HDFC Bank Ltd. will focus on profitable growth after the merger with Housing Development Finance Corp., the private lender's top executive said in an effort to get the messaging right after the third-quarter earnings disappointed the street.

The bank's third-quarter net interest income didn't rise as fast as expected as lower deposit growth put pressure on margin.

Sashidhar Jagdishan, managing director and chief executive officer, in his first analyst interaction after the earnings, acknowledged that there has been feedback suggesting that the bank's narrative could have been better.

"Our single minded focus is to create a very sustainable franchise and our focus is going to be on profitable growth," Citi Research quoted Jagdishan as saying in an effort to allay concerns. "That's the only metric I am going to be looking at for years to come and especially during the period of transition. We will not disappoint you, I can assure you that."

Bernstein Research, citing the analyst meet, said HDFC Bank management clearly guided that earnings per share growth will be prioritised over loan growth. "The fresh deposits will be first utilised to replace the maturing high cost borrowings of erstwhile HDFC Ltd., with the balance then used to fund incremental growth opportunities," the research firm said in a Feb. 19 note.

"While the resultant loan growth can hence be 'a tad lower', the replacement of high-cost liabilities will boost margins/profitability," the note said.

According to Citi, the key takeaways are building a granular sustainable franchise. Balanced profitable growth will be the key focus and the bank will not chase high-cost deposits during the period of tight liquidity, it said.

Here is what analysts have to say on the analyst meet

Bernstein Research

The research firm has an 'outperform' rating on the stock with a target price of Rs 2,100 apiece. This implies an upside of 48%.

The long-term thesis remains solid for the bank— its best-in-class deposit gathering ability and superior underwriting outcomes should position it well to be the long-term winner.

The incremental LDR levels would be in line with the long term average for the bank, with repetition of a Q3 like ILDR unlikely, even as the focus remains on granular and sustainable deposits.

The stock LDR would hence move down along a glide path, with lower ILDR also helping the bank maintain LCR within the long term range of 110-120%.

The bank expects a sharp improvement in deposit accretion in the next few quarters and the CEO also reiterated that there is no diktat from the central bank to bring down the LDR immediately.

Branch expansion will continue to be a core part of the bank's strategy, with investment in digital seen more of an acquisition/transactional tool.

The rising branch productivity will also help deliver operating leverage to the bank in the long-term. The exact pace of branch expansion could vary but the long-term goal on the branch count remains intact.

Management hinted that the loan growth could be seen as a residual post the reserve maintenance and replacement of high cost erstwhile HDFC Ltd. liabilities with the fresh deposits.

"If deposits are indeed used to replace maturing borrowings and no fresh borrowings are raised, then loan growth can be sharply lower than the deposit growth (8-10 pp lower)," Bernstein said.

Citi Research

Citi Research has a 'buy' on the stock, with a target price of Rs 2,050 apiece.

With latest developments at Paytm, HDFC Bank will be more sanguine on pockets of opportunities that open up in certain merchant segments, that makes economic sense.

It will leverage on the group's distribution strength and its share in third party product distribution should rise.

Funding profile has been reasonably healthy, and distribution is well poised in terms of granular focus. With scrambling for funding amid tight liquidity and rates moving up, it has decided against participating in high-cost flows. Hence, growth has been lower than expected.

Post the merger, there will likely be a transitioning period to scale up market share of granular, sustainable deposits to match with loans share.

HDFC Bank's growth in unsecured lending has been contrary to industry and its architecture is comfortable to a particular level that is leading to lower growth. Risk-adjusted profitable and balanced growth is the focus.

Consistent earnings growth should be the anchor going forward. Metrics like loan growth can be ignored during the transitioning period.

It will not chase market share and will stay away from few pockets that do not make economic sense. The focus will be to operate in a particular band of NIM and RoA.

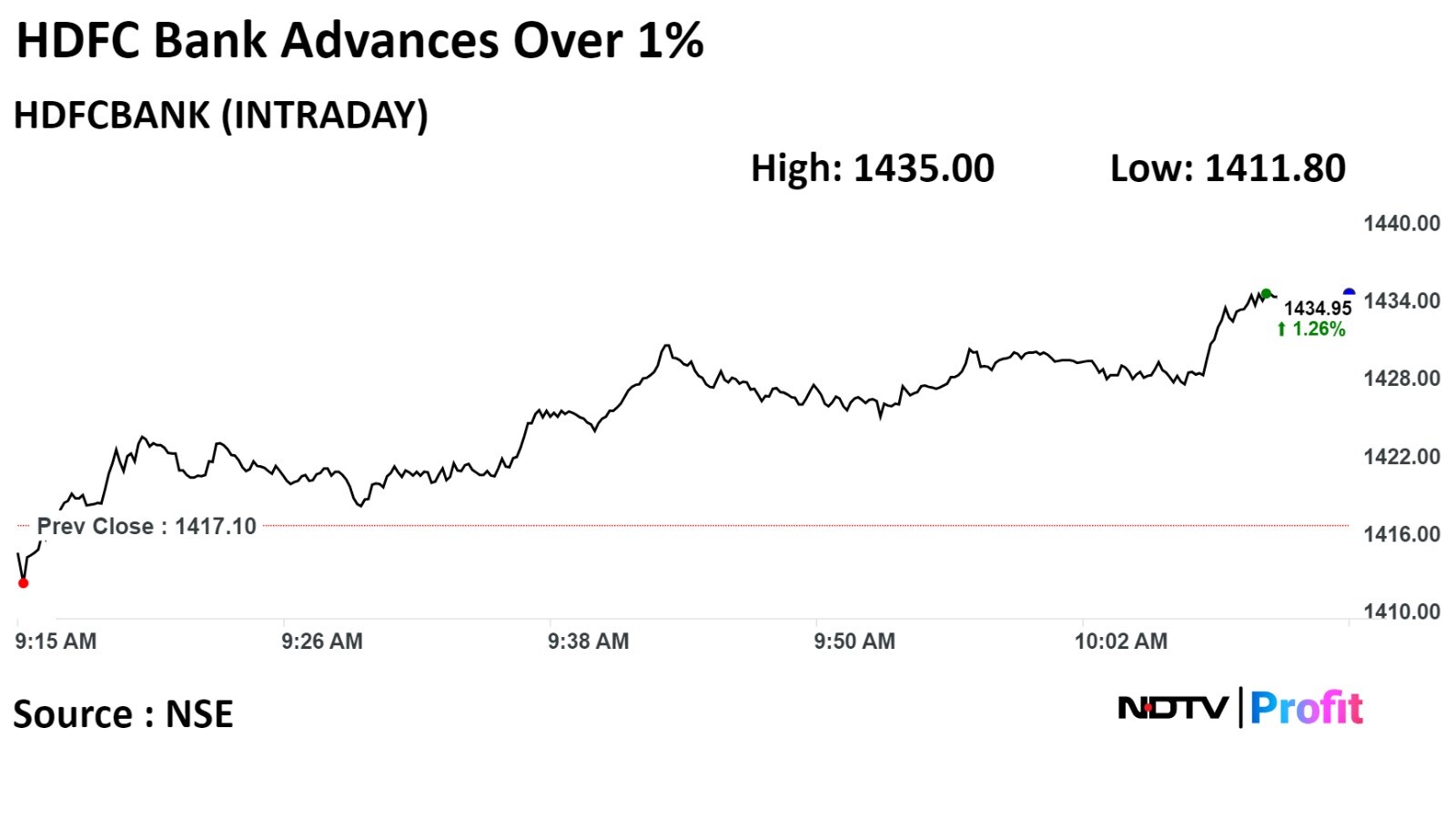

Shares of the company rose as much as 1.19%, before paring some gains to trade 1.17% higher at 10:10 a.m., compared to a 0.14% decline in the NSE Nifty 50.

The stock has declined 12.60% in the past 12 months. The relative strength index was at 41.83.

Of the 50 analysts tracking the company, 45 maintain a 'buy' rating and five recommend a 'hold', according to Bloomberg data. The average 12-month analysts' price target implies an upside of 35.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.