Three is greater than two, and even four, in India's electric-vehicle space.

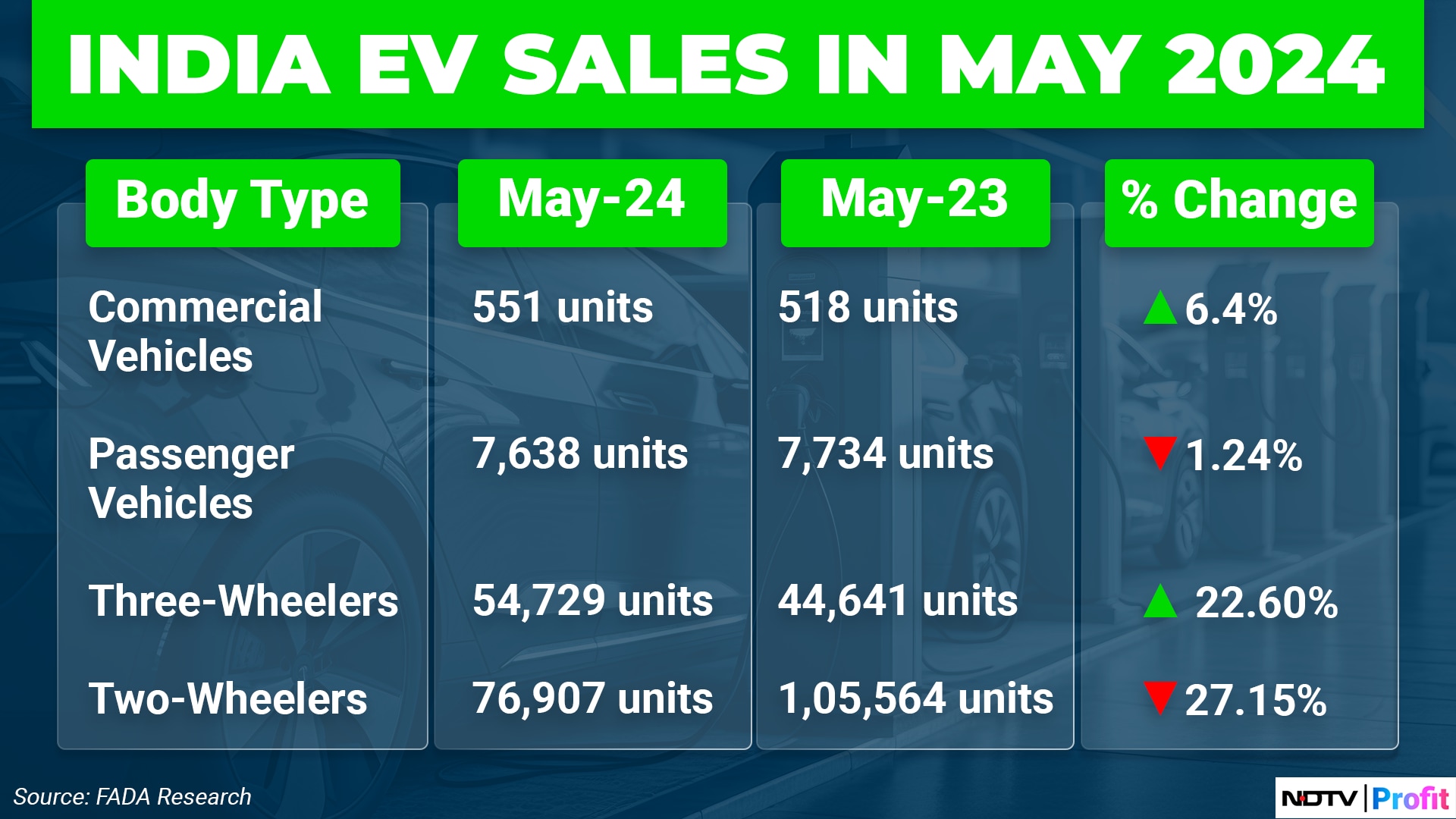

Retail sales of electric three-wheelers surged more than 20% year-on-year in May, even as those for electric two-wheelers dwindled by more than a fourth, according to VAHAN data collated by the Federation of Automobile Dealers Associations. There were fewer takers for electric cars but more for electric trucks and buses.

To be sure, the outperformance among electric three-wheelers hasn't come off a low base. Among all vehicle classes, e-rickshaws have achieved the highest market penetration of 55.7%, even as electric cars (2.5%) and electric scooters (5%) continue to find few takers.

The Outperformance

For electric three-wheelers, three things are working on the ground, FADA President Manish Raj Singhania told NDTV Profit over a telephonic interview.

“Permits are mandatory for operating an internal combustion three-wheeler. That's not the case with electric three-wheelers,” Singhania said. “Some states are trying to introduce permits but a proper regime isn't in place yet.”

Secondly, the bulk of the electric three-wheeler sales is happening in rural areas, even as they fulfil last-mile connectivity in urban centres.

The pandemic brought with it a reverse migration of sorts—migrant workers who returned home took to driving electric three-wheelers for want of jobs. “This (e-rickshaws) gave out-of-work migrants pride in ownership,” Singhania said. “They are entrepreneurial now.”

Moreover, public transport is scarce in rural areas—at best, there may be a morning bus or an evening bus connecting towns and villages. It is this gap that electric three-wheelers filled. Fuel stations too are few and far between, but almost every household has power back-up. Also, commutes are shorter in rural India—that also worked in favour of e-rickshaws, which run an average of 100 km per charging cycle.

Finally, consumers are more aware of the benefits of electric mobility—reduced cost of ownership, tax breaks, subsidy, etc. An electric three-wheeler may cost Rs 50,000 to Rs 3 lakh more, but the premium paid can be recovered in less than three years.

Subsidy Regime

Demand for electric two-wheelers has dwindled since the government first reduced subsidy under the FAME-II scheme in June last year and removed it entirely in March this year. The Electric Mobility Promotion Scheme 2024 came into effect but that too ends on July 31.

“May 2024 has shown a slight recovery in EV retail across various segments following the major decline caused by the conclusion of FAME-II subsidies in March,” Singhania said. “Despite this modest increase, the market share for electric CVs, two-wheelers and three-wheelers has remained relatively stagnant over the past few months.”

The industry is now awaiting a FAME-III subsidy regime.

“The automotive industry is eagerly looking forward to the announcement of FAME-III by the newly formed government,” Singhania said. “We believe the introduction of new subsidies and incentives under FAME-III will provide the necessary boost to EV sales and help increase their market share significantly.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.