Unilever Plc agreed to take over GlaxoSmithKline Plc's nutrition business and then merge their Indian units in a deal worth £3.1 billion or $3.8 billion.

The deal involves the merger of GSK Consumer Healthcare Ltd. with Hindustan Unilever Ltd., according to their filings, adding India's No. 1 malted-milk drink Horlicks to HUL's portfolio. The transaction will give GlaxoSmithKline approximately 5.7 percent stake in HUL, while Unilever's holding in its Indian unit will drop by 5.3 percent to 61.9 percent.

GSK Consumer Healthcare shareholders will get 4.39 shares of HUL for every one share held. The transaction values the total business of GSK Consumer Healthcare at Rs 31,700 crore. The deal is expected to be completed in one year subject to regulatory and shareholder approvals.

Horlicks is the leader in India's nutrition drink market pegged by Euromonitor International at Rs 7,873 crore. It competes with Mondelez International's Bournvita. HUL will pay royalty to Unilever ranging from 1.8 percent to 4.5 percent on Horlicks, depending on the variant. And it's entering a stagnant market.

Glaxosmithkline's Indian healthcare business reported a flat revenue growth at Rs 4,377 crore in the year ended March—most of it coming from nutrition products like Horlicks and Boost. And industry forecasts are not upbeat. The health drink category is expected to grow at 3.7 percent till 2022 compared with 11.5 percent in five years through 2017, according to Euromonitor International.

The category still remains under-penetrated in India, HUL said in its statement, adding that it's well positioned to further develop the market given the extent of its reach and capabilities.

“I am confident that this merger will create significant shareholder value through both revenue growth and cost synergies,” said Sanjiv Mehta, chairman and managing director of HUL, in the press release. After the merger, the turnover of its food and refreshment business will exceed Rs 10,000 crore, making HUL one of the largest business in the industry, he said.

The maker of Lipton tea will use its distribution to increase the reach of Horlicks and Boost across the country, Mehta said at a press conference later. He said HUL's reach of eight million outlets is several times bigger than that of GSK Consumer.

Sudip Bandhopadhyay, chairman of brokerage Inditrade JRG Group, said HUL has been trying to get into the food segment with various products at various times. “Unfortunately, they have not been as successful as they would have loved to be,” he said. “This is probably the best bet for them. With their marketing muscle and distribution muscle, they can finally do something meaningful in the food sector.”

HUL's Chief Financial Officer Srinivas Phatak expects the acquisition to help HUL expand its margins by 8 to 10 percentage points in the “medium term”.

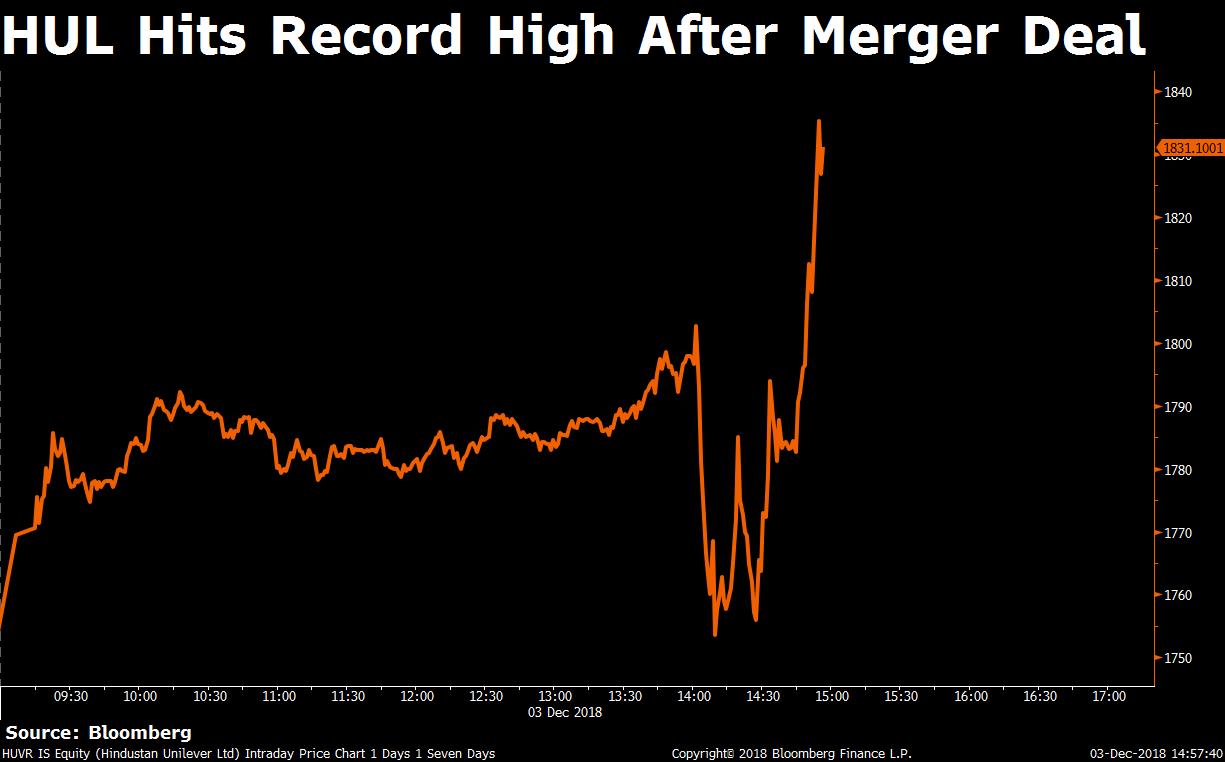

Shares of Hindustan Unilever rose as much as 4.62 percent, the most since Feb. 15, to a record of Rs 1,835 after its board approved the merger. GSK Consumer Healthcare's shares rose as much as 6.08 percent to Rs 7,710.

GSK's India Plan

GSK will also sell its 82 percent stake in GlaxoSmithKline Bangladesh Ltd. and other related brand rights for GSK's consumer healthcare nutrition activities in certain other territories to Unilever, for which £566 million in cash, according to the company's statement.

Once the merger of its Indian unit is complete, GSK intends to sell its holding in HUL, the company said. “Such sell down will be in tranches and at such times as GSK considers appropriate, taking into account market conditions.”

India remains an important market for GSK which will continue to invest in growth opportunities for its over-the-counter and oral health brands including Crocin, Eno and Sensodyne. After the merger, HUL will sell these brands.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.