In a first, Apple Inc. is set to retail Made-in-India iPhone 15 from the launch day. That doesn't, however, mean preferential pricing for the local fanboys.

That's because Apple remains an aspirational brand in India, and the company doesn't want to dilute that perception, according to Counterpoint Research. Instead, the company has increased the frequency and magnitude of promotions and discounts on older models.

“Apple is passing down the cost benefit from manufacturing to consumers by reducing the effective price on a regular basis across channels, rather than changing the pricing strategy,” Shilpi Jain, senior research analyst at Counterpoint Research, said in response to emailed queries. “For instance, we witnessed more offers on iPhone 14 from the beginning of this year, which was not the case earlier as models used to get assembled in India after 5-6 months of launch, while iPhone 14 manufacturing started from the launch month itself.”

“We believe Apple will continue with the same strategy as its working well in their favour and the brand image remains premium,” she said.

On Tuesday, the world's most valuable company unveiled the iPhone 15 and the iPhone 15 Pro at the Apple Park in Cupertino at a starting price of $799 and $999, respectively. In India, the devices start at Rs 79,900 and Rs 1,34,900 a pop.

The conversion math doesn't add up. The aberration is Apple's doing.

The company—known for retailing its devices at a premium to every other in a segment— counts each dollar at Rs 100 for pricing its products in India. By that logic, the pricing for the iPhone 15 and iPhone 15 Plus holds, but the Pro models are costlier still.

Blame that on the taxman.

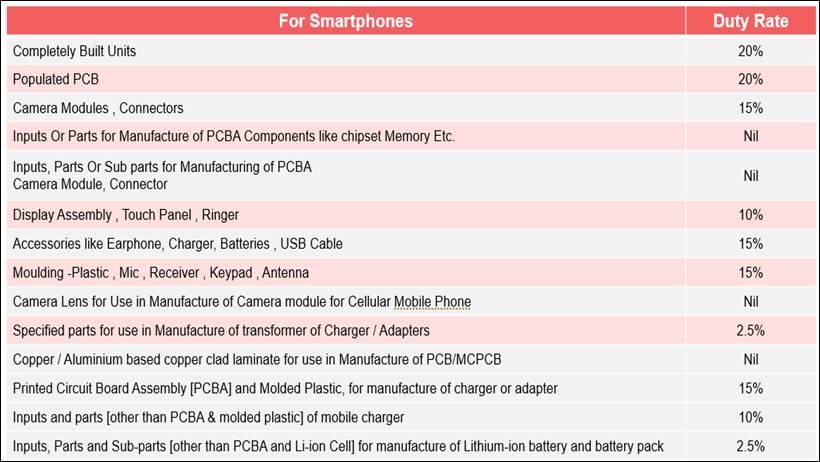

The iPhone 15 Pro models are mint-in-box imports from their country of origin—similar to how luxury cars are brought to India as completely built-up units, or CBUs. The government has imposed a 22% import duty, including a 2% “social welfare surcharge”, on smartphones since FY21. Add to that GST at 18%, and the total tax incidence on an iPhone Pro model rises to nearly 40%.

The iPhone 15, to extend the automotive analogy, is like a completely knocked-down, or CKD, unit of a luxury car—auto components are imported to be assembled in India.

Apple doesn't manufacture the iPhone 15 in India. Its biggest contract manufacturer, Taiwan's Hon Hai Precision Industry Ltd. or Foxconn Technology Group, assembles the device at its Sriperumbudur plant near Chennai. All the components that go into an iPhone 15 are imports, which attract customs duty. For example, the display—the most expensive component manufactured by South Korea's Samsung Electronics Co. Ltd. —has an import duty of 20%. The printed circuit board, on which state-of-the-art custom processors, diodes and transistors are soldered on, is taxed similarly. An 18% GST is applicable on top of this.

(Courtesy: Counterpoint Research)

That, more or less, explains the steep pricing. But things are changing.

Apple is seen moving nearly a fifth of its global iPhone production to India in the next two years, underscoring the growing importance of Asia's third largest economy in the shifting sands that is the global supply chain for electronics manufacturing. In fact, the company started assembling the iPhone 15 in India within weeks of doing so in China. That's crucial for the Cupertino-headquartered phone maker, which is adopting a “China+1” approach to its production in the face of an increasingly hostile Beijing. Just hours ago, China flagged “security incidents” with iPhones after barring their use at its government offices.

India, on its part, is trying to ease Apple's weaning from China.

In her budget speech earlier this year, Union Finance Minister Nirmala Sitharaman proposed reduction in customs duty on mobile camera lenses and continuation of concessional duty on lithium-ion cells for another year. Additionally, India has rolled out the second round of production-linked incentive schemes for IT hardware—Foxconn is an applicant here.

Separately, India's largest conglomerate Tata Group is closing in on a deal to acquire Apple supplier Wistron Corp.'s factory near Bengaluru, marking for the first time a local company would move into the assembly of iPhones.

“We believe that in addition to China, India will be a key strategic manufacturing location for Apple,” Prachir Singh, senior analyst with Counterpoint Research, told BQ Prime over email. “However, the company may also develop Vietnam or some other Southeast Asian as a suitable alternative manufacturing location.”

Apple could move at least 18% of its global iPhone production to India by 2024-25, BofA Securities said in a June 15 report. This is based on targets already committed by Apple's contract manufacturers under the PLI scheme. “We see scope for Apple's share expanding further in a larger scale incentivises its vendor ecosystem to also move/expand within India,” the report stated.

Given how iPhone sales are growing in India—double-digit to a record high in the June quarter—that shouldn't be too much of an ask after all.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.