Auto sales may have gotten a boost in September, with brokerages expecting automakers to remain active on expectations of higher sales during the ongoing festival period. The festival season, which started with Onam earlier this month and ends with Bhai Dooj in November, contributes significantly to the automakers' annual sales.

Some automakers may show stellar growth on an annualised basis, while players in the tractor industry might have seen a meaningful shift sequentially. However, demand weakness, exacerbated by the inauspicious Shraddh period that began on Sept. 17 versus Sept. 29 last year, continues to weigh on sentiments. This factor would have led to lower retail sales, but pre-festive inventory buildup will have a positive effect on wholesales. Hence, despite one negative Shraddha factor, a positive inventory factor will drive sales growth for these players.

Since this is the last month before the festive season, don't assume that companies across sectors will be building up inventory. Instead, expect wholesale volumes to significantly outpace retail sales.

Two-Wheelers: Pre-Festive Inventory Buildup

Two-wheelers have borne the brunt of weak demand trends across segments so far till Sept. 24, despite festivals such as Onam and Ganesh Chaturti. However, the numbers may not fully reflect this, as inventory buildup ahead of the festive season may have compensated for it.

Bajaj Auto Ltd. and TVS Motor Co. may see decent sales growth in September. Bajaj may have seen enquiries and bookings for its CNG motorcycle Freedom 125 largely stable, but it is experiencing some decline in the regions where it was initially launched, according to Motilal Oswal. Customers have responded positively to TVS Motor's launch of the new Jupiter 110 scooter, which boasts a 10% higher mileage and superior features compared to the outgoing model. The company is also positioning itself in a very interesting space, as its pricing is very close to that of EV Scooters.

Hero MotoCorp Ltd. anticipates a significant inventory build-up during the festive season even as it faces competition, particularly from Bajaj Auto's CNG motorcycles and TVS's formidable scooter presence with the launch of their own Destini 125 and XOOM 125. The on-road price of Freedom 125-CC base variant with drum brakes is around Rs 1,09,200 versus Rs 90,000/91,000 for Splendor Plus/Passion Plus.

Inventory levels have risen with Hero MotoCorp to 75-80 days, with TVS Motor/Honda Motor Co. at 50-55 days, Bajaj Auto at 60 days, and Royal Enfield at 30 days, according to Motilal Oswal.

Bajaj Auto Ltd. and TVS Motor Co. may see decent sales growth in September

Passenger Vehicles: Tata Motors To Show Highest Growth

Four-wheeler makers will be the most looked-out segment this month, with all three players in the news. Tata Motors Ltd. is expected to report the highest year-on-year growth, marking its first meaningful growth in the last five months, with a projected growth of 9-10%. Sequentially, the growth is expected to be around 12%. Test drive cars for the petrol variant of Curvv have not yet arrived at dealerships, causing customers to postpone their purchases.

Mahindra & Mahindra Ltd. will report an increase in sales compared to last year, but the growth would be slower compared to its momentum so far this year. Thar Roxx test drives have commenced, with bookings open from Oct. 3. Strong initial response to Thar Roxx has led to a discount of Rs 150,000 on the three-door Thar.

Maruti Suzuki India Ltd.'s momentum will be similar to the last few months with flat to negative sales growth. The company is seeing an improvement in its Grand Vitara strong hybrid retails in UP mainly due to a reduction in road tax announcements by the government, according to Motilal Oswal.

The brokerage expects inventory levels for Maruti to be around 55-60 days, Tata Motors to be around 60 days, and 40-45 days for M&M.

Commercial Vehicles: Demand Remains Subdued

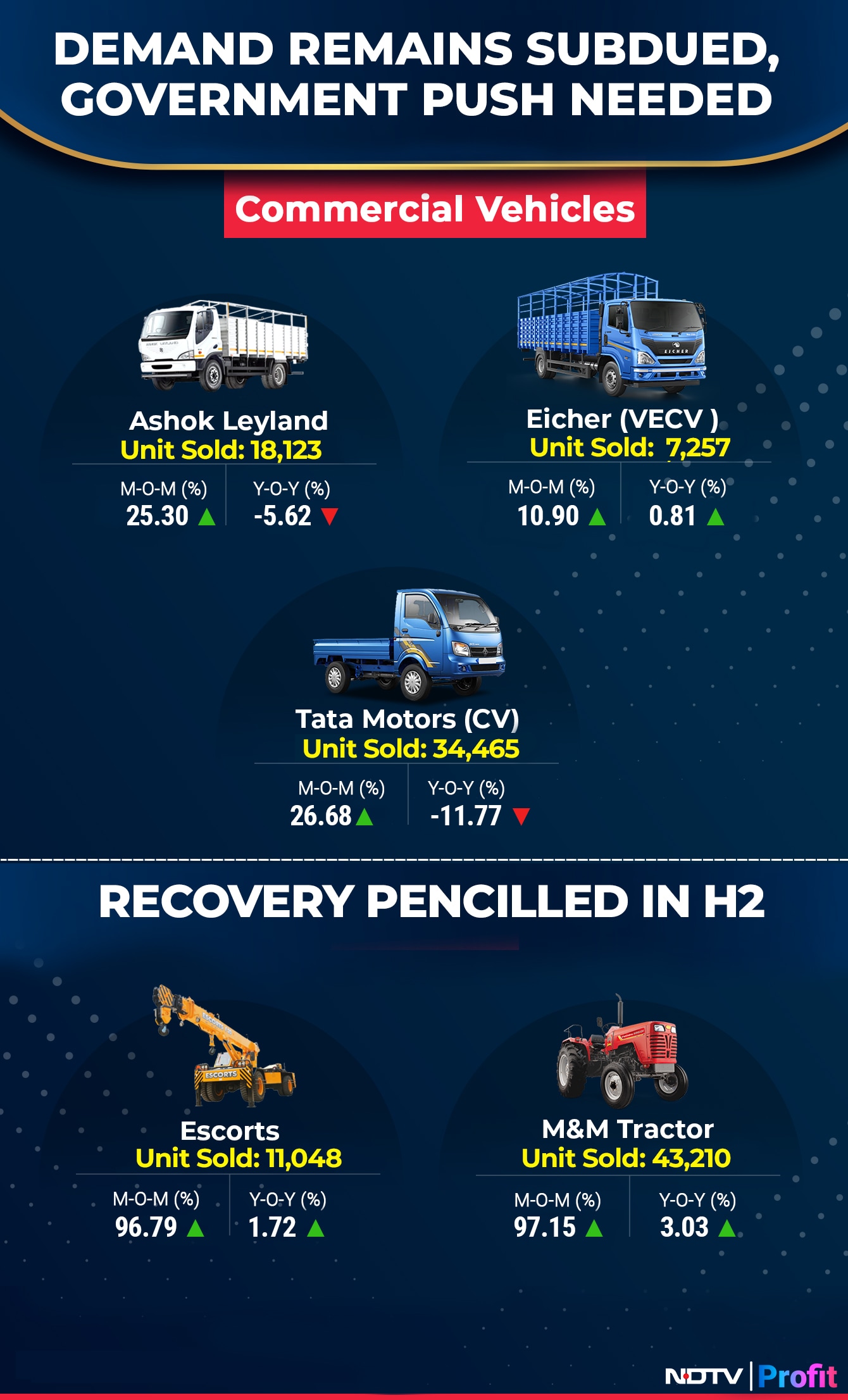

The government hasn't made any significant improvements to the tendering processes, resulting in fleet operators postponing purchases, particularly for tippers. This delay will have an impact on commercial vehicle manufacturers' sales this month. While Ashok Leyland Ltd., Tata Motors, and VE Commercial Vehicles Ltd. will show 10-25% sales growth on a sequential basis, their year-on-year performance will fall 1-11%, which is disappointing.

Current fleet utilisation levels remain stable at 65–70%, driven by better off-take in consumer-based sectors such as Agri, Auto, and FMCG. E-way bill generation has increased compared to last year, indicating improved freight availability for transporters.

In the fiscal year 2024, the industry recorded its highest sales in the last four years. This is at similar levels to the industry's last high back in 2019 and will need major government push in terms of infrastructure tendering.

Ashok Leyland Ltd., Tata Motors, and VE Commercial Vehicles Ltd. will show 10-25% sales growth on a sequential basis, their year-on-year performance will fall 1-11%, which is disappointing.

Tractors: Recovery Penciled In Second-Half

Tractors have shown some positive growth since June, thanks to better monsoons. Retail sales during the Ganesh festival in Maharashtra have largely remained flat YoY, in a region where M&M has roughly 50% market share. But this is not a negative, as the region has shown steady growth in the last five months and is outperforming other regions, such as UP.

Escorts Kubota has degrown by 2% between April and August, and recovery is only pencilled in the second half of fiscal 2025. The lack of presence in Western regions of the country has subdued sales, but a larger recovery in North India in H2 will be beneficial.

Current industry inventory levels are around eight weeks, which we consider normal as we approach the festive season.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.