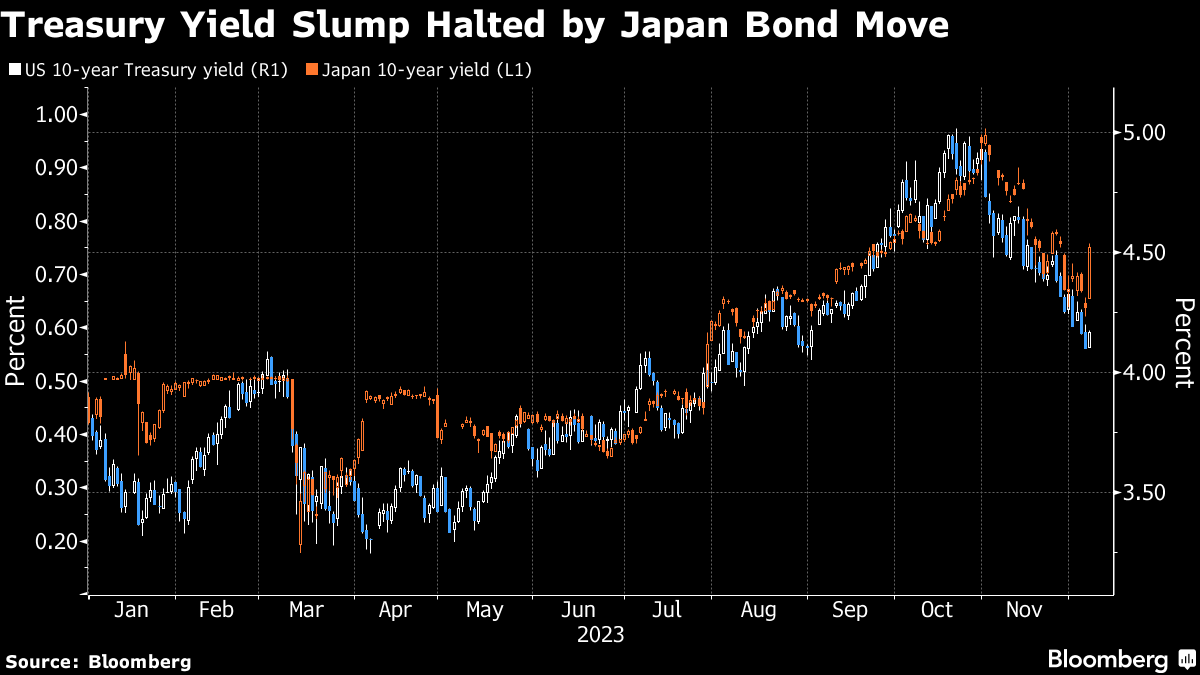

(Bloomberg) -- This week's sizzling bond rally ran into a stop sign on Thursday as a slump in Japanese debt jangled the nerves of Treasury traders already fretting that yields had dropped too far.

The yield on 10-year US notes jumped seven basis points to 4.18%, paring declines this week to a mere two basis points. That came as similar-dated Japanese yields soared by the most this year, after comments from central bank Governor Kazuo Ueda on more challenging policy ahead and a weak auction of long-term debt.

US Treasuries are on course to end a tumultuous year with a stunning rally on bets the Federal Reserve will soon be slashing interest rates after the most aggressive hiking cycle in decades. Some strategists are warning that bonds look overstretched as traders defy warnings from central bankers by pricing in as many as five, quarter-point US rate cuts next year.

“While everyone is watching Santa Claus loading the bond tree with presents, the BOJ Grinch just snuck down the chimney with coal in hand for the second year in a row,” said Calvin Yeoh, who helps manage the Merlion Fund at Blue Edge Advisors. “The auction seems to have crystallized some of the risks of an earlier than expected policy-exit by the BOJ.”

TD Securities recommended selling 10-year Treasuries ahead of Friday's November employment report, which puts yields “at risk of backing up sharply.” JPMorgan Chase & Co. strategists highlighted in a note there's a risk yields may move higher, after they dropped below the firm's targets for the second quarter of next year.

Japanese government bonds tumbled after the sale of 30-year notes received bids for only 2.62 times the securities on offer, the lowest level since 2015. Yields surged across the curve in Tokyo.

The slump came as traders speculated the Bank of Japan's December policy meeting may be a “live” event after Governor Ueda said handling monetary policy will get tougher from the year-end and through next year. Those remarks built on comments Wednesday from one of his deputies that the central bank is inching closer to putting an end to the world's last negative interest rate regime.

The 10-year JGB yield rose 10.5 basis points following the auction, hitting 0.75%. That was the steepest jump since Dec. 20, 2022, when then-Governor Haruhiko Kuroda stunned the market by widening the trading band for the benchmark note.

Benchmark 10-year Treasury yields reached as low as 4.1% this week, a stunning drop of more than 90 basis points from the multi-decade high of 5.02% touched in late October.

Bond investors came into the week facing key tests from US data on the labor market, and while the first couple of reports favored bets on a Fed pivot toward rate cuts, Friday's payrolls report may easily overwrite that impression. Economists estimate unemployment was steady at 3.9% last month, with the economy adding 185,000 jobs, up from October's 150,000 reading that was the weakest growth since June.

The Treasuries market is also showing signs of the traditional poor liquidity that often makes December a “silly season” for markets, JPMorgan said in its note.

That sort of issue may have weighed on US bonds to exacerbate the impact of the BOJ's seeming shift toward finally tightening policy, according to Prashant Newnaha, a rates strategist in Singapore for TD Securities.

“The fact that you've got two BOJ officials who are pretty much singing from the same hymnbook has clearly caught markets off guard,” he said “It's spilling over into US Treasuries. Liquidity is also really thin at the moment and it's going to get even thinner — the risk is some of the moves in markets are being over-exaggerated.”

(Adds JPMorgan comments in fifth, 11th paragraphs and TD Securities comments in 12th, 13th paragraphs. An earlier version of this story was corrected to say Thursday in the first paragraph)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.