(Bloomberg) -- The Federal Reserve is confronting a familiar nemesis as it tries to pilot the economy into a rarely-seen soft landing: rising oil prices.

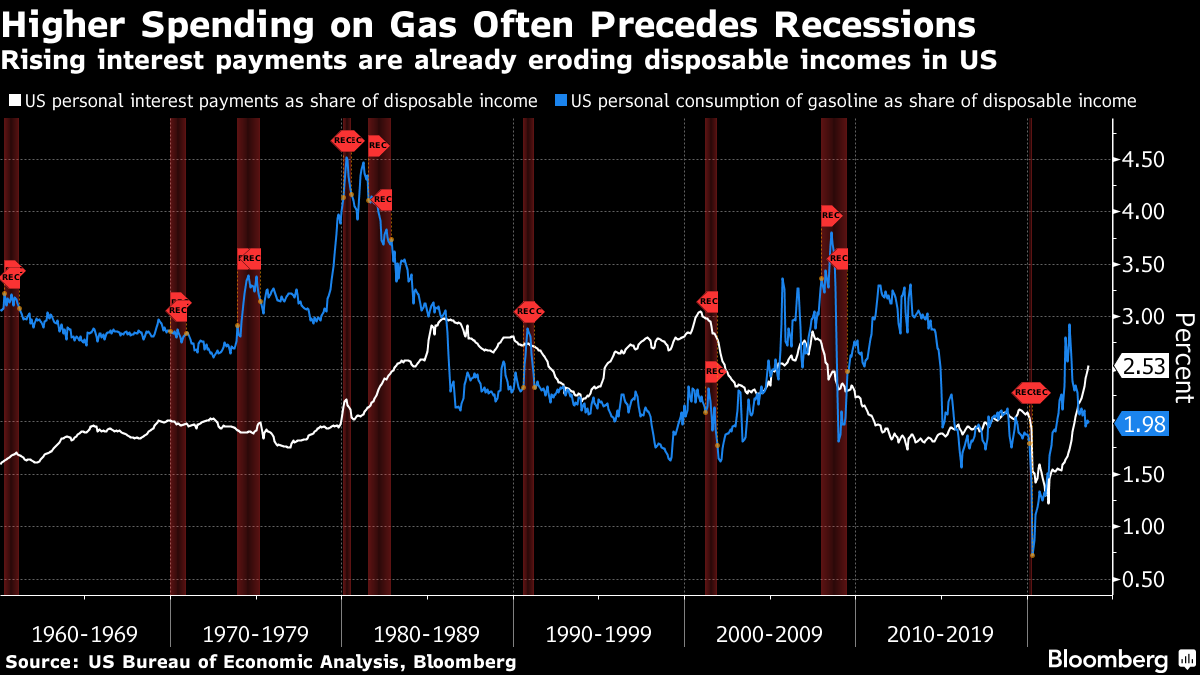

Surging energy costs played a role in tipping the US into recession in the mid-1970s, as well as the early 1980s and 1990s, as they drove up inflation and robbed consumers of purchasing power.

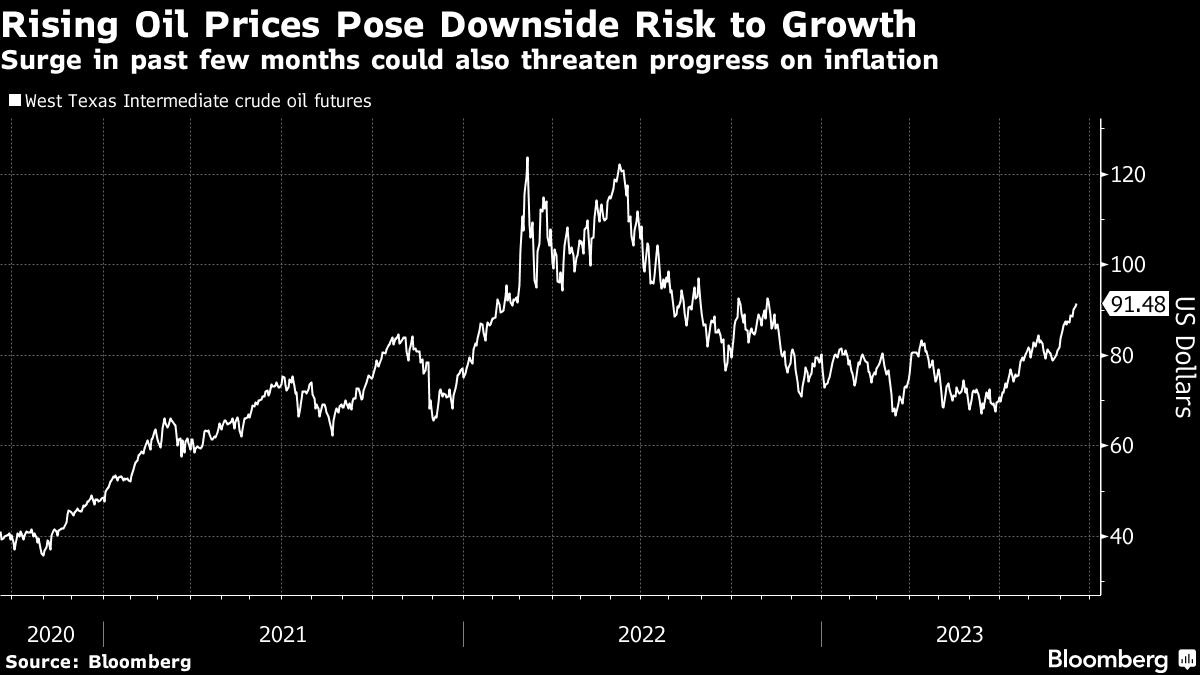

Driven by cutbacks in supply by Saudi Arabia and Russia, oil prices have surged by almost 30% since June, with benchmark US crude topping $91 a barrel. Though prices are still well below their 2022 highs, the latest rise poses risks as the Fed seeks to return inflation to its 2% target without triggering an economic downturn.

“The run-up in oil prices is at the very tip top of my worries at this point,” said Mark Zandi, chief economist at Moody's Analytics. “Anything over $100 for any length of time and we're going to be very sick.”

After boosting interest rates by more than five percentage points over the last 18 months, Fed Chair Jerome Powell and his colleagues are widely expected to hold them steady at their two-day meeting starting today.

Supply shocks such as climbing oil prices present the Fed with a quandary as they simultaneously boost inflation and curb economic growth, leaving policymakers at times uncertain about whether to tighten or loosen credit in response.

The question is becoming particularly salient now, as the central bank debates whether or not it should raise its benchmark rate once more this year before going on hold for an extended period.

Read More: Fed's Policy Paradox: Too-Slow Growth Threatens Inflation Fight

Traditionally, the Fed has tended to play down the impact of higher oil prices on inflation, viewing the effect as transitory. That's one reason why officials focus on core inflation — which strips out volatile food and energy costs — when mapping out monetary strategy.

In August, consumer prices jumped 0.6%, registering the fastest monthly increase in over a year. Higher gasoline costs accounted for more than half the advance. Core prices, in contrast, rose 0.3%.

“The Fed will look through this shock,” Morgan Stanley chief US economist Ellen Zentner and her team said in a Sept. 13 note to clients. The drag on spending may even be seen as a welcome development, they said, since it's coming at a time when growth has been running stronger than the central bank had expected.

High Alert

Policymakers will be on high alert for a gasoline-driven rise in inflation expectations in particular, as they fear that could lead to a more broad-based increase in prices.

So far, that's not happening. US consumers' inflation expectations instead fell in early September, to the lowest levels in more than two years, according to preliminary results of the University of Michigan's monthly survey of households published on Sept. 15.

There are even signs that consumers have become more tactical in their purchases, waiting for discounts and promotions before they buy, according to Michelle Meyer, chief US economist at Mastercard Economics Institute.

“It is kind of consistent with a disinflationary psychology, which was more the norm prior to the pandemic,” Meyer said.

What Bloomberg Economics Says...

“Oil prices pushed up overall inflation in August and have surged toward $95 a barrel, threatening to heat up inflation yet again. The Fed will be keen to look though these gyrations at the Sept. 19-20 FOMC meeting — especially with consumer inflation expectations having come down — but will stay resolute in the inflation fight.”

— Eliza Winger, economist

To read the full note, click here

Still, some Fed watchers doubt the impact on inflation will ultimately prove so benign.

“Energy costs are one of the big wild cards that the Fed is facing right now,” said Lindsey Piegza, chief economist for Stifel Financial Corp. “This could cause a significant reversal in headline inflation, forcing the Fed to take more aggressive action than I think investors are focusing on.”

Meanwhile, the rise in oil prices adds to a growing list of emerging headwinds to economic growth, with consumer balance sheets showing incipient signs of strain as interest payments eat up a bigger share of expenditures.

The excess savings households built up during the pandemic probably will be exhausted this quarter, according to researchers at the San Francisco Fed, and credit card delinquencies are rising, through they're still well below pre-pandemic levels. A resumption of student loan payments in October will probably also curb spending.

A lot will depend on how high oil goes. Francisco Blanch, head of commodities research at Bank of America Corp., told Bloomberg Television on Sept. 12 that Saudi Arabia will become cautious about pushing prices up further once they rise above $100 a barrel, out of concern that would cut deeply into demand.

But fine-tuning the market may not be easy. Even if Saudi Arabia and Russia relax their supply curbs in early 2024, oil inventories will be severely depleted, leaving prices vulnerable to shocks, the International Energy Agency said in a Sept. 13 report.

The US Strategic Petroleum Reserve has also been run down by massive sales after Russia's invasion of Ukraine, which means Washington now has less supply to release to counter sudden price surges. That leaves government officials and investors alike hoping the rise in oil prices will soon short-circuit on its own.

“My expectation is that they will stabilize, but we'll just keep an eye on it,” Treasury Secretary Janet Yellen said Monday in an interview on CNBC.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.