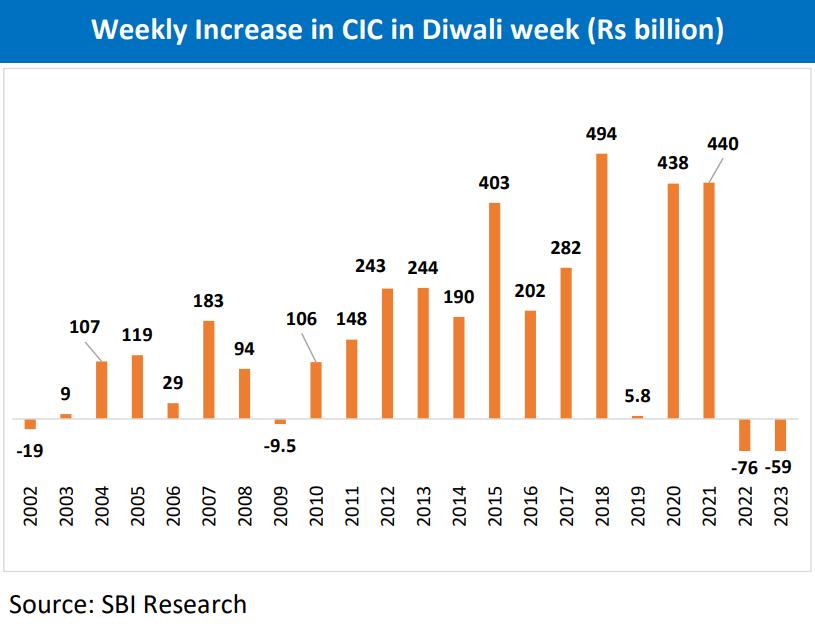

Currency in circulation declined during the Diwali week for the second straight year as Indians opted for digital payments like the popular UPI platform, according to a SBI Research report.

In the Diwali week, CIC decline Rs 5,900 crore compared with a fall of Rs 7,600 crore a year earlier, according to a SBI Ecowrap report authored by Soumya Kanti Ghosh, group chief economic adviser at State Bank of India.

The report attributed the success of the digital payment ecosystem to the relentless push by the government to formalise and digitalise the economy.

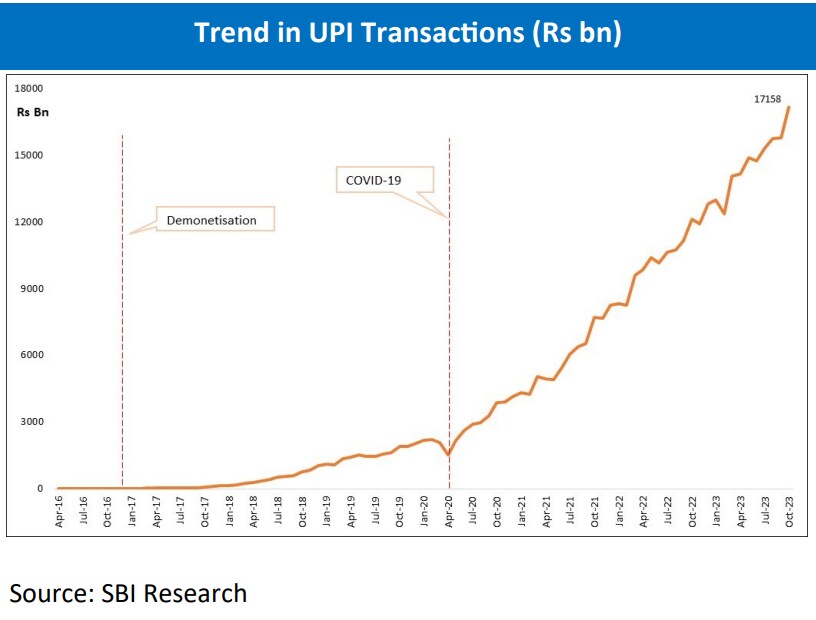

"The interoperable payments systems like UPI (Unified Payments Interface), wallets and PPIs (Prepaid Payment Instruments) have made it simple and cheaper to transfer money digitally, even for those who don't have bank accounts," the report said.

The system has also expanded rapidly with new innovations like QR code and near-field communication or NFC and has also seen the swift entry of big tech firms in this industry.

UPI is used for immediate money transfer through mobile devices round the clock.

According to the National Payments Corporation of India, over 11 billion transactions worth Rs 17.16 lakh crore via UPI took place in the festive month of October.

A lower currency in circulation is akin to a cut in cash reserve ratio for the banking system as it results in less leakage of deposits and it impacts monetary transmission positively, Ghosh wrote.

According to the SBI report, National Electronic Fund Transfer holds a share of around 51% in value terms in retail digital transactions. Most of the transactions are done through either at branch or internet banking.

Transactions done through smartphones on platforms like UPI and Immediate Payment Service (IMPS) have a share of around 21% and 8.5%, respectively. While, UPI transactions in volume, holds around 75% of the total transactions in the payment industry.

The report states that as per its model, the RBI has to print less currency given that UPI transactions impact currency in circulation with a lag.

"This is a win-win for both RBI and government, as it results in saving of seigniorage costs and also a less cash economy," the report said. "This will also mean all the analysis of currency leakage impacting bank deposits, liquidity estimation now could see a fundamental reorientation in the future."

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.