Bharti Airtel Ltd. received an 'outperform' rating and a target price hike from CLSA, indicating that the brokerage is optimistic about the telecom major's data center business.

The target price was raised to Rs 1,820 per share from Rs 1,655 each, implying a 9.97% upside.

Presently, Nxtra Data—Bharti Airtel's data center subsidiary holds a 25% market share and plans to triple India's data center capacity by 2028, the brokerage said. The company will also double its own capacity to 400 megawatts, contributing to the rapid growth of the sector.

Bharti Airtel holds 76% shares of Nxtra Data and is part of its enterprise business, accounting for a 20% of Airtel's operations. The data center market in India is expected to grow at a fast pace due to increased digital activity, cloud adoption, government regulations, and the rise of 5G, the brokerage said.

Nxtra Data operates 12 large and over 120 edge data centers across India that focus on renewable energy and sustainability. The company plans to infuse Rs 5,000 crore to double its capacity.

Nxtra has shown a major growth, with revenue and Ebitda increasing by 65-70% over the past three years. Though it's only 10% of Airtel's overall business, Nxtra is expected to drive further growth and valuation, the report said.

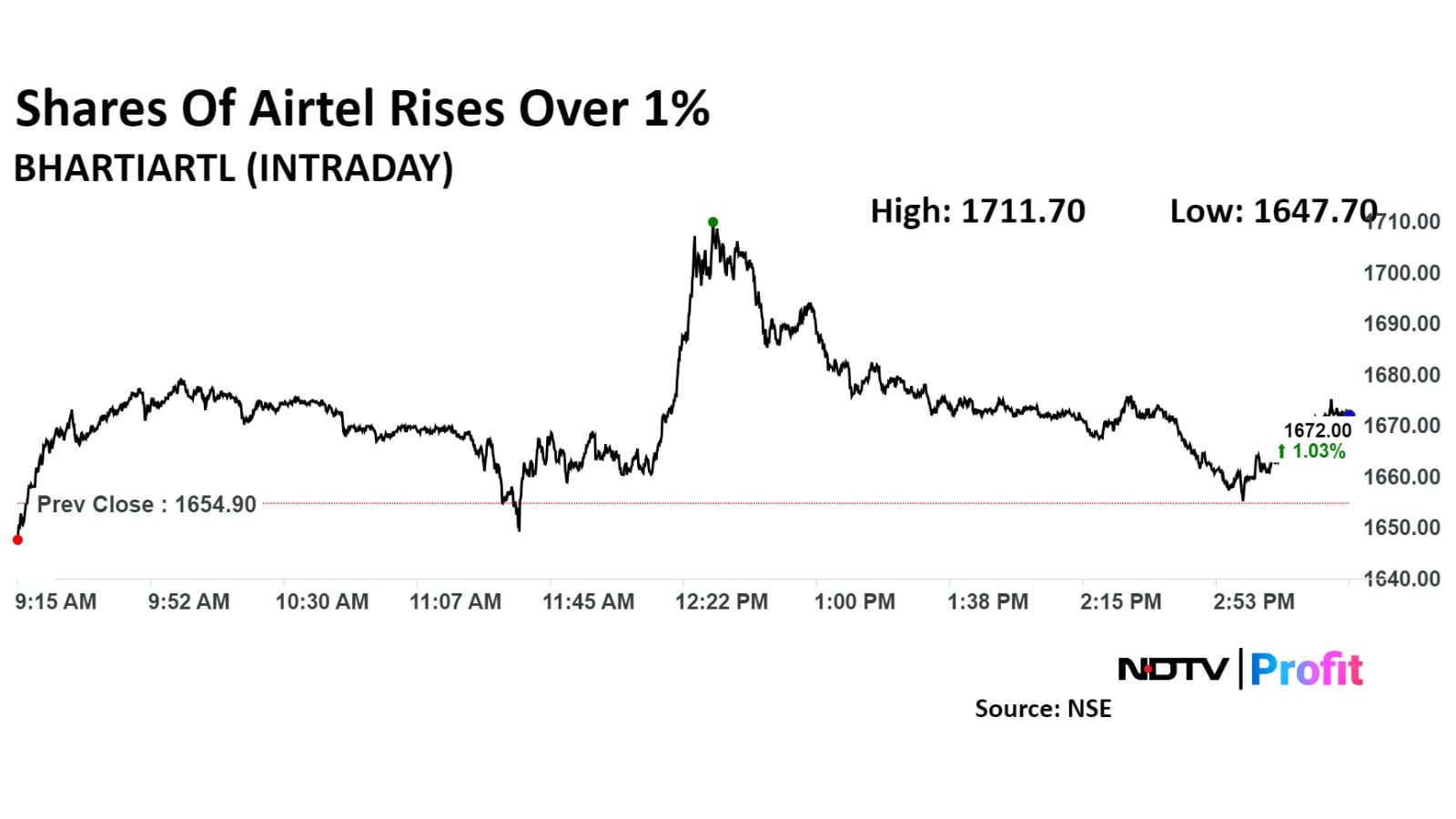

Shares of Airtel rose as much as 3.43%, before paring gains to trade 1.04% higher at Rs 1,672.05 apiece as of 3:28 p.m., compared to a 0.27% rise in the NSE Nifty 50.

The stock has risen 83.60% in the last 12 months and 61.82% year-to-date. The relative strength index was 74.36, indicating that the stock is overbought.

Out of 33 analysts tracking the company, 24 maintain a 'buy', seven suggest a 'hold' and two recommend a 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 3.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.