Screening smallcap stocks can be difficult because first of all, there are so many to choose from. There are many factors that need to be considered when screening for potential investment opportunities.

So, if you're looking to invest in the smallcap space, this is how you should screen for the best smallcap stocks.

# First of all, think long term

A lot of people I talk to, seem to be punting in smallcaps.

But mind you, short-term punting in smallcap stocks is a dangerous game.

The performance of smallcaps is more volatile and unpredictable in the short term than other market segments.

The business of smaller firms is far more uncertain because the cash flows are more difficult to estimate.

Our smallcap guru, Richa Agarwal, frowns on short term investing in smallcaps. She strongly believes smallcaps are the best asset class for long-term wealth creation not for short-term speculation.

According to her approach, you need to do a bottom-up analysis i.e., focus on the business fundamentals, growth prospects, management, and valuations with a time frame of 3 to 5 years.

This approach varies from the mainstream approach, which is more top down, focused on the short-term, and chases stocks which are expected to gain from macro themes.

To make this process easier for you, here are three ready-made screens to find the best smallcap stocks:

#1 Top High Profit Margin Smallcap Stocks

#2 Top Fastest Growing Smallcap Stocks

#3 Top Multibagger Smallcap Stocks

# Look beyond smallcaps that the market is aware of

The well-known smallcaps will probably deliver decent returns in the long run...but if you want potentially life-changing profits, you must look elsewhere.

Finding multibaggers from an entire universe is no easy task. That is why you must have some criteria laid out to find hidden gems from the smallcap space.

One way to do this is to focus on companies which have low marketcap or companies which are leaders in the segment they operate in. Basically, they should have an economic moat and some niche products, or services in the offering.

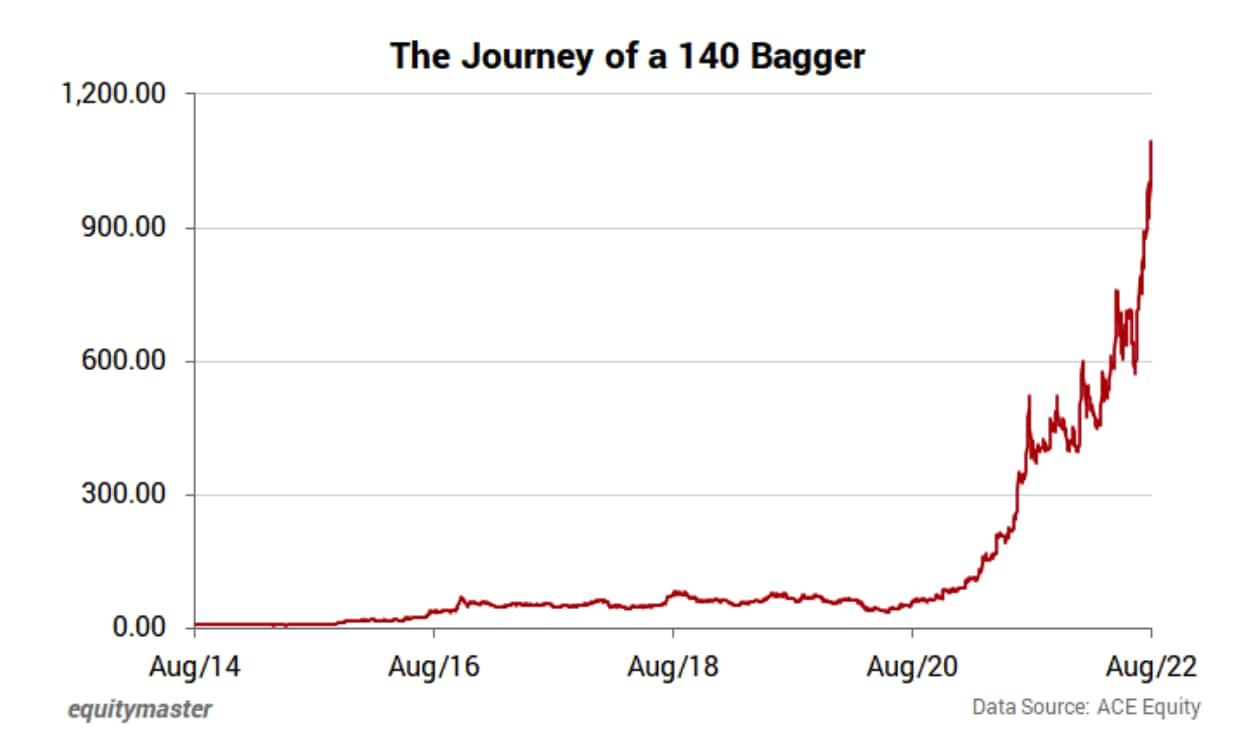

Take the example of Rajratan Wires. The company is into tyre bead manufacturing - a very niche segment.

The company is the only bead wire manufacturer in Thailand (via a wholly owned subsidiary). It has a market share of over 50% in India.

Over the years, the company took huge capacity expansions to drive future growth. The results are there for you to see…

Over this time, the country has seen a crash in smallcaps, a deadly pandemic, supply chain shortages, inflation, and even slowdown in the auto sector which is the prime industry the company caters to.

None of this has come in the way of the stock's performance.

That's the beauty of investing in small-cap stocks, having patience, and the power of long-term investing.

Well known smallcaps of today started from scratch when they were trading at a low share price and a low market cap.

# Identify a strong business with good management

"The key to investing is ... determining the competitive advantage of any given company and, above all, the durability of that advantage. The products or services that have wide, sustainable moats around them are the ones that deliver rewards to investors."

The roadmap to making it big with smallcap stocks begins when you select a company with a strong economic moat and a good quality management team heading it.

In investing, a moat refers to a business's ability to maintain its competitive advantage over its peers to protect market share and ensure sustained profits. This is what allows a business to earn high returns on capital over time.

Moats could come from having a cost advantage (being the lowest cost producer), brands (such as Asian Paints, Castrol), exclusive licensing or patents (Astral Polytechnik and its tie up with Lubrizol a few years ago), network effects (as in the case of Alphabet), higher switching costs (like in case of private banks).

Think about Coca Cola, Amex, and Wells Fargo. These companies have been around for decades.

There are businesses that compete with them. Yet these companies have not just survived but expanded market share multifold.

Now that we saw how to initially build a list of fundamentally strong smallcap stocks, here are some other screening criterions that could help you filter out the needle from the haystack.

# Check if the smallcap is shareholder friendly firm

You need to see if the smallcap firm under question has a history of regular payouts.

Dividends form an important part of your investing journey. They provide a steady stream of income and help you build wealth over time.

That is why dividend investing has proven to be a successful way to retire early.

The key here is to look for smallcap companies who have stood out in tough times, and rewarded investors by making regular payouts.

If these dividends come at a growth rate, that is an extra point to the company.

From the smallcap space, companies which have consistently paid dividends and have shareholder friendly policies include Sanofi India, Bata India, Tata Investment Corp, Page Industries, Swaraj Engines, Oracle Financial Services, VST Industries, among other names.

Here are three ready-made screens to find smallcap stocks paying big dividends:

#1 Top Smallcap Dividend Payout Stocks

#2 Top Smallcap Dividend Yield Stocks

#3 Top Smallcap Dividend Growth Stocks

# Growth

Growth is what every investor wants in a stock. As long as the company's sales and profits are growing at a satisfactory pace, most investors won't complain.

Smallcap growth stocks are one of the most exciting segments in the market, as small companies with higher growth rates often offer investors the opportunity for market-beating returns.

These companies are sitting on the runway, waiting to take-off. However, they usually tend to trade at a premium valuation.

Check out some ready-made screens to find the best smallcap growth stocks in India:

#2 Top Electric Vehicle Smallcap Stocks in India

# Debt

While screening stocks, an obvious metric one should consider is to look at the company's debt. Too much debt can sink a company.

In financial terms, leverage means the ratio of a company's loan capital (debt) to the value of its ordinary shares (equity). The two ratios to look at here are the debt-to-equity ratio and interest coverage ratio.

An important point to note is high level of debt alone cannot define the company's ability to service it. There's a good chance the companies with high debt can generate strong cash flows to service their interest cost and re-pay the debt comfortably.

Therefore, a better way to identify the risk is to check the interest coverage ratio. A higher coverage ratio is better, although it may vary from industry to industry.

Smallcap growth stocks might have big capex plans and for this, they might take on debt. While the firm's focus towards expansion is good, higher growth does not always return in higher returns. You need to see how the smallcap company is servicing debt.

Assess whether the management is too conservative or too aggressive. For instance, we would avoid an NBFC that grows aggressively by taking on more debt and without having in place enough controls when it comes to maintaining asset quality.

Debt free companies are good options, and a general thumb rule should be to choose companies below debt to equity ratio of 1.

Here are a few ready-made screens to select the best debt free smallcap stocks in India:

#1 Top Debt Free Smallcap Stocks

#2 Top Smallcap Companies with Debt Reduction

# Margin of safety

The concept of 'Margin of Safety' is undoubtedly one of the most important concepts in the field of value investing.

The margin of safety is an expression for the difference between the intrinsic value of a business and its market price. It can be used as an indicator of a company's growth potential because it measures how much investors are willing to pay for the firm's future cash flows.

Always ask how much a company is worth and never overpay. Margin of safety ensures that you buy a stock only when it trades at a reasonable discount to its true value.

Use the basic valuations tools and measure the company's price to earnings (PE) ratio and price to book value ratio. These two ratios are the most important valuation metrics.

Here are 3 ready-made screens to select the best smallcap stocks offering decent margin of safety. These stocks are also called undervalued stocks.

#3 Top Undervalued Smallcap Stocks

Ask yourself these questions

- Does the company have a strong balance sheet?

- What is the company's growth rate?

- How much debt does the company have?

- Is management in place and trustworthy?

- Will the business survive the worst-case scenario of a global crisis?

- Has the business seen such down cycles before and has come out strong?

- Will the business become stronger while its competitors fall by the wayside?

If the answer is yes to most of these questions, then you have what we like to call a fundamentally strong smallcap stock.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.

This article is syndicated from Equitymaster.com

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.