Easy Trip Planners Ltd.'s board on Monday approved the bonus issue of shares in the 1:1 ratio. However, shares of the company fell following the announcement.

The board gave its nod for the "issue of one bonus equity share for every one fully paid-up equity share subject to shareholder's approval," the company said in an exchange filing.

The record date to determine the shareholders eligible for the bonus issue was not announced.

This marks the company's third bonus issue in recent years. It had approved a 1:1 bonus issue in March 2022, followed by a 3:1 issue in November 2022.

Easy Trip Planners, which operates the online travel agency platform EaseMyTrip, has proposed to issue a total of 177.2 crore bonus shares at a face value of Rs 1 each. This will increase the company's post-bonus issue share capital to Rs 354.4 crore.

The company expects the bonus shares to be credited to the demat account of the shareholders on or before Dec. 12, 2024, subject to completion of the rest of the formalities.

Notably, bonus issues are launched by listed entities to capitalise on their free reserves and improve their earnings per share and paid-up capital.

Easy Trip Planners' public shareholding stood at 35.7%, whereas the promoters held 64.3% as of June 30, according to data available with the BSE. The company's market capitalisation stood at Rs 6,007.2 crore.

The company's board also approved the increase in the authorised share capital of the company to Rs 500 crore, divided into 500 equity shares of Rs 1 each, the filing said.

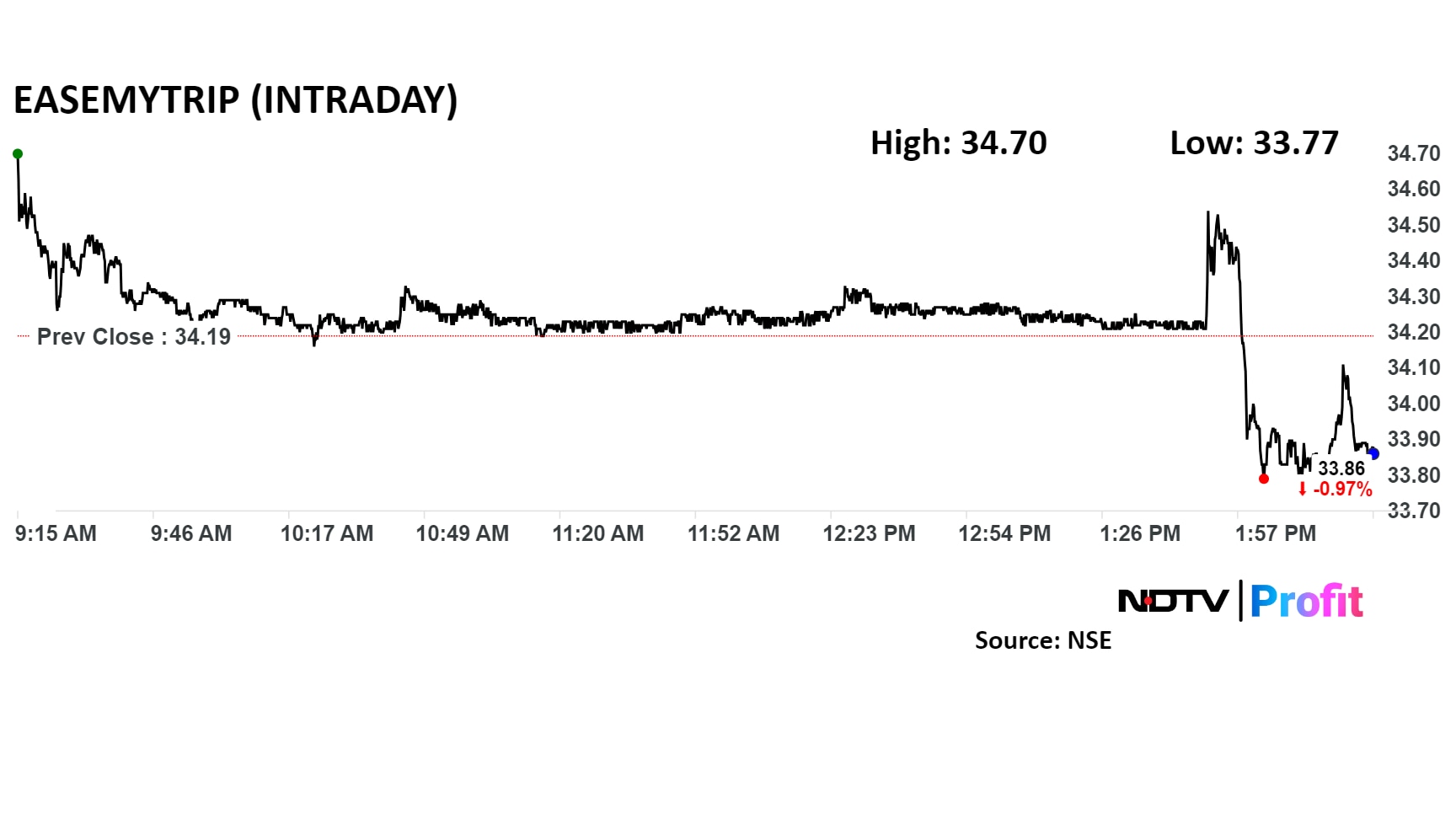

Easy Trip Planners share price declined by nearly 1%.

Shares of the company fell 0.94% to Rs 33.87 apiece on the NSE, compared to a 0.63% rise in the benchmark Nifty 50 as of 2:25 p.m.

The stock has fallen 16% so far this year and by 20.7% over the past 12 months. The relative strength index stood at 41.42.

Among the two analysts tracking the company, one each has a "hold" and "sell" rating, as per Bloomberg data. The average of 12-month analysts' price targets implies a potential upside of 21.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.