The central government on Thursday notified an increase in some small savings schemes effective in the next quarter, ending Dec. 31.

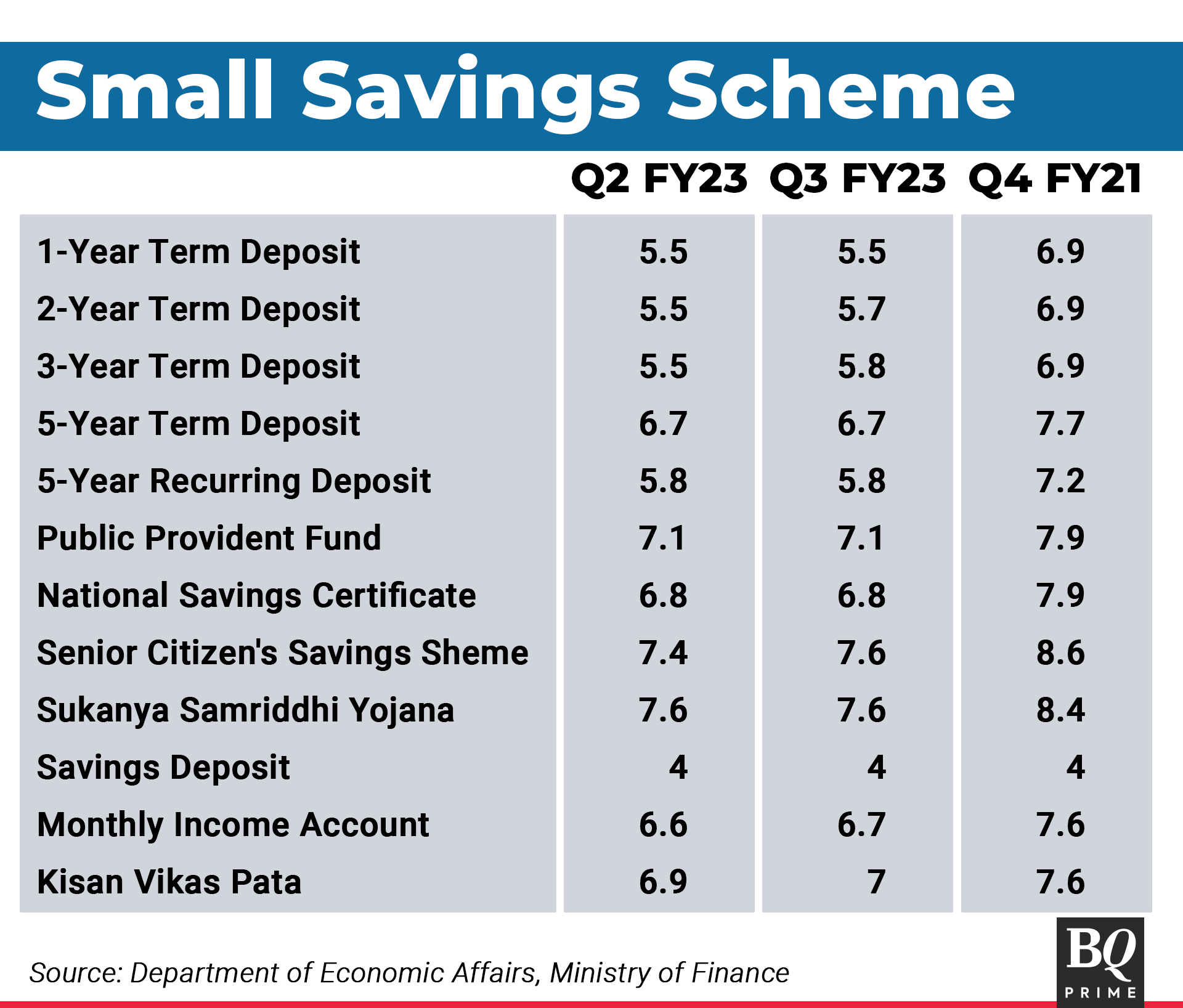

The interest rate offered on the Senior Citizen Savings Scheme will be increased to 7.6% from 7.4% earlier, according to a notification by the Department of Economic Affairs in the Ministry of Finance.

The Monthly Income Account Scheme will now yield 6.7%, up from 6.6%. The interest on the Kisan Vikas Patra will rise to 7% from 6.9%. And the two- and three-year deposits will yield 20 basis points and 30 basis points more, respectively, at 5.7% and 5.8%.

The rates on the popular Public Provident Fund and National Savings Certificate were kept unchanged at 7.1% and 6.8%, respectively.

The rates on the Savings Deposits, one-year and five-year deposits, the recurring deposit and the Sukanya Samriddhi Account Scheme were kept unchanged as well.

Small savings schemes are fixed income investments made available by the government that offer risk-free, guaranteed returns. The rates on these investments are reviewed every three months.

However, the latest change comes after a protracted status quo. The previous changes were notified by the department on March 31, 2020 for the following quarter. They came soon after quick rate cuts by the Reserve Bank of India totalling 100 basis points after the onset of the Covid-19 pandemic.

The RBI went on to cut the policy rates by a further 40 basis points, but this was not passed on to the small savings schemes.

The RBI has, since then, brought policy rates back to pre-pandemic levels, raising the repo rate by a total of 140 basis points. It is widely expected to raise rates again on Friday after the culmination of the latest meeting of the Monetary Policy Committee.

“The government is looking to give small savers as much as it can without increasing its interest burden,” said Monika Halan, author and adjunct professor at the National Institute of Securities Markets.

“Globally, every government is in a tight corner, so the Indian government is justified in taking a pragmatic approach. In any case, many of these schemes offer tax benefits, so the post-tax return is better than other fixed income investments.”

Indeed, the prevailing rate on one-to-five-year fixed deposits by State Bank of India and smaller banks like RBL Bank range from 5.45% to 6.3%. For senior citizens, the rates range from 5.8% to 7.5%. However, the interest income on these deposits is taxed at slab rate.

“The government seems to be attempting to align the small savings scheme rates to the prevailing rates of government paper. The yields on the five- and 10-year government bonds are now comparable,” said Amol Joshi, founder of PlanRupee Investment Services.

An important point to note is that the rate on the RBI's floating rate bond will also remain unchanged. The rate of interest on the bond is reset half-yearly and is set at a spread of 35 basis points over the prevailing rate of the National Savings Certificate. The seven-year bonds currently bear a coupon of 7.15%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.