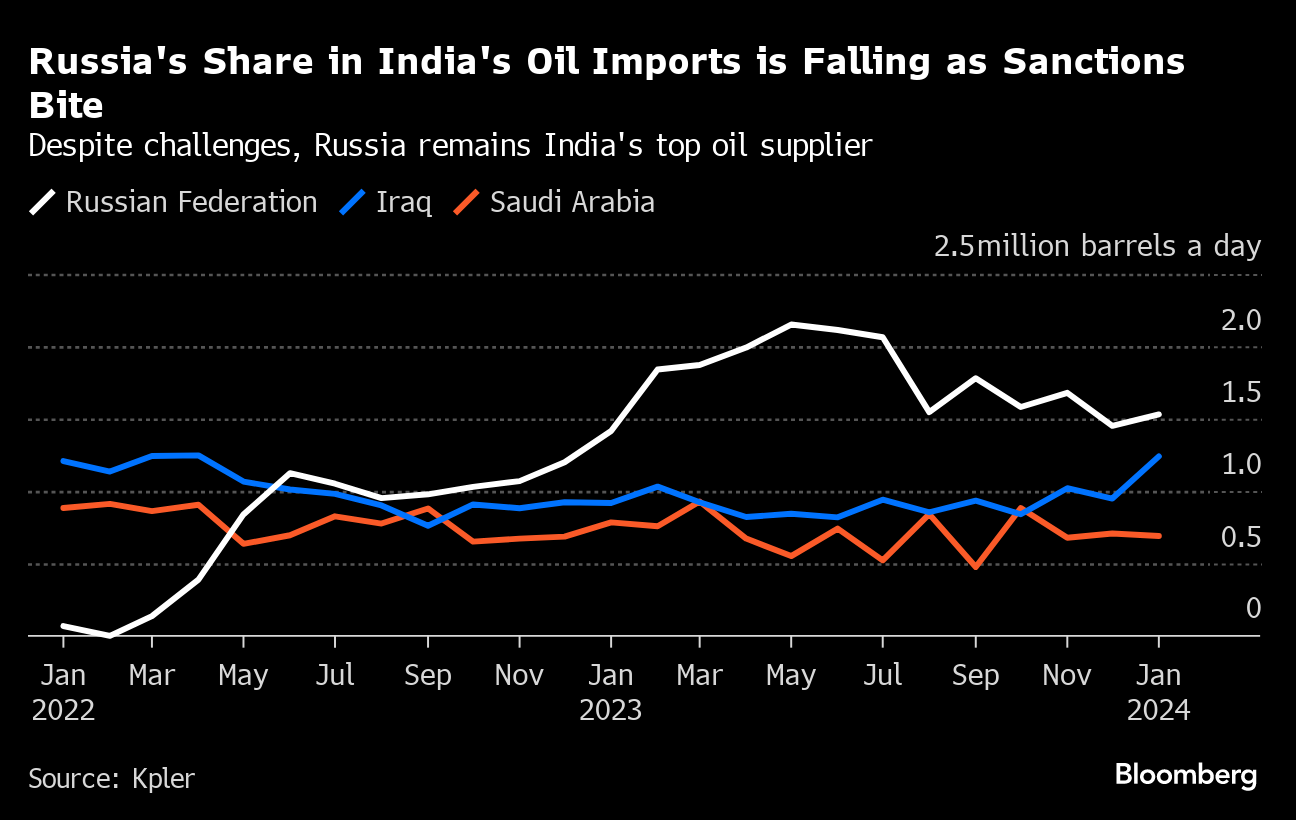

Oil imports from Russia, negligible before Moscow's invasion of Ukraine, climbed steadily through 2022 and the first half of last year as India saw an opportunity to procure discounted barrels. Russia overtook traditional suppliers like Iraq and Saudi Arabia.

But volumes have dropped off over recent months, in part because of payment and other hurdles as the US ramps up enforcement of a $60 a barrel price cap on Russian oil, with demands for documentation and tighter curbs on middle men assisting the trade and state shipping company Sovcomflot PJSC. Russia's share of India's oil imports in January has contracted to 31%, with supplies averaging 1.5 million barrels a day, according to data from market intelligence firm Kpler. That's down from 43% in June last year.

Read More: Russia Oil Tankers Do Strange Things Since US Sanctions Ramp-Up

Several tankers with Sokol crude destined for India from the Russian Far East are now idling, most off Singapore, as they wait for instructions on their next move. The ships are estimated to be carrying more than 4 million barrels of oil. Tanker-tracking data shows two other Sokol-laden vessels still heading toward India, but it's unclear they will reach their final destinations.

Indian refiners, which bought an average 140,000 barrels a day of Sokol in 2023, haven't received any shipments of the grade since December, according to Kpler, in part because of questions over the ownership structure of Sakhalin-1 LLC, which extracts the oil.

The increased scrutiny of the Russian flows comes at a challenging time for India, already dealing with tighter global supply that's left import-reliant countries with less bargaining power than a year ago, and has an election due within months. India also needs to balance its need for the discounted oil with the need to maintain ties with term sellers Saudi Arabia and Iraq.

To make matters worse, soaring freight rates due to a massive rerouting of vessels away from the Red Sea after Houthi attacks have closed arbitrage opportunities for refiners. Aside from Sokol, supplies of Russia's flagship Urals variety to India are also under threat, as ships typically travel via the Suez Canal and Red Sea to reach South Asia.

Talks between Indian officials and Russian executives are likely to focus on payments, and a choice of currency both sides can accept. India's use of the yuan, favored by Moscow, has been increasing and hit 5% of total oil payments to Russia in October, the highest since the Chinese currency began being used in August — but just shy of half is still in dollars. Rupee payments, favored by India but resisted by Russia until now, may also be on the agenda.

Discussions are likely to touch on logistics too, including new intermediaries and banks. Many had previously been based in Dubai, according to traders, but the United Arab Emirates is facing pressure to clean up its reputation as a conduit for restricted oil and to curb the use of the dirham currency for such transactions.

India Energy Week runs Feb. 6 to 9.

--With assistance from Dina Khrennikova.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.