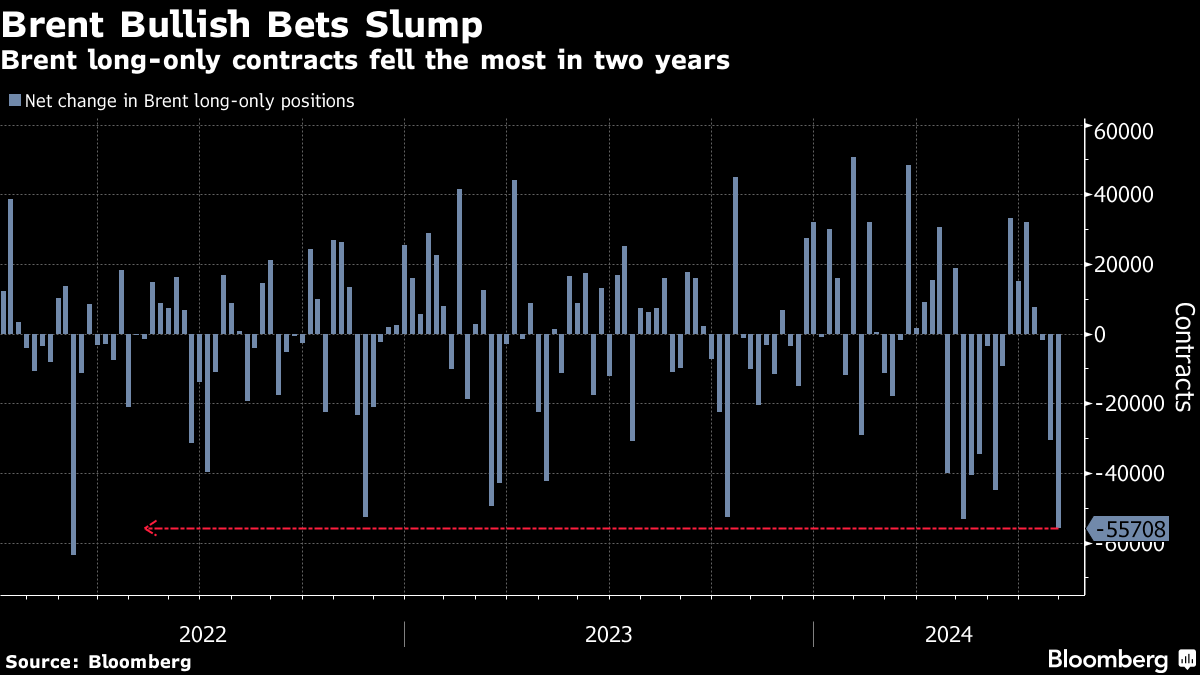

(Bloomberg) -- Hedge funds slashed bullish wagers on Brent crude by the most in almost two years amid an algorithmic selloff and increasing concerns about demand.

Money managers reduced their long-only positions on Brent by 55,708 lots to 209,518 lots in the week ended July 30, the biggest absolute decline since March 2022, according to figures from ICE Futures Europe. Meanwhile, funds' net bullish position on West Texas Intermediate slid to a six-week low, Commodities Futures Trading Commission data.

The drop comes after Brent futures sank below $80 a barrel amid an algorithmic-propelled selloff. Commodity trading advisers dumped their bullish positions after futures pierced both the 50-day and 100-day moving averages, which had acted as support levels for the commodity.

Fears of decreasing crude demand are also souring market sentiment as data this week pointed to economic sluggishness in two key crude-consuming countries: the US and China. In China, crude imports were 2.3% lower in the first half of 2024 compared to the same period last year. Meanwhile, higher US interest rates have weighed on consumer sentiment.

In a sign of worriesa about decreasing demand, hedge funds increased their net-bearish diesel bets to the highest in almost four years. Diesel is a mainstay product for the global economy, powering trucks, ships and trains.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.