The Reserve Bank of India's proposal to overhaul the compensation structure for chief executive officers (CEOs) of private sector banks and wholly owned subsidiaries of foreign banks, could mean a decline in effective salaries from current levels.

The rules seek to cap the level of variable pay, including stock options, in relation to the fixed pay, at 200 percent. Earlier while variable pay was capped at 70 percent of fixed pay, ESOPs were not included.

“It is likely that if these proposals become norms, we may see the effective salaries of CEOs could come down. However, it is likely that bank boards would increase the basic salaries to bridge the gap,” said Amit Tandon, founder and managing director, Institutional Investors Advisor Services (IiAS). He added that some additional clarity is awaited on valuing stock options.

How Top Banker Salaries Are Currently Structured

Annual reports of top private banks shows that salaries are structured with a fixed pay component, a variable pay component and stock options.

The RBI is proposing the following changes in variable pay:

- Total variable pay, including ESOPs, should be capped at 200 percent of fixed pay.

- At least half the variable pay should be non-cash.

- A minimum of 60 percent of the total variable pay must be under deferral arrangements. Of this, at least 50 percent of the cash component should also be deferred.

According to a former banker, who is now a member of the nominations and remunerations committee of the board of a large private sector bank, currently there are no fixed norms for computing fixed and variable pay for a CEO. The board member spoke on conditions of anonymity. Bank boards reserve about 10 to 20 percent of the annual salary of a CEO for variable pay. By increasing the ratio of variable pay in the overall salaries, CEOs could see their effective compensation come down and that could create some uneasiness, the board member said.

It may, however, improve attention to performance of the bank.

“A higher variable pay component ensures more skin in the game. If your compensation depends on the performance of the bank you manage, then it is in your best interest to ensure that the bank performs well,” said Rituparna Chakraborty, co-founder and executive vice president, TeamLease.

According to Chakraborty, variable pay could be linked to quantitative components, such as the bank's profitability, as well qualitative components, such as long term investments decisions and their effectiveness. Under the new rules, quantitative components will likely get a higher weightage over qualitative ones, she added.

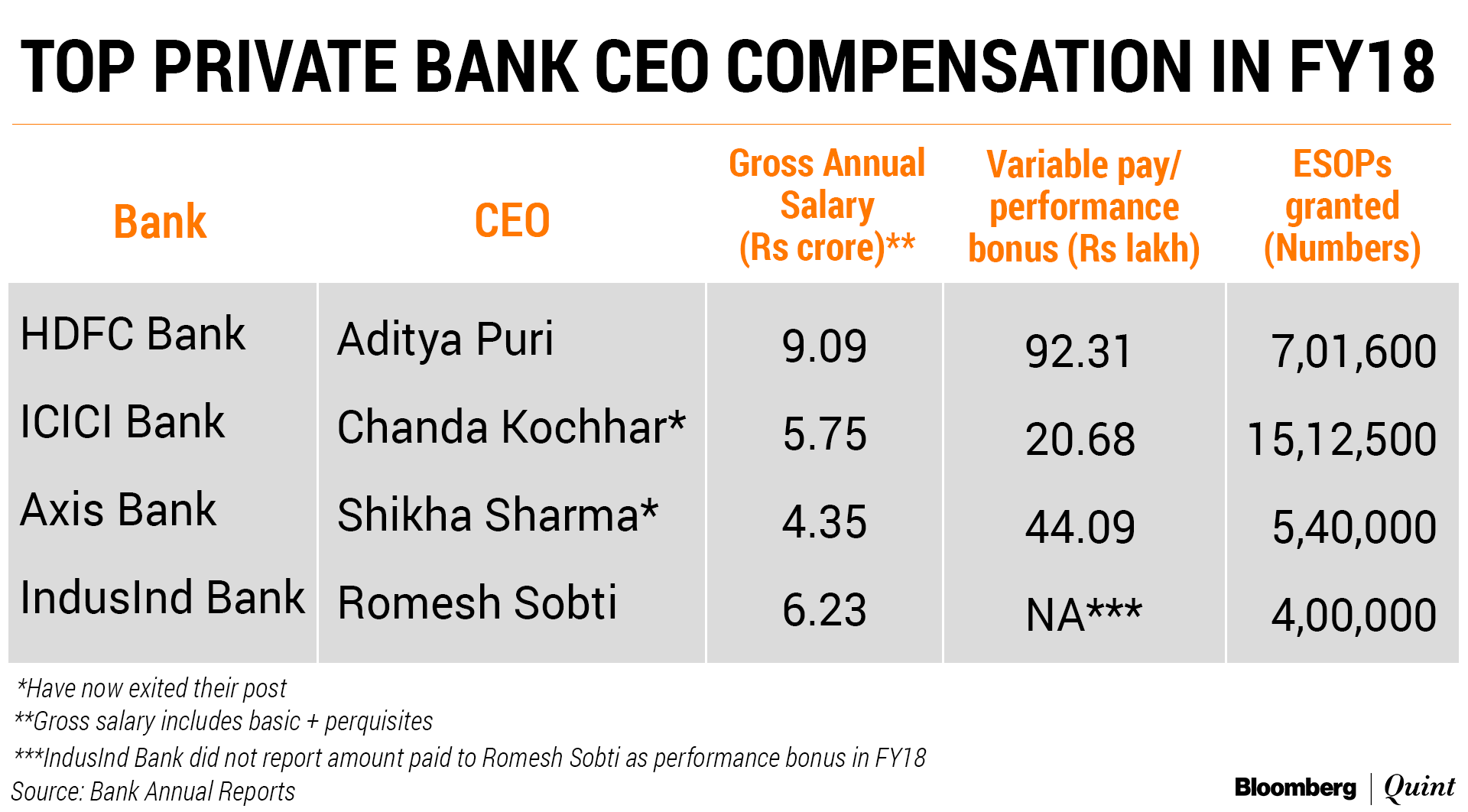

The table below provides an illustrative example of professional CEO salaries at top private banks as reflected in annual reports. The ESOPs shown would be accumulated over time. As such it is difficult to assess whether the total variable compensation of these executives was more than 200 percent of the fixed pay.

Existing Salary Trends Across Private Banks

An April 2018 study conducted by IiAS showed that the variable pay across private banks stood at 49 percent of total compensation. This is in line with the trend across a broader basket of BSE 500 companies.

Private bank CEO salaries were about 66-times the median salary of bank staff. This is lower than 88-times for BSE 500 companies. “In private banks, salary levels are generally higher than the S&P BSE 500. Hence, the CEO pay as a multiple of median employee pay is reasonable,” said the report.

Almost 36 percent of CEOs in the sector were paid more than Rs.10 crore in FY17, the study said.

For its study, the proxy firm considered the salaries of CEOs of all 14 private sector banks, for the year ended March 2017.

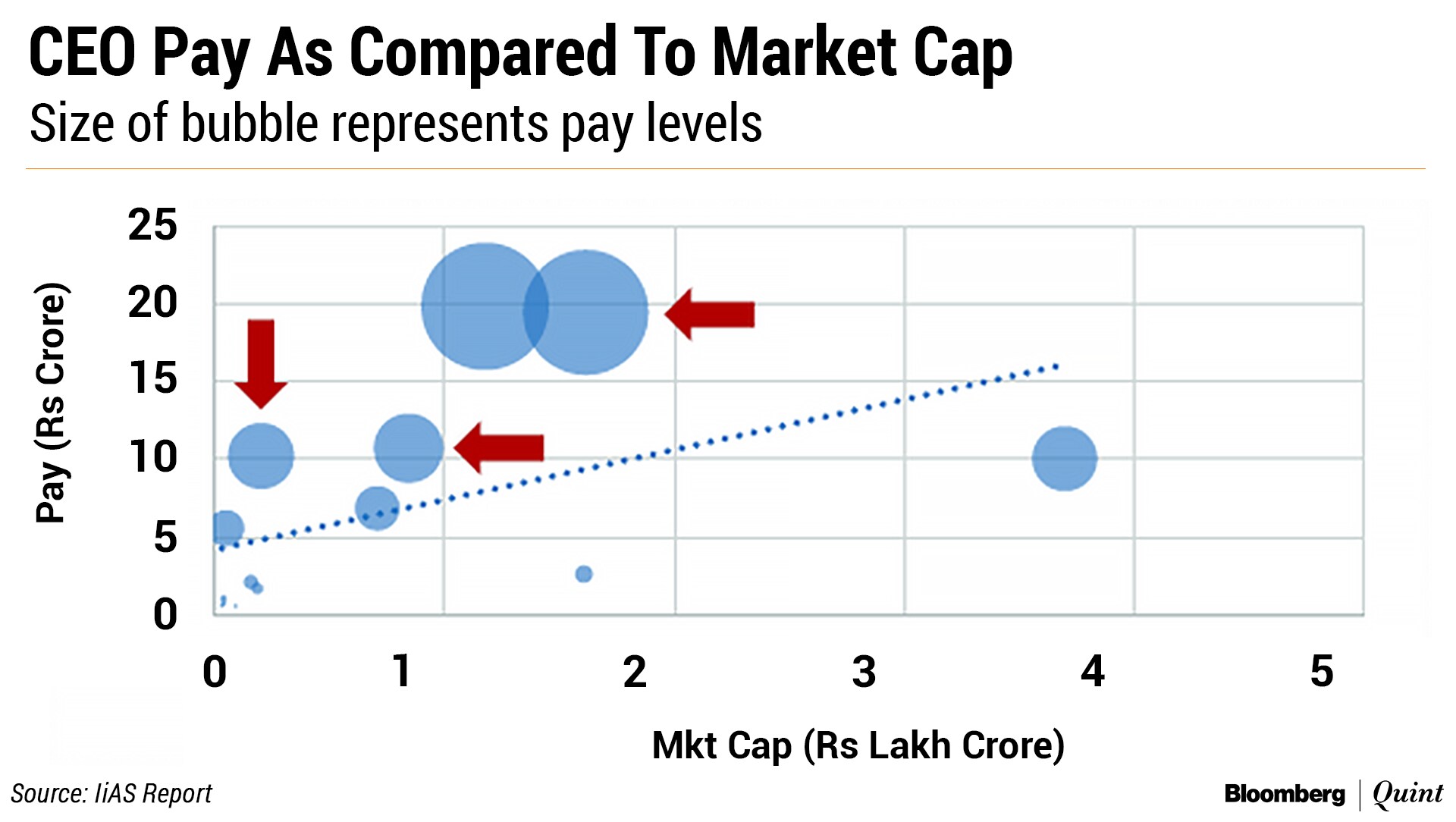

While CEO pay is well correlated with asset size, two CEOs in the ‘Rs 10 crore club' are running companies with an asset base of less than Rs 2 lakh crore... The correlation is a bit weaker for market cap. Four CEOs had pay levels disproportionate to the market cap of the bank.IiAS Report (April 2018)

The chart below shows pay levels at individual banks compared to trend. Bubbles above the trend line suggest an elevated level of compensation compared to the industry average.

Puneet Bhatia, a client partner and head of digital practice at executive search firm, Pendersen & Partners told BloombergQuint that the RBI's suggestions are in line with global best practices. Bhatia, however, suggested that the timing of the proposals may be connected to recent incidents of poor asset quality and governance at some private banks.

Since banking is a business of trust, the current scenario where senior managements at various private banks have been found wanting on several counts of governance and are still paid a high compensation, needed to be corrected to maintain that trust, said Bhatia.

In FY19, the RBI denied an extension to chief executive officers of two private banks — Axis Bank and Yes Bank. This was perceived to be due to high level of divergence in asset classification. Chanda Kochhar, the former CEO of ICICI Bank exited after allegations of quid pro quo.

Claw-Back For Asset Quality Divergence

As part of its proposals, the RBI suggests that if a bank reports a divergence in asset classification of more than 15 percent, the CEO's unvested variable salary must be withheld. “Further, in such situations, no proposal for increase in variable pay (for the assessment year) shall be entertained,” the RBI said.

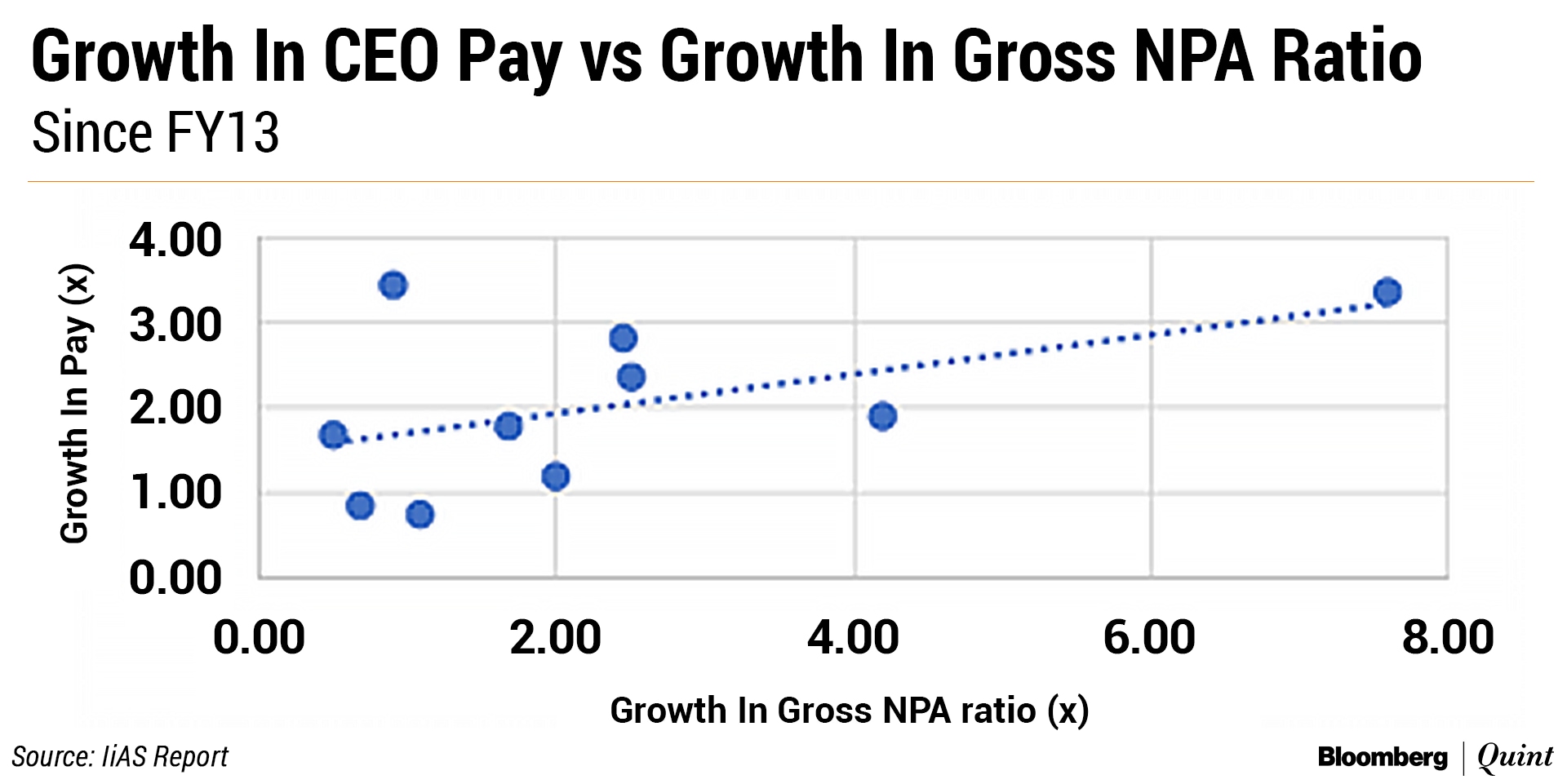

The IiAS report cited above had found that CEO salaries were not commensurate with the asset quality performance of the bank in some cases.

According to the study, despite a consistent rise in non-performing assets (NPAs) for private banks since financial year 2012-13, at least five private bank CEOs had seen their compensation increase by 2-to-4 times.

Currently, most private sector banks have a claw-back option in the contracts with their CEOs, said another retired banker who sits on the board of a private bank. Typically, the claw-back provision states that the variable pay could be deferred or even withheld, if there is an inquiry linked to gross negligence or a breach of integrity by the CEO.

However, Indian private sector lenders have rarely invoked a claw back provision, said this banker. It is only recently, in the case of ICICI Bank, that the board of the bank approved a claw-back on all performance bonuses paid to its former CEO between April 2009 to March 2018. Kochhar had been found guilty of violating the bank's code of conduct.

Compensation For Risk Management Departments

As part of the discussion paper, the regulator also said that "members of staff engaged in financial and risk control should be compensated in a manner that is independent of the business areas they oversee and commensurate with their key role in the bank.”

While it is not clear what the RBI means by saying this, it would be essential that crucial functions like risk and compliance should be untouched by the growth in core business of the bank, said Chakraborty.

The job of risk and compliance staff must be to maintain a certain level of hygiene in the business and should work as a check on other departments such as the credit team.Rituparna Chakraborty, Co-Founder & Executive Vice President, TeamLease

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.