Passenger vehicle sales in India dropped for the ninth straight month in July amid production cuts by carmakers.

According to a report by Axis Research, that's because of a combination of supply shocks—stricter regulations, a credit squeeze and weaker exports—and sluggish consumer demand.

Here's what's been going on in the auto industry and why:

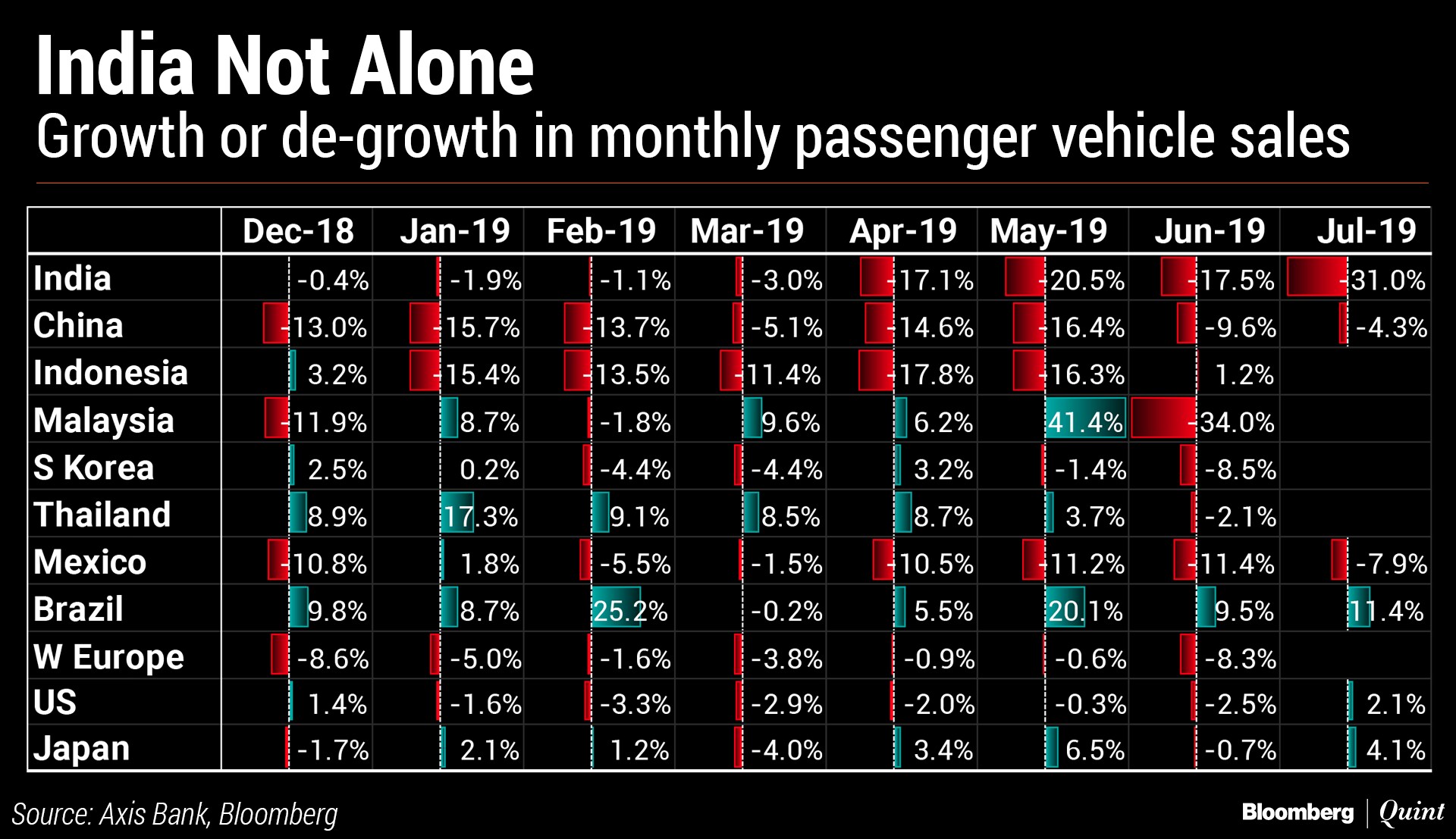

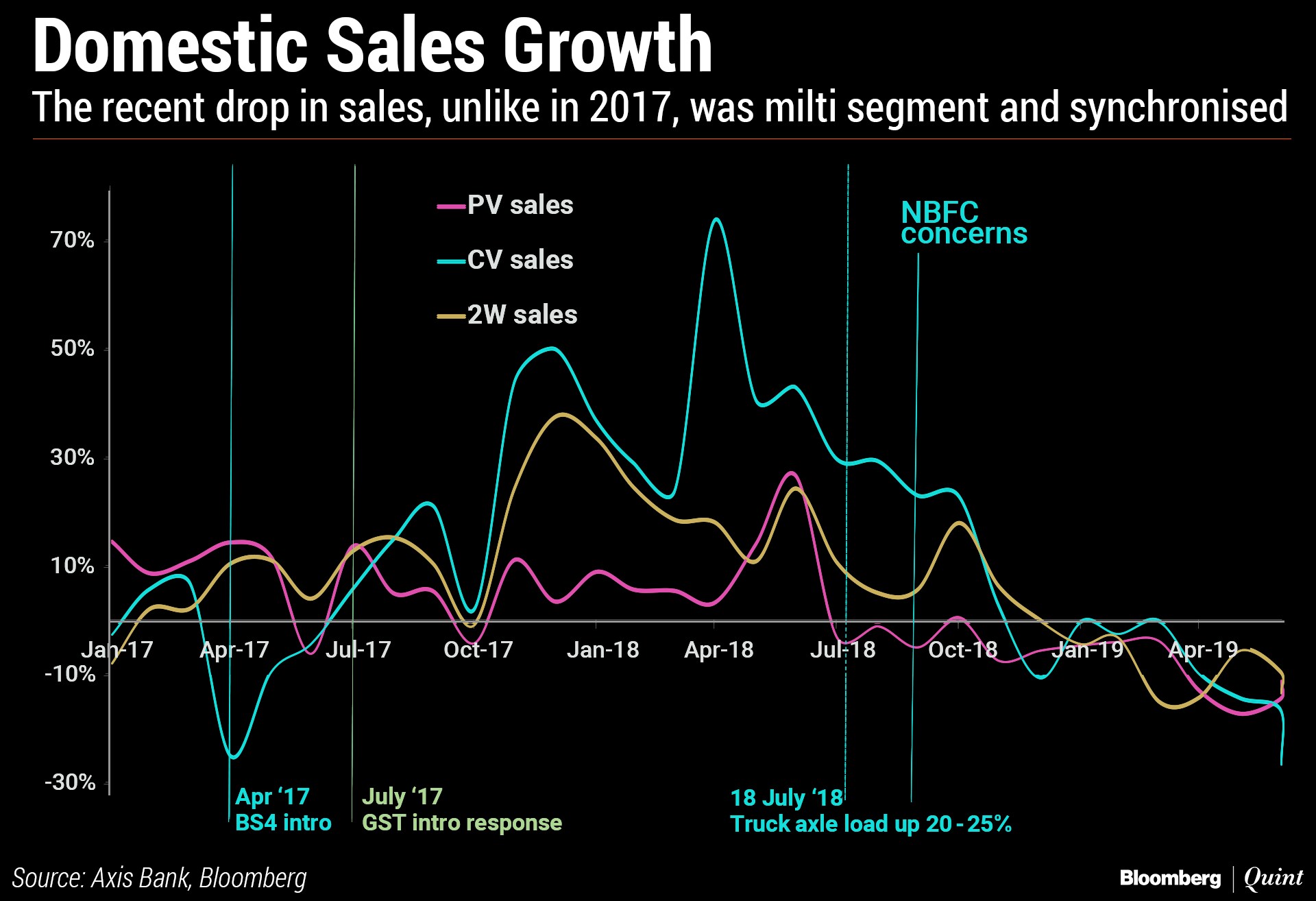

Slowdown in the auto sector has been a global phenomenon, the report showed. But with cross-border trade issues impacting many countries, India seems to have been hit harder than most others.

While the drop in sales growth in May and June can be partially attributed to a higher base seen in the corresponding months of the previous year, the slump was deeper in July despite the lower sales growth of passenger vehicles in 2018, the report pointed out.

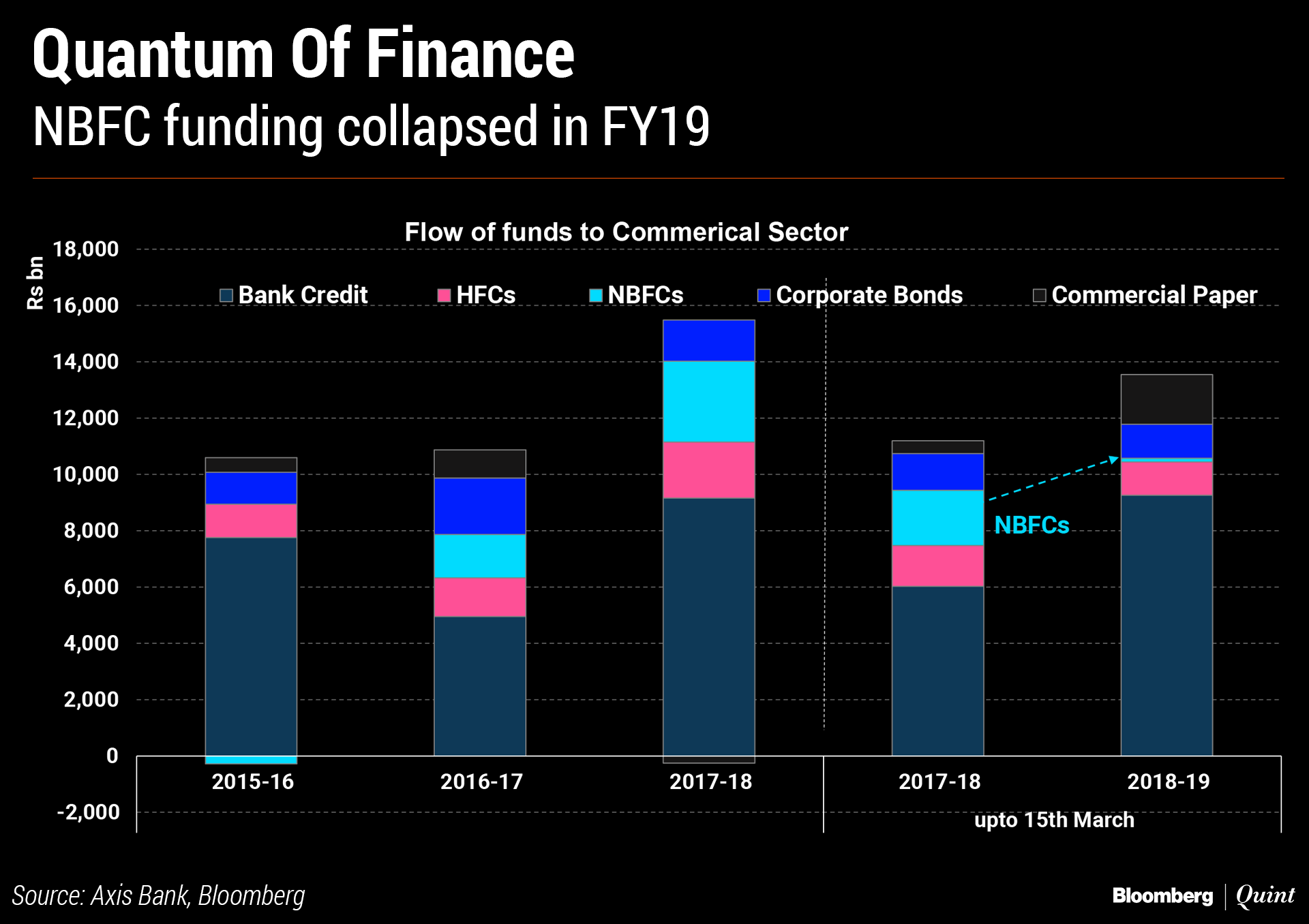

Funding from non-bank lenders saw a sharp decline in 2018-19, emanating from the loss of confidence in the non-banking financial companies' sector after the IL&FS crisis in October last year.

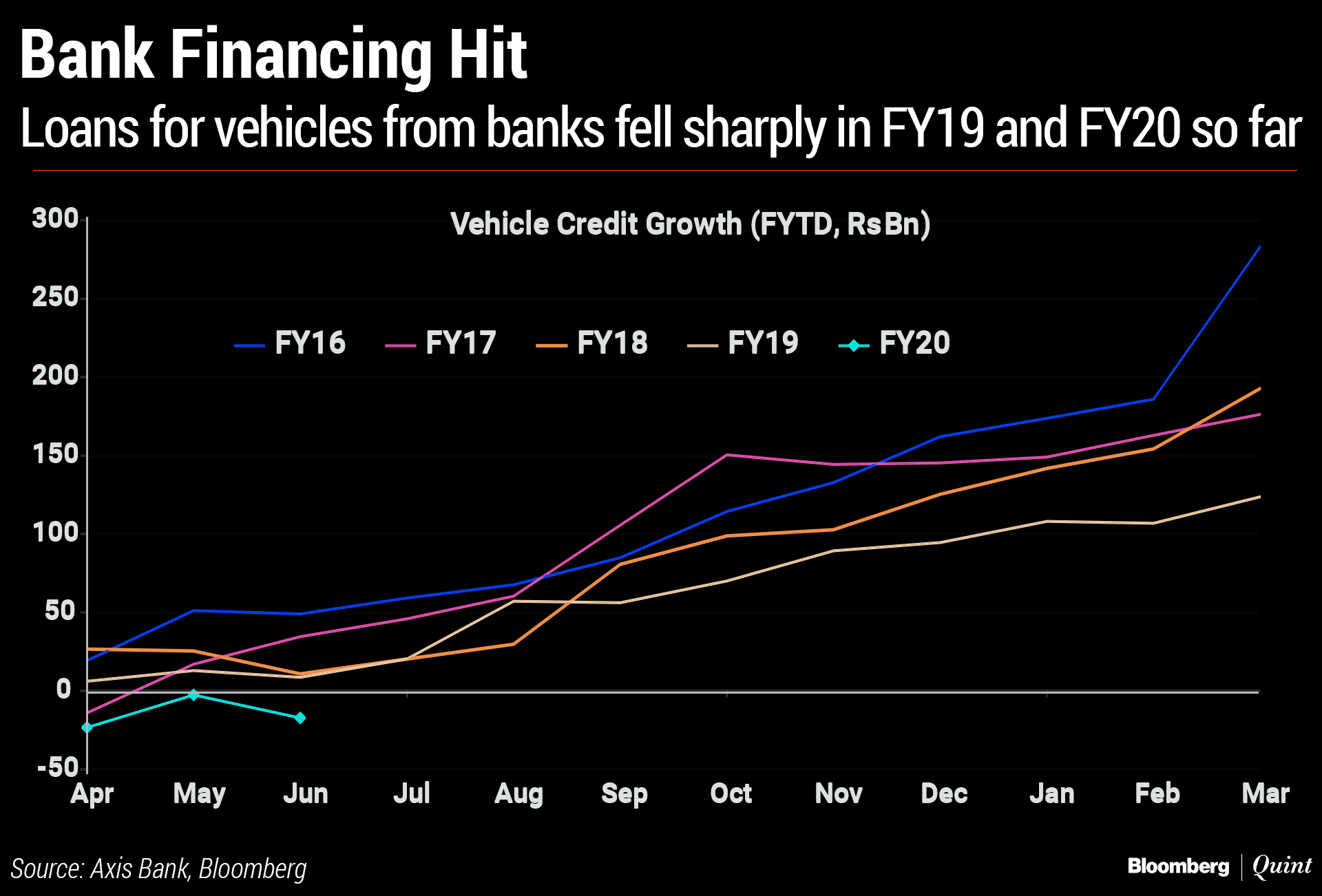

While bank credit to the sector rose during the previous year, bank loans to buy vehicles have fallen drastically in FY20 so far.

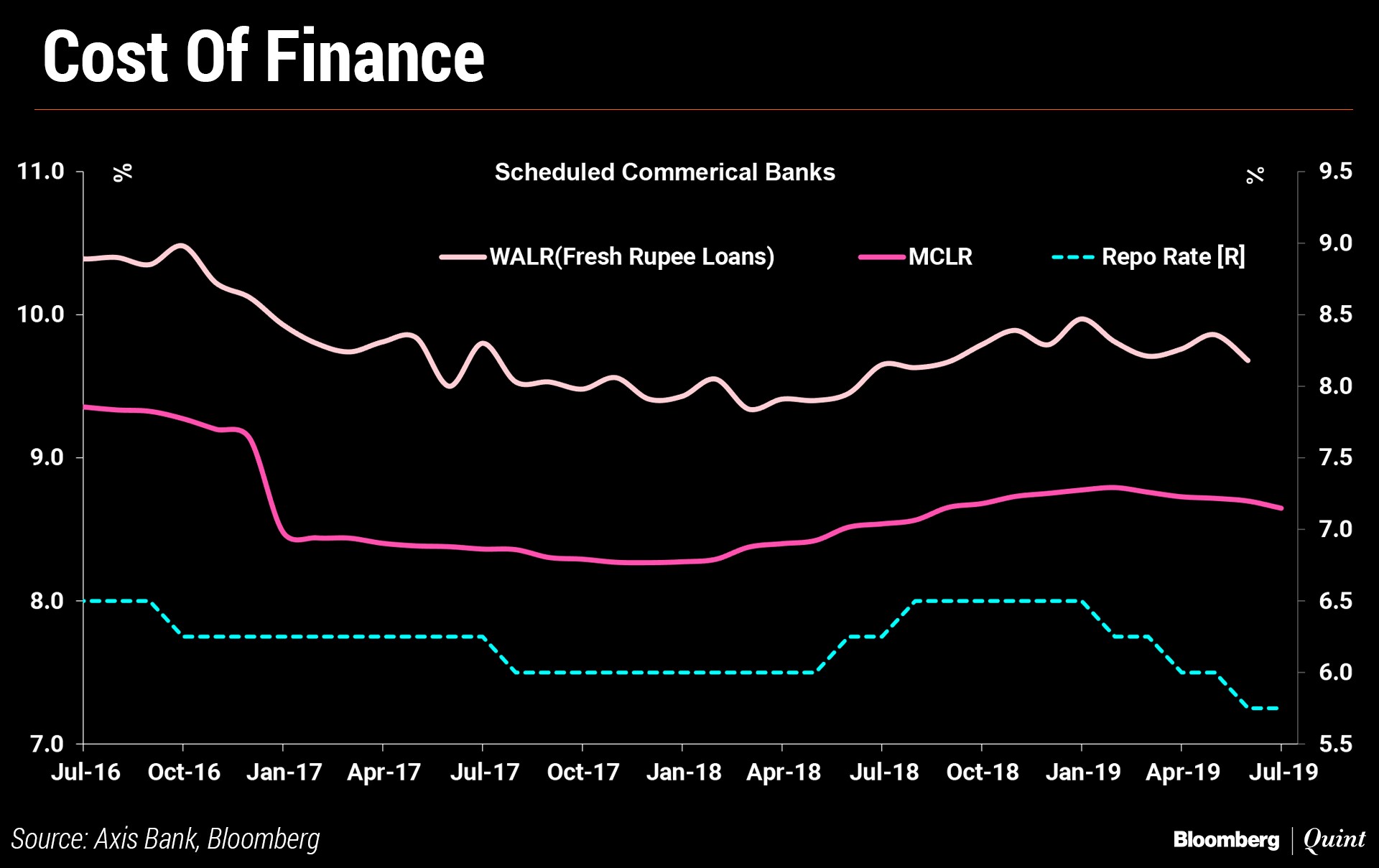

Interest costs, too, played their role in slowing demand. Lending rates were high till late July but have fallen after a rate cut by the Monetary Policy Committee of the Reserve Bank of India. “Vehicle loans will probably become cheaper in months ahead,” the report said.

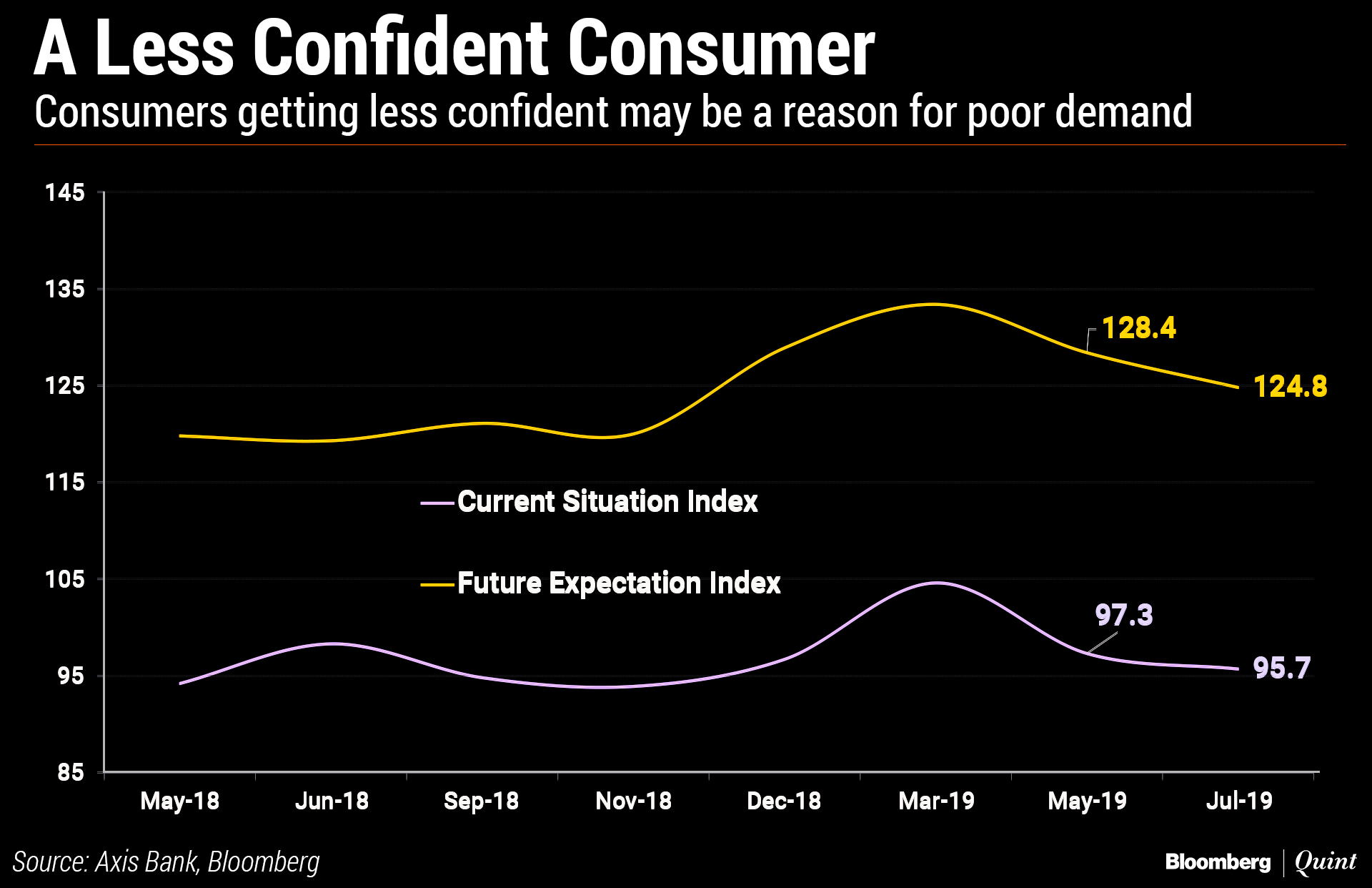

Reserve Bank of India's latest confidence survey showed a change in perception of risk while consumption demand, particularly of larger-ticket products, seems to be getting pushed back.

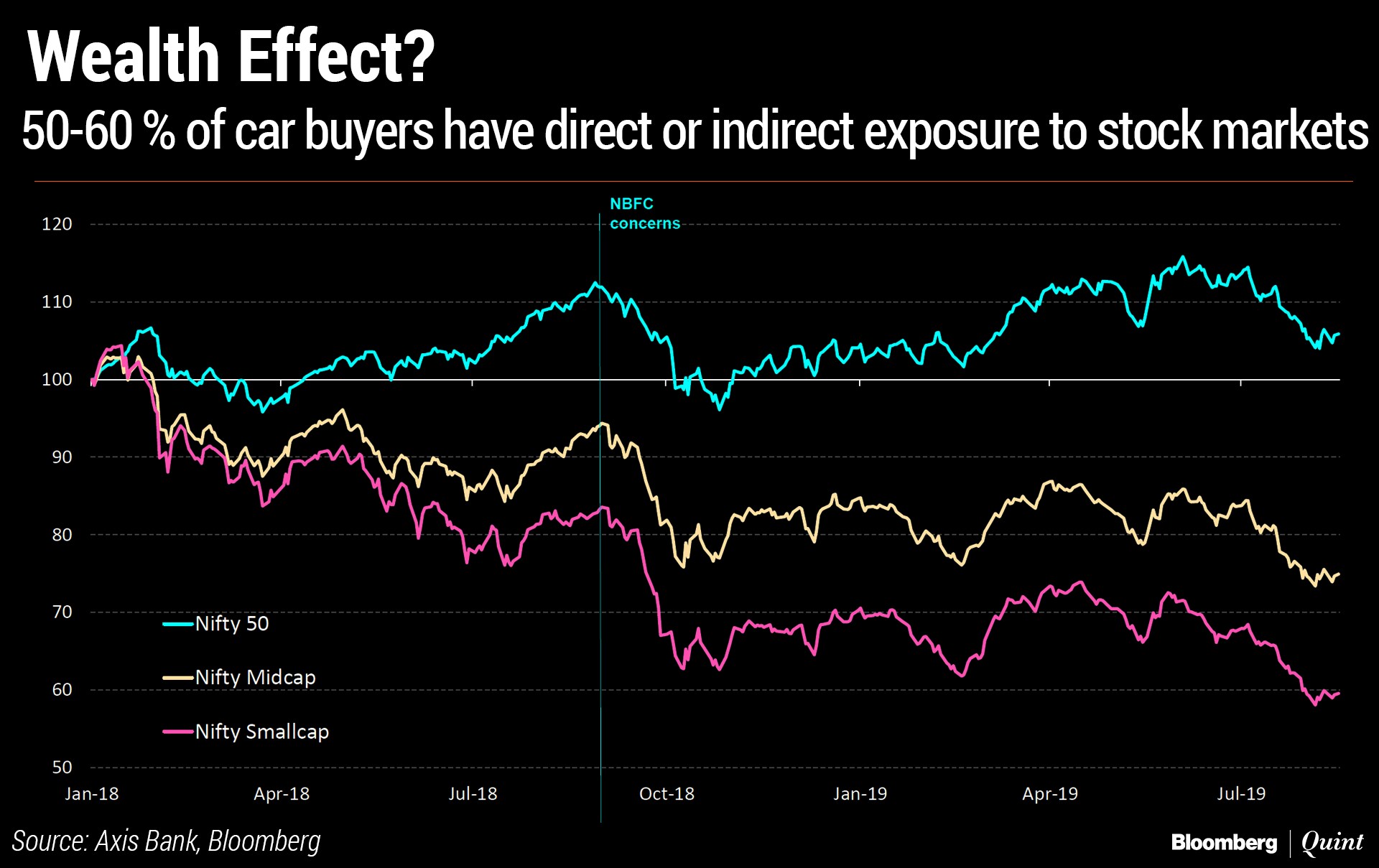

The report said that nearly 50-60 percent of all car buyers have a direct or indirect exposure to stock markets. The increased volatility in the market over the last one year—due to trade war, Brexit, India's general elections, among others—may have had an impact on a prospective vehicle buyer, it said.

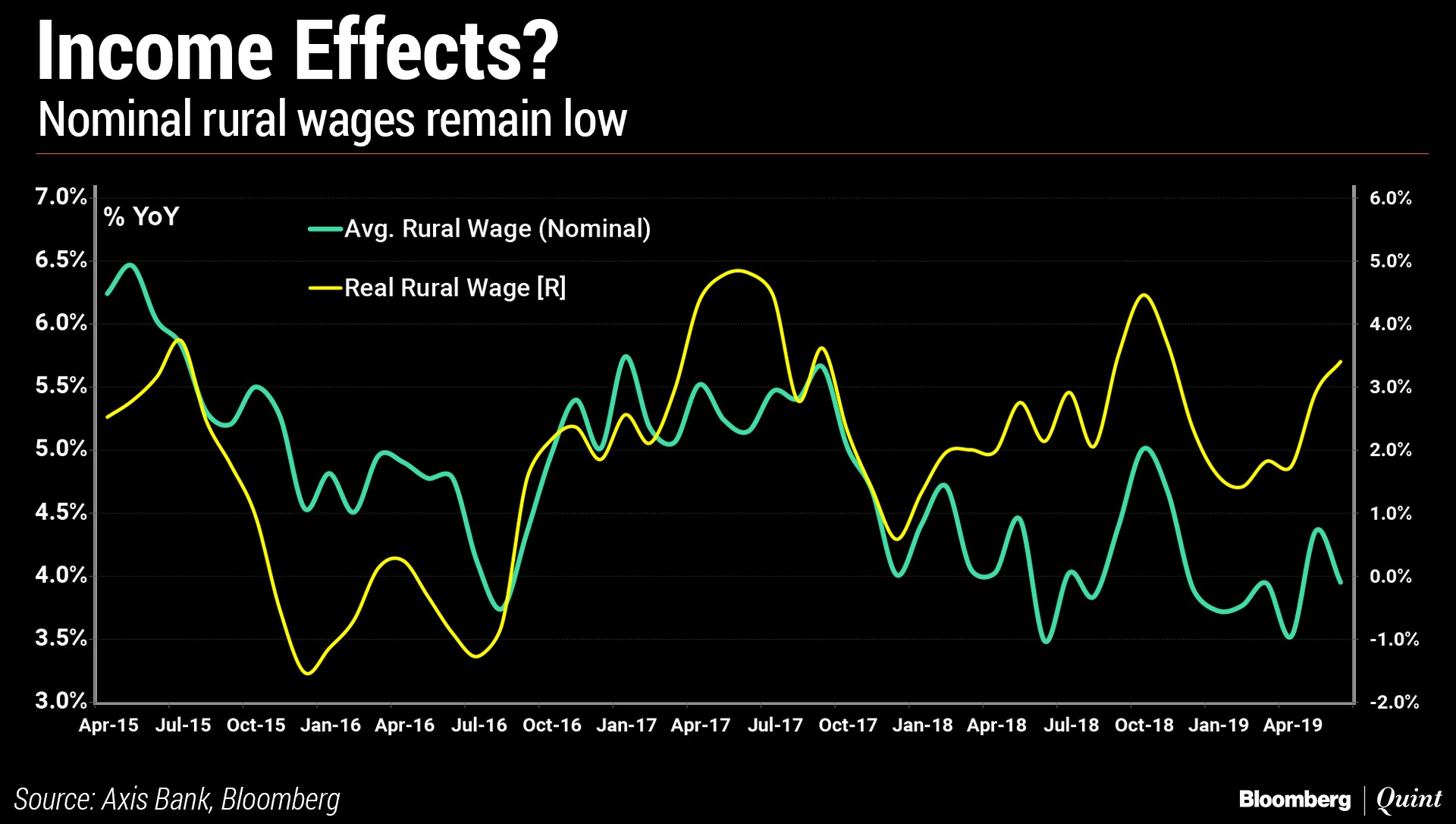

On the income side, despite an improvement in real rural wages, nominal income growth has remained low.

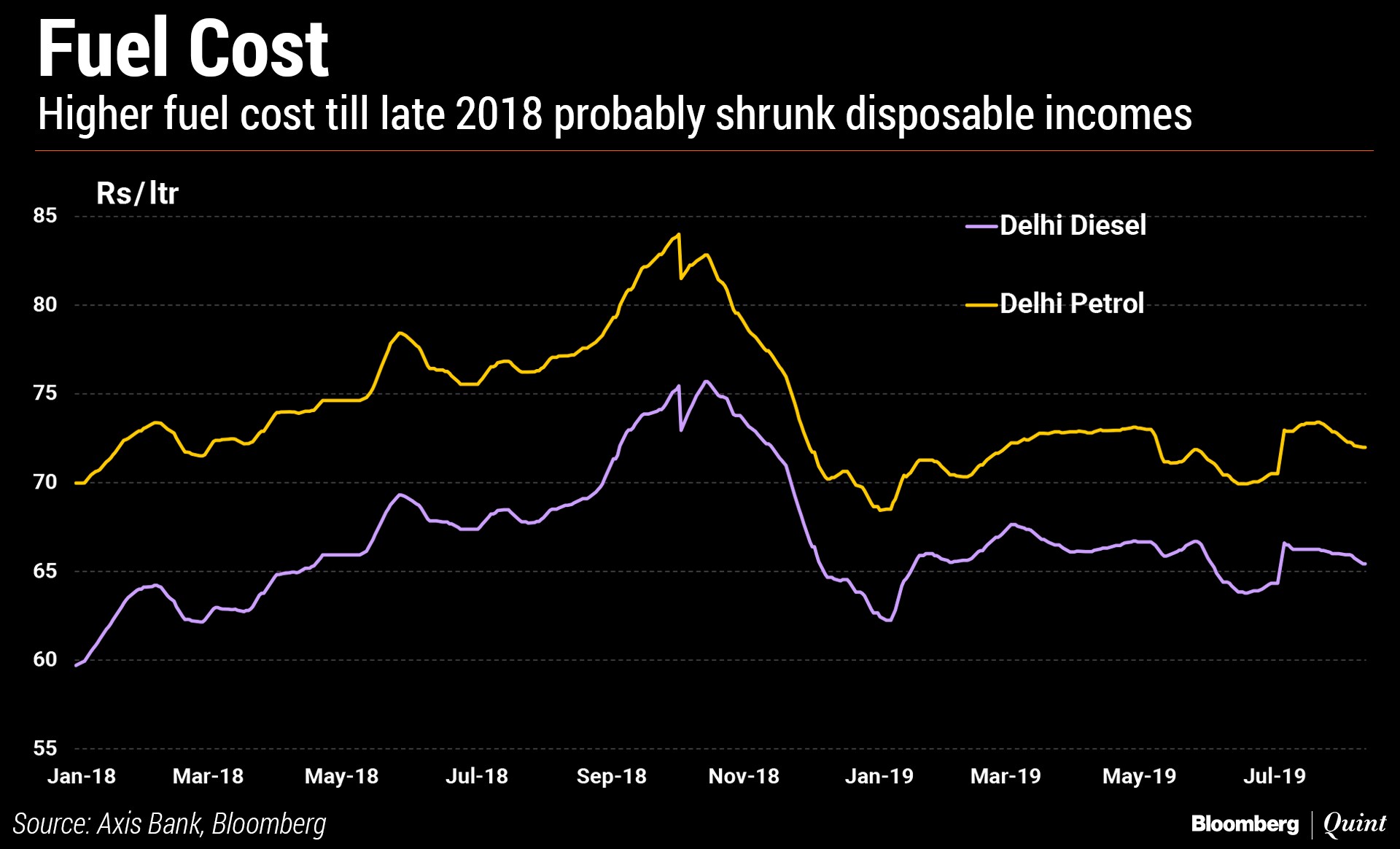

Brent crude price was around $80 a barrel in October last year, leading to higher petrol and diesel prices which probably cut into people's disposable incomes, the report said. This, however, can't explain a protracted slowdown since oil prices have come down since then.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.