(Bloomberg) -- The message coming from Wall Street is that investor optimism is running dangerously high.

Overstretched technicals, hedge fund selling and the broad belief that the Federal Reserve won't cut rates quickly are underpinning a pessimistic turn from equity specialists at JPMorgan Chase & Co. and Morgan Stanley. As Goldman Sachs Group Inc. Managing Director Scott Rubner put it in a report, there are “no longer any bears left.”

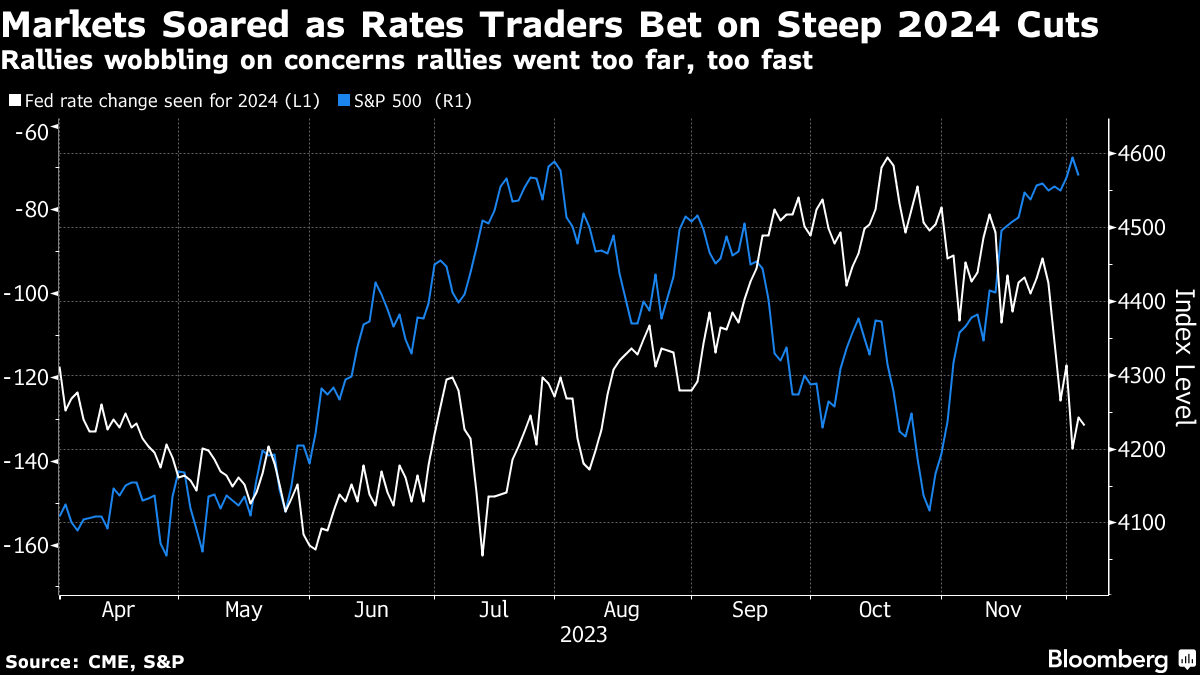

After a roaring rally in November that sent the S&P 500 surging 9% and US bond yields tumbling, markets are now trading more cautiously. The question on everyone's mind is whether the Fed will actually start cutting rates as aggressively as what's been priced into swap markets, or whether traders called it too early again.

The advance was “a sign of excessive euphoria,” said Florian Ielpo, the head of macro research at Lombard Odier Asset Management. “Valuations are no longer attractive. Equities should be seen for what they are: expensive.”

Read More: BlackRock Warns on Rate-Bet Disappointment, Volatility in 2024

Ielpo joins a broad section of investors that have highlighted the warning signs over how quickly Fed policy expectations have changed. Traders now see about a 70% chance the US central bank will cut rates in the first quarter, and have priced in as many as five quarter-point reductions by the end of 2024. BlackRock Inc. strategists expect the easing will only begin in the middle of the year.

“We see the risk of these hopes being disappointed,” strategists including Wei Li and Alex Brazier wrote. “Higher rates and greater volatility define the new regime.”

Goldman's Rubner said the odds of a stocks selloff are greater after commodity trading advisers, who usually trade on market momentum, rushed to equities. He estimates that CTAs bought $225 billion worth of stocks during the past month. That's “the fastest increase in exposure that we have ever seen,” Rubner wrote in a note, and reinforces the view that traders will be more inclined to sell, rather than buy.

According to data from Morgan Stanley's prime brokerage business, some fast-moving traders are already starting to cut their stock positions. Hedge funds trimmed bullish wagers on big tech and added to short positions last week, wrote a team at the bank led by Bill Meany.

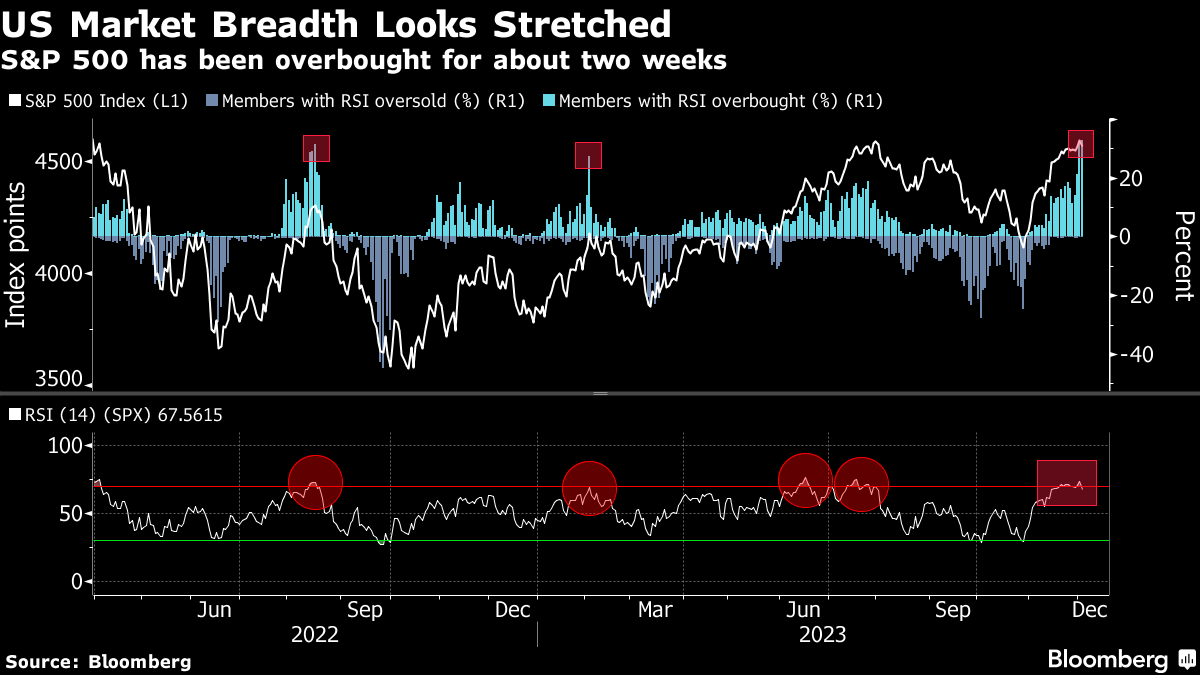

Other traders cite technicals for their argument that stocks are vulnerable. The S&P 500's Relative Strength Index is above 70, putting it in so-called overbought territory.

“My gut says that the market has baked in slightly more than enough cuts for the strength of economic data for the US right now,” said Amy Xie Patrick, head of income strategies at asset manager Pendal Group in Sydney.

Xie Patrick is recalibrating her firm's wagers to account for the growing risks in bond markets. She trimmed long positions on Treasuries, shifted to neutral on US high-yield credit, and exited bets for the dollar to fall against the South Korean won and Brazilian real.

Still, in the view of Bloomberg Intelligence Chief Equity Strategist Gina Martin Adams, there's still room for stocks to keep charging higher. She uses a sentiment indicator called the BI Market Pulse Index, which has shifted to a neutral reading after signaling panic in October.

Even as the S&P 500 Index heads toward a double-digit return this year, investment strategists still seem skeptical of the rally's staying power. Yet to Bank of America Corp., that's a sign of more gains to come in the new year.

“Bull markets end in euphoria, and we are far from euphoria,” Savita Subramanian, the firm's head of US equity and quantitative strategy, told Bloomberg Television.

How euphoric or fearful market are depends on who you ask. JPMorgan Chase & Co. strategists say that stocks looked priced for perfection. Almost all economists and the market are in the soft-landing camp now, leaving no room for error, strategist Mislav Matejka wrote in a client note on Monday.

“Perhaps one should be contrarian,” he said.

--With assistance from Michael Msika, Jan-Patrick Barnert and Garfield Reynolds.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.