In Mumbai's sleek skyscrapers, harried bankers race the clock to appraise a company that hasn't been valued in decades. Bureaucrats burn the midnight oil in New Delhi, working through power cuts to pull together an initial public offering to rival any in Asia this year. And across the hinterland, front-page newspaper ads alert more than 250 million policy holders of the chance to own a piece of a company nearly as old as post-independence India.

For almost two years, India has steeled itself for a gargantuan task: readying the country's premier insurer -- with nearly $500 billion in assets and a valuation estimated as high as $203 billion -- for what could become its biggest-ever stock listing. Some bankers have described the public offering of Life Insurance Corp. of India, or LIC, as India's Aramco moment. As with the Gulf oil giant's $29.4 billion listing, the world's largest, LIC's debut will test the depth of the nation's capital markets and global appetite for its state-owned crown jewel.

Success is far from assured. With about two months to the targeted launch, consultants have been pouring over reams of policy documents to come up with LIC's embedded worth -- a key valuation metric. Bankers say global investors worry about the autonomy of an institution regularly pressed into service to rescue teetering banks and floundering state assets. Local investors are skeptical the 65-year-old firm can compete against up-and-comers.

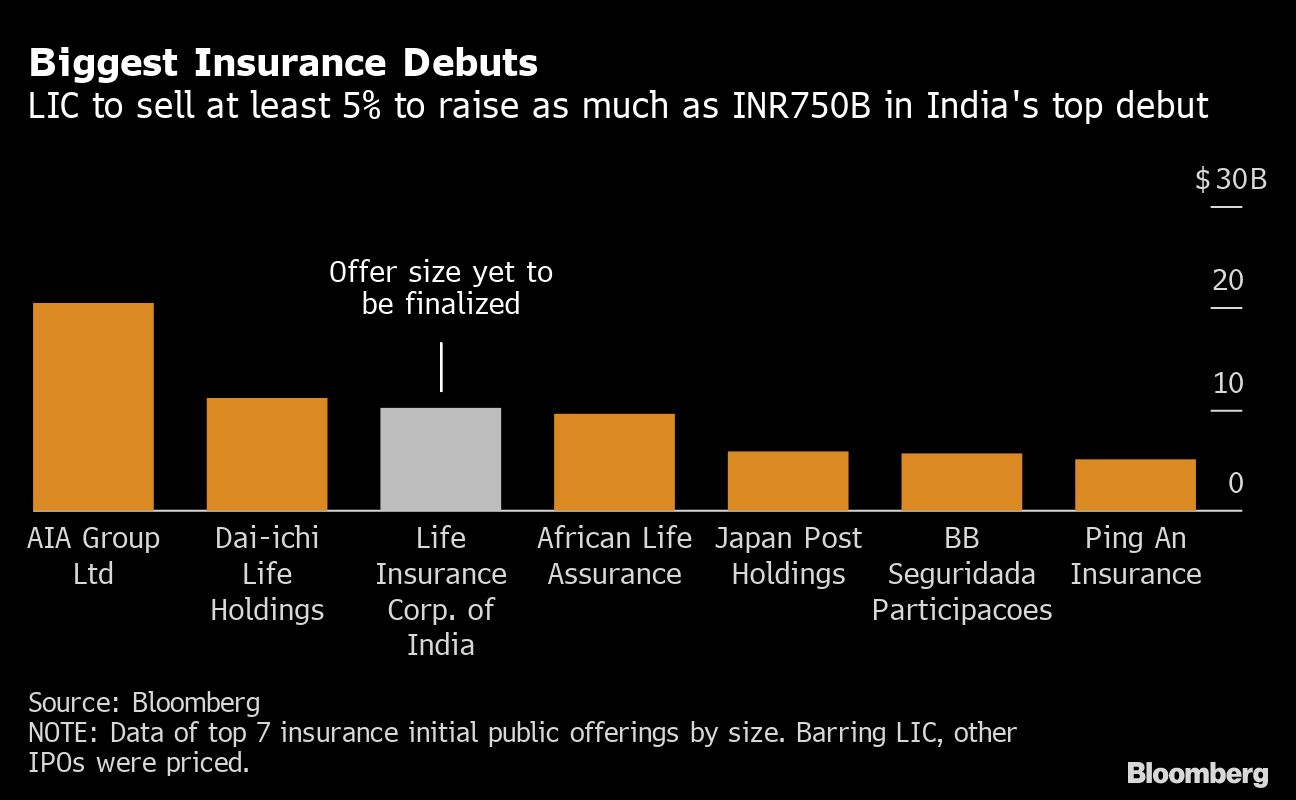

A knock-out listing could see LIC raise as much as $10 billion from the IPO with a minimum dilution of 5%. That would make it the third biggest globally involving an insurer. More importantly, it would burnish Prime Minister Narendra Modi's reputation as a market-oriented reformer ahead of key state elections and help plug a gaping budget deficit.

“If the listing happens, it could change the global image of India,” said James Beeland Rogers, who's been investing in emerging markets for a few decades and is the chairman of Beeland Interests Inc. and Rogers Holdings.

Sizing up a Giant

LIC is a household name in India. With 2,000 branches, more than 100,000 employees and 286 million policies, the Mumbai-headquartered company reaches practically every corner of the country. The sheer size of LIC lays bare the challenges of listing what is effectively a black box.

The insurer releases its balance sheet only once a year, meaning there are no publicly available numbers to discern its embedded value, which combines the current value of future profits with the net value of assets. Milliman and Ernst & Young executives overseeing the valuation must sift through piles of policies to account for parameters as wide-ranging as mortalities, morbidities, lapses and surrenders.

Add image caption here

Comparisons with peers are tricky. LIC, which was founded in 1956, follows rules set by a unique parliamentary act rather than the law that governs the nation's other insurance firms. In March 2020, LIC's property holdings were internally valued at about $5.8 billion, according to a person with knowledge of the matter, though it's unclear whether all of this was adjusted to current market rates.

LIC plans to file the draft IPO prospectus in the final week of January, which will provide the embedded value as well as the number of shares for sale, according to people with knowledge of the matter.

“The due internal valuation, which is required to be done you would presume by a company of that size almost annually, hasn't been done,” Nirmala Sitharaman, India's finance minister, said in an October interview with Bloomberg. “The essentials of keeping valuations prim and proper -- and the efforts that are required to keep them valuated appropriately -- are all being done now.”

Sitharaman has set a March deadline for the listing. If investors agree with the $203 billion valuation sought by the government, LIC would compete against India's biggest companies -- Reliance Industries Ltd. and Tata Consultancy Services Ltd. The IPO would account for the bulk of a $23.5 billion asset-sale target needed to plug India's widening budget deficit, which is forecast to be 6.8% this year.

LIC declined to comment.

Investors Want Answers

Another challenge is convincing foreign investors that LIC will deliver for them.

Ten bankers managing the listing spoke with almost all large funds that could be interested in buying shares, including GIC Re, Canada Pension Plan Investment Board, Blackrock Inc. and Abu Dhabi Investment Authority, according to people familiar with the matter.

Many of Mumbai's globe-trotting investors wanted to know whether LIC would have greater autonomy from India's government after the listing. They were initially skeptical, the people said, noting that the company bears the marks of a slow-moving arm of the establishment.

With arrangers each receiving at least Rs 1 crore ($135,000) in fees, the actual earnings from the LIC transaction would be minuscule if you stripped away the prestige of delivering what would be the biggest share sale in India's already red-hot market, some of the people said.

GIC and Blackrock did not respond to requests for comment. CPPIB and Abu Dhabi Investment Authority declined to comment.

But for deep-pocketed investors who don't have many places to park their money after China's technology curbs last year, LIC could still be a good bet. The company has one of the highest assets under management by an insurer globally, owning two-thirds of India's insurance market share.

LIC also has a sovereign guarantee on all payment liabilities, meaning it can operate with a thinner capital base than its competitors. With a valuation potentially four times higher than AIG, the company could appeal to investors hunkering for returns and safety.

“The Life Insurance Corporation's IPO is an excellent development not only for India's capital markets, but also for India's economic growth,” said Mark Mobius, the veteran emerging-markets investor and founder of Mobius Capital Partners LLC.

He said listing massive state-owned enterprises like LIC results in “an expanded market capitalization of the Indian market generally with greater liquidity, making it attractive to large investors like pension funds and endowments not only in India but abroad.”

India had a bumper year for IPOs last year and a solid debut by LIC would only build on that momentum. Listings raised around $18 billion in 2021, even with mixed results from some of the more hyped entries, which included Paytm, a digital payments service, and Zomato, a food delivery startup.

An All-India Heave

As the deadline nears, India's labyrinthine bureaucracy has become a pressure cooker.

Officials from the Department of Disinvestment are pulling all-nighters, double-checking hundreds of filings and opening their doors to let in weak winter sunlight when New Delhi's power grid gives out. Bankers are working through holiday trips in the Himalayas and the Maldives. LIC executives said they are missing birthdays, giving up weekends and working through illnesses.

Indians in rural areas are rushing to ensure their eligibility for receiving a piece of the pie. LIC has started sending SMS blasts to its agents and publishing newspaper ads with the title: “It's best in life to be prepared.”

Raj Kumar Shukla, a marketing manager who lives in Kiraoli, a village in northern India, said a friend alerted him to the IPO, which pushed him to download an app to track stock indexes. He saved Rs 50,000 (about $670) and opened a demat account so he could invest in LIC.

“The government will benefit from this listing,” he said. “They can use the money for the development of the nation.”

Modi's critics have framed the disinvestment drive differently. Anshul Avijit, a national spokesperson for Indian National Congress, the largest opposition party, said in an interview that the IPO amounted to “handing over our critical resources, slowly and gradually, to a few select private hands.” He called the measure “anti-poor.”

But unlike Aramco's 2019 IPO, when Saudi Arabia leaned on wealthy citizens to buy stock after global funds balked at the kingdom's high initial valuation, Modi's government has lobbied for a different approach: offering as much as 10% of LIC's IPO shares to policy holders spread across the country.

Giving ordinary Indians a share in LIC may offer political ammunition ahead of regional elections starting next month. Many policy holders are scattered in northern India, where the governing Bharatiya Janata Party hopes to hold onto power.

“The Prime Minister has always said ‘the government has no business to be in business,'” said Gopal Krishna Agarwal, a national spokesperson for the B.J.P. “As a party, as an ideology, we believe in the free market economy.”

Whether all of the pieces come together is anyone's guess. But the potential rewards are bountiful: Nearly half of the IPO could be raised from individual investors, including teachers, small business owners and parents saving up for their children's college funds.

A homegrown brand long recognized in every pocket of India, from mountainous Kashmir to villages in the Andaman Islands, might soon have clout around the world.

“I'm telling all my clients to invest in it,” said Bhagvati Prasad Sharma, one of LIC's 1.3 million agents.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.