European Banks’ $62 Billion Record Year Will Be Hard To Repeat

European banks generated record profits last year thanks to a rapid succession of interest rate increases. It’s a feat many will struggle to repeat.

(Bloomberg) -- European banks generated record profits last year thanks to a rapid succession of interest rate increases. It’s a feat many will struggle to repeat.

Analysts surveyed by Bloomberg expect the combined net income for 11 of the biggest European banks to fall 6.3% this year from €56.5 billion ($61.5 billion) posted for 2023. That would still be the second-highest on records going back almost two decades.

The figures don’t include several large Italian and French banks, along with Switzerland’s UBS Group AG, which are scheduled to report earnings next week.

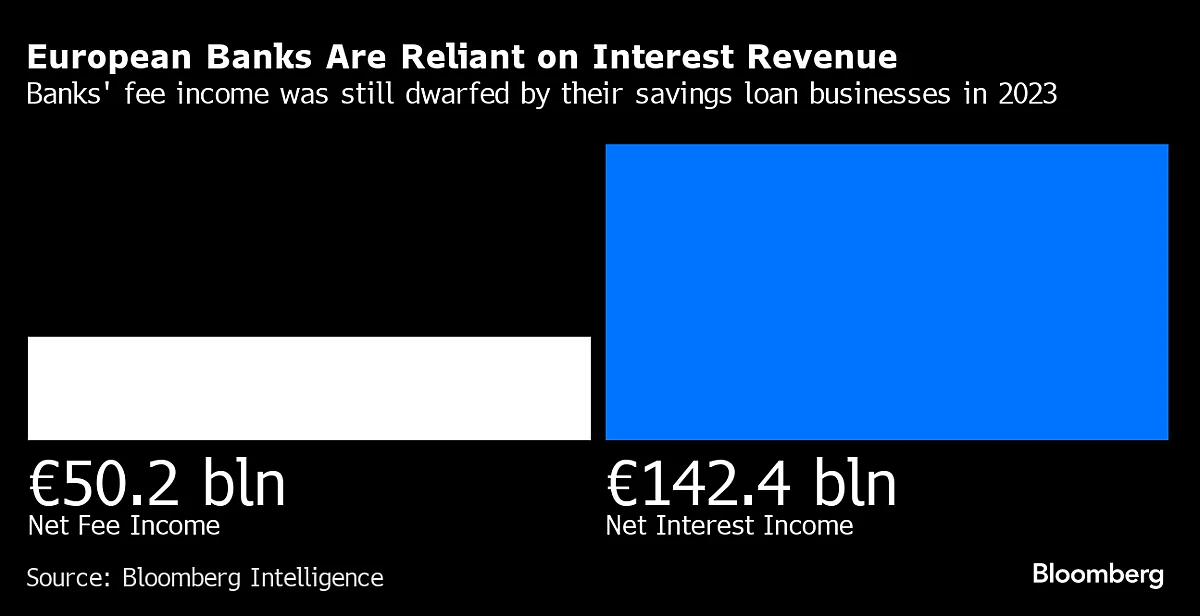

Lenders benefited as rapid interest rate increases by the European Central Bank allowed them to charge more for loans while paying comparatively little still for deposits. With inflation slowing and rates in the euro area stabilizing or even falling, that tailwind is expected to slow this year, hitting those banks particularly hard that rely heavily on lending in their home markets.

“About 80% of our income is interest-linked, which is also for European standards very high,” Steven van Rijswijk, chief executive officer of ING Groep NV, said in an interview last month. “We need to diversify.”

Read more: Banks Turn to Fee Business as End of Europe’s Rate Boom Looms

ING slumped the most in almost a year on Thursday after the Dutch lender warned its key revenue source will weaken as it passes on higher rates to depositors. That hit may amount to about €600 million this year, outstripping the more than €200 million that the Dutch bank expects from lending growth.

While lenders including Deutsche Bank AG and Spain’s Banco Bilbao Vizcaya Argentaria SA face a similar predicament, they’ve been working to diversify geographically or build up other sources of income. Deutsche Bank, for instance, raised its mid-term revenue outlook as it bets on a rebound in dealmaking to lift fee income and flagged a strong start to the year in trading.

At BBVA, higher-than-expected revenue from fees and commissions helped offset the slowdown in interest income last quarter. Its local rival Banco Santander SA also acknowledged that the boost from higher rates in Europe is likely to fade, but said it has other businesses to lean on.

“This year has been about very high growth in all our global businesses and a lot of tailwinds in Europe,” Chairman Ana Botin said in an interview Wednesday. “What we see is an even better ‘24 where we’re going to have a very different engine, it’s going to be more on the consumer business side, which is Europe and the US, and more in South America.”

One exception to last year’s interest income bonanza have been lenders in France, where local rules make it harder to raise rates on loans. BNP Paribas SA on Thursday trimmed its expectations for the revenue benefit from higher rates, citing the ECB’s decision to stop paying interest on minimum reserves at the institution as well as Belgium’s sale of government debt that has lured some deposits away from banks.

Yet even if the boost from rising rates fades this year, European banks are still set for a higher level of profitability than in the previous decade as they replace loans granted during an era of record low interest rates.

“We are for a large part in a fixed-rate mortgages environment,” BNP Paribas finance chief Lars Machenil told analysts on Thursday. “The repricing is there, but it takes time.”

--With assistance from Oliver Crook and Guy Johnson.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.