APY or Atal Pension Yojana is a pension scheme focused on the unorganised sector in the country. Introduced in 2015, the Atal pension scheme allows individuals aged from 18 to 40 years of age to make pre-defined monthly investments in the scheme, and offers a pension benefit in multiples of Rs 1,000 up to Rs 5,000 per month, according to pension fund regulator PFRDA's website - pfrda.org.in. The amount of monthly contribution depends on two factors: (i) the age of investor at the time of joining the pension scheme and (ii) the fixed pension slab chosen (Rs 1,000 per month, Rs 2,000 per month, Rs 3,000 per month, Rs 4,000 per month or Rs 5,000 per month). The Atal pension scheme, therefore, requires a minimum contribution period of 20 years by the investor. (Also read: How to make most of Atal Pension Yojana)

The government is considering a proposal to increase the pension limit under Atal Pension Yojana (APY) to up to Rs 10,000 per month, news agency Press Trust of India had reported last month citing a top government official.

Here are five key details you need to know in order to make most of the Atal pension scheme (Atal Pension Yojana):

1. What is the age requirement to be eligible to invest in the Atal pension scheme?

The minimum age to invest in Atal Pension Yojana is 18 years and the maximum age is 40 years, according to PFRDA. The pension starts once the investor attains the age of 60 years.

2. What is the minimum amount of investment required for the Atal pension scheme?

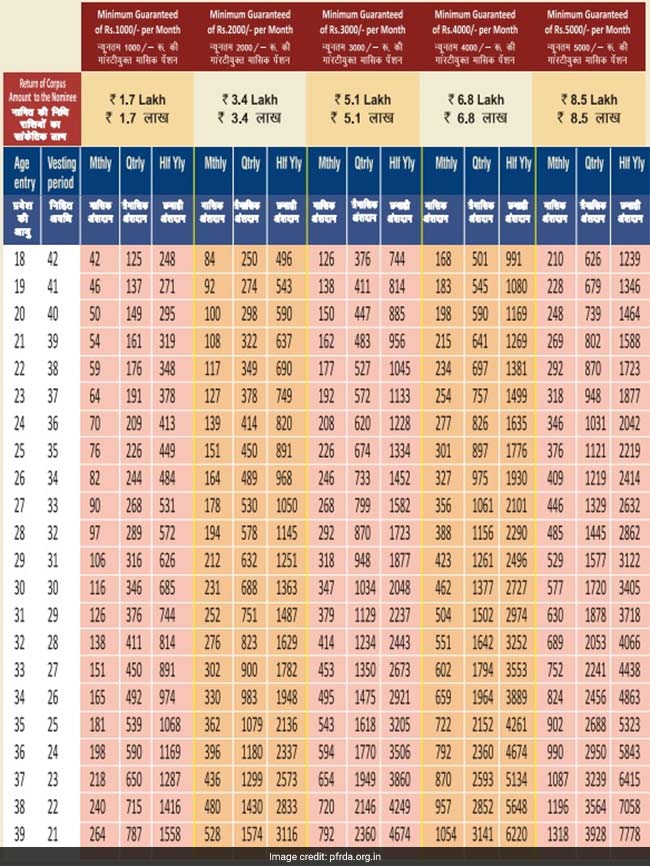

One can invest in the Atal pension scheme through three modes of payment: monthly, quarterly and half-yearly. That means the pension scheme requires the investor to make a minimum of two contributions every year. Subscribing to the Atal pension scheme at an early age minimises the contribution required to reach the desired minimum monthly pension, maximising the pension benefit, say experts. For instance, an investor subscribing for the Atal scheme at the age of 18 years is required to pay Rs 42 per month to reach a pension goal of Rs. 1,000 per month.

3. How to subscribe to or exit from the Atal pension scheme?

Opening an Atal Pension Yojana account requires the applicant to hold a savings account either with a bank or a post office. Atal pension scheme subscribers are allowed premature exit before the age of 60 years "only in exceptional circumstances, i.e., in the event of the death/ terminal disease", according to the PFRDA website. (Read more)

4. How much maximum pension can be earned through the Atal pension scheme?

Currently, the Atal pension scheme offers five fixed, pre-defined pension slabs: Rs 1,000, Rs 2,000, Rs 3,000, Rs 4,000 and Rs 5,000. The earlier one starts, the lower is the monthly contribution required to reach the desired pension goal, say experts. For instance, a subscriber at the age of 18 will contribute Rs 210 per month for 42 years to earn a pension of Rs 5,000 per month after maturity of the scheme. That means a total investment of Rs. 1,05,840. That is lower than investment worth Rs 3,48,960 required by an individual who enters the scheme at 40 years of age for the same pension slab. The 40-year-old investor is required to contribute Rs. 1,454 per month for a period of 20 years for the pension goal of Rs 5,000 per month.

(Using a chart, pension regulator PFRDA explains the contribution levels vis-a-vis minimum fixed monthly pension in the Atal pension scheme)

5. What are the income tax benefits one can claim by investing in the Atal pension scheme?

Contributions paid in Atal Pension Yojana can be claimed for income tax deduction up to Rs. 50,000 under Section 80CCD (1B) of the Income Tax Act, over and above the Rs. 1.5 lakh per financial year allowed under Section 80C.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.