(Bloomberg) -- Encouraged by a weaker yen, Hong Kong investors are hunting for Japanese real estate, snapping up luxury second homes on Tokyo's waterfront and seeking steady rental yields from studio apartments in smaller cities.

International property agents said sales have increased this year as the yen fell to multi-decade lows against the Hong Kong dollar, which has risen alongside the US dollar as the Federal Reserve raised interest rates while the Bank of Japan kept its ultra-easy policy. Expectations for an end to anti-Covid border controls have also led to a recent rise in inquiries, although some clients were buying properties without even seeing them in person, they said.

“You have Japan as a tourist destination, as well as somewhere people can see themselves spending a lot of time,” said Jason Lam, the Hong Kong-based co-founder of Japan Hana Real Estate. “The falling yen has definitely triggered a lot of focus on Japan.”

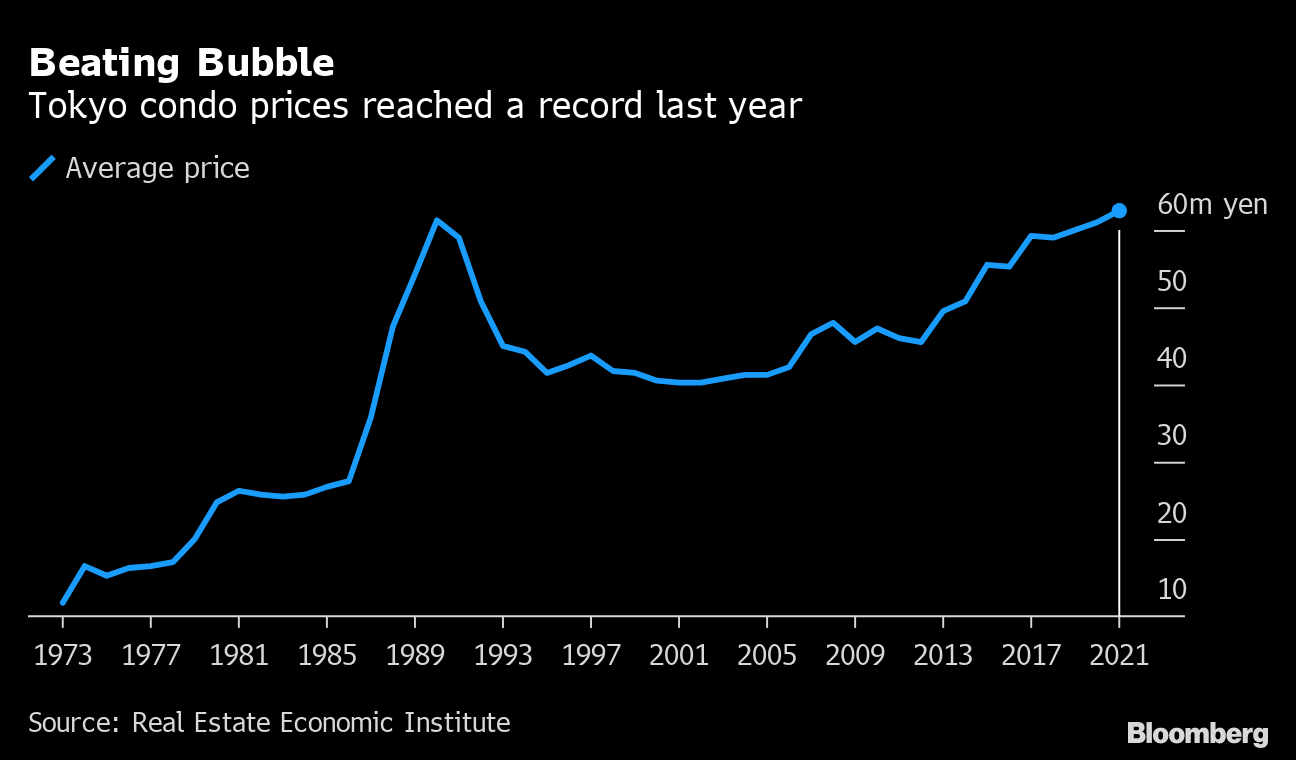

The trend may provide more tailwind to Japan's housing market, bolstered in recent years by new developments ahead of the Olympic Games. Prices of new condominiums in Tokyo last year topped a record set in 1990 at the end of Japan's asset-inflated bubble era. Even with those gains, Tokyo apartments remain cheaper per square meter than those in London, New York and especially Hong Kong -- the world's least affordable home market.

At Jones Lang LaSalle Inc., inquiries by Hong Kong residents about Japanese properties have jumped as much as 70% from last year, and actual apartment sales are up about 30%.

Recent high-end listings by international brokers include a 1.7 billion yen ($12.5 million) three-bedroom townhouse in expat enclave Hiroo, and a Kengo Kuma-designed penthouse near Meiji Shrine with an infinity pool and tea house, estimated at over 5 billion yen. In the more moderate price range, Japan Hana is offering one- to three-bedroom apartments in Tokyo's waterfront Shibaura district, some with views of Rainbow Bridge and priced from 64 million yen.Lam said many of his customers are searching for second homes in Tokyo and Osaka, as well as in Kyoto and Fukuoka, cities popular with tourists and known as top-class culinary destinations. Some were also interested in ski resorts in the northern prefecture of Hokkaido, he added.

While some sellers are wooing wealthy investors with package tours involving helicopter rides and champagne, brokers said most buyers are seeking lower-key deals, with many opting for small and older apartments that can be purchased in cash. Mandy Wong, head of international residential for Asia-Pacific at Jones Lang LaSalle, described prospective buyers as wealthy individuals accustomed to investing overseas and buying properties mainly for long-term rental returns.

Grace Lau, a bank employee in her 30s and living in Hong Kong, is one such investor. Having purchased two apartments in Fukuoka last year, she bought a 200-square-feet studio in June for HK$300,000 ($38,000) after seeing the yen tumble. She said her latest purchase was almost 20% less than what she previously paid for a similar room, and that she may buy more if the yen keeps falling.

“There's no gain if you park your money at the bank,” she said. “But with this I get a 5% yield.”

Read More: Apartment Prices in Tokyo Exceed Bubble-Era High to Hit RecordYen's Freefall Triggers Rush to Buy Among Asia's Amateur TradersHong Kong's Refusal to Open Border Is Crushing City's Businesses

Sam Wu, a Hong Kong restaurant owner in his 40s, said he saw Japan as a relatively safe market compared with Hong Kong. He and his wife bought a shop for HK$4 million near Shinsaibashi, Osaka's landmark shopping district, about six months ago.

“Hong Kong's property market seems shaky, with so many people leaving, so I wanted to look elsewhere,” he said, adding that they encountered fierce competition from other bidders. Wu already owned three properties in Japan and visited the country frequently before the pandemic, so he felt comfortable making his latest purchase with just a virtual inspection using online street views.

He said rental yields in Japan can exceed 6% while in Hong Kong they were usually no more than 3%. Yields on prime residences in Singapore and London are also under 3%, according to Jones Lang LaSalle.

However, some point out the risks for Japan's market, including a shrinking local population and a tendency for the value of buildings to depreciate quickly. Shun Ogishima, a researcher at Sumitomo Mitsui Trust Research Institute, also said the pandemic had changed people's lifestyles and preferences, trends which may be difficult for foreign investors to assess.”We have seen a shift from the city center to the suburbs, and higher demand for bigger properties. It's difficult to read what demand will be like after Covid,” he said. “It's risky for foreign retail investors who are unfamiliar with the local area and unable to visit the properties before buying.”

Still, Hong Kongers see opportunities in a housing market that has no special restrictions on foreign buying, or additional taxes for non-residents, even if few of them qualify for Japan's super-low mortgage rates.

And once border controls are loosened at both ends, brokerages expect investment in Japanese real estate to pick up even more.

“Japan is so close to Hong Kong that if people want to buy, more often than not they will visit,” said Mark Elliott, head of international residential at Savills Plc.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.