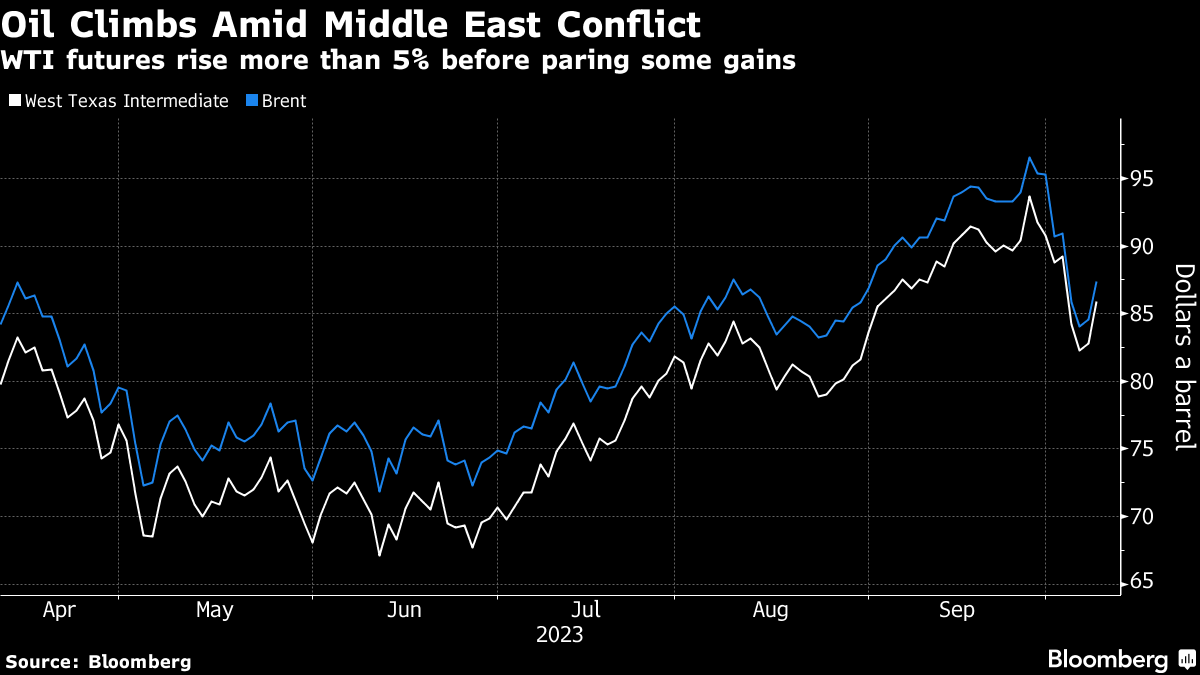

(Bloomberg) -- Stocks rose as remarks from Federal Reserve officials bolstered bets officials will refrain from lifting rates this year. Oil climbed after Hamas' attack on Israel raised fears of a wider conflict.

The S&P 500 erased losses as Fed Vice Chair Philip Jefferson said officials are in a position to “proceed carefully” after the recent rise in Treasury yields. Earlier in the day, Fed Bank of Dallas President Lorie Logan said the recent surge in long-term US bond rates may mean less need for the central bank to tighten again. The dollar edged lower. Treasury futures climbed, with the cash market closed for Columbus Day.

“The script has changed,” said Andrew Brenner at NatAlliance Securities. “The odds for another tightening have dropped dramatically since Friday.”

At the end of last week, traders had boosted bets on another Fed hike this year as data showed US employment unexpectedly surged in September.

Read: Wall Street's Narrative Gets Lost in World of Hurt: Surveillance

Energy companies led gains in the S&P 500 as US crude futures briefly topped $87 a barrel. Exxon Mobil Corp. and Chevron Corp. added over 2.7%. Defense companies rallied, with Northrop Grumman Corp. up the most since March 2020 and Lockheed Martin Corp. gaining 8.9%. American Airlines Group Inc. and Delta Air Lines Inc. fell more than 4%.

Israeli companies Teva Pharmaceutical Industries Ltd. and Check Point Software Technologies Ltd. slipped in US trading. The shekel dropped even after the central bank unveiled a $45 billion support program. Gas prices in Europe soared.

Read: Five Key Charts to Watch in Global Commodities This Week

The latest Middle East conflict comes at a time of ongoing geopolitical concerns, with markets also facing a period of moderating global economic growth, according to Solita Marcelli, chief investment officer Americas at UBS Global Wealth Management

“Against this backdrop, we continue to prefer fixed income to equities,” Marcelli noted. “We see a better risk-reward profile for fixed income, and we recommend investors consider buying high-quality bonds in the 5-10-year maturity range. We foresee further cooling in inflation and slower global growth.”

The next risk to US stocks could come from fiscal policy constraints at a time when the Fed is still fighting high inflation, according to Morgan Stanley's Michael Wilson. The strategist — among the most prominent bearish voices on Wall Street — said while the US government narrowly avoided a shutdown last week, “the lack of a resilient long-term structure that supports fiscal discipline” could have an impact on financial markets.

BlackRock Inc. Vice Chairman Philipp Hildebrand said the International Monetary Fund should frame discussions this week around the new economic reality, where central banks are less able to support growth by cutting interest rates.

“We are going to be in a much more sticky inflation environment and rates will not be able to come down to respond to weakness,” Hildebrand said in an interview with Bloomberg TV on Monday. “That should be the framing of the IMF and I hope they start to pay attention to these new structural conditions.”

Read: JPMorgan, Citi Gird For Recession Risk: US Earnings Week Ahead

Key events this week:

- Bank of England releases minutes of financial policy meeting, Tuesday

- IMF issues its latest world economic outlook, Tuesday

- US wholesale inventories, Tuesday

- Fed's Raphael Bostic, Christopher Waller, Neel Kashkari and Mary Daly speak at separate events, Tuesday

- Germany CPI, Wednesday

- NATO defense ministers meeting in Brussels, Wednesday

- Russia Energy Week in Moscow, with officials from OPEC members and others, Wednesday

- US PPI, Wednesday

- Minutes of Fed's September policy meeting, Wednesday

- Fed's Michelle Bowman and Raphael Bostic speak at separate events, Wednesday

- Japan machinery orders, PPI, Thursday

- Bank of Japan's Asahi Noguchi speaks, Thursday

- UK industrial production, Thursday

- US initial jobless claims, CPI, Thursday

- European Central Bank publishes account of September policy meeting, Thursday

- Fed's Raphael Bostic speaks, Thursday

- China CPI, PPI, trade, Friday

- Eurozone industrial production, Friday

- US University of Michigan consumer sentiment, Friday

- Citigroup, JPMorgan, Wells Fargo, BlackRock results as the quarterly earnings season kicks off, Friday

- G20 finance ministers and central bankers meet as part of IMF gathering, Friday

- ECB President Christine Lagarde, IMF Managing Director Kristalina Georgieva speak on IMF panel, Friday

- Fed's Patrick Harker speaks, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.6% as of 4 p.m. New York time

- The Nasdaq 100 rose 0.5%

- The Dow Jones Industrial Average rose 0.6%

- The MSCI World index rose 0.5%

Currencies

- The Bloomberg Dollar Spot Index fell 0.1%

- The euro fell 0.2% to $1.0569

- The British pound was little changed at $1.2243

- The Japanese yen rose 0.6% to 148.44 per dollar

Cryptocurrencies

- Bitcoin fell 1.1% to $27,621.63

- Ether fell 3.4% to $1,581.8

Bonds

- Germany's 10-year yield declined 11 basis points to 2.77%

- Britain's 10-year yield declined 10 basis points to 4.48%

Commodities

- West Texas Intermediate crude rose 4.3% to $86.34 a barrel

- Gold futures rose 1.7% to $1,876.80 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Vildana Hajric.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.