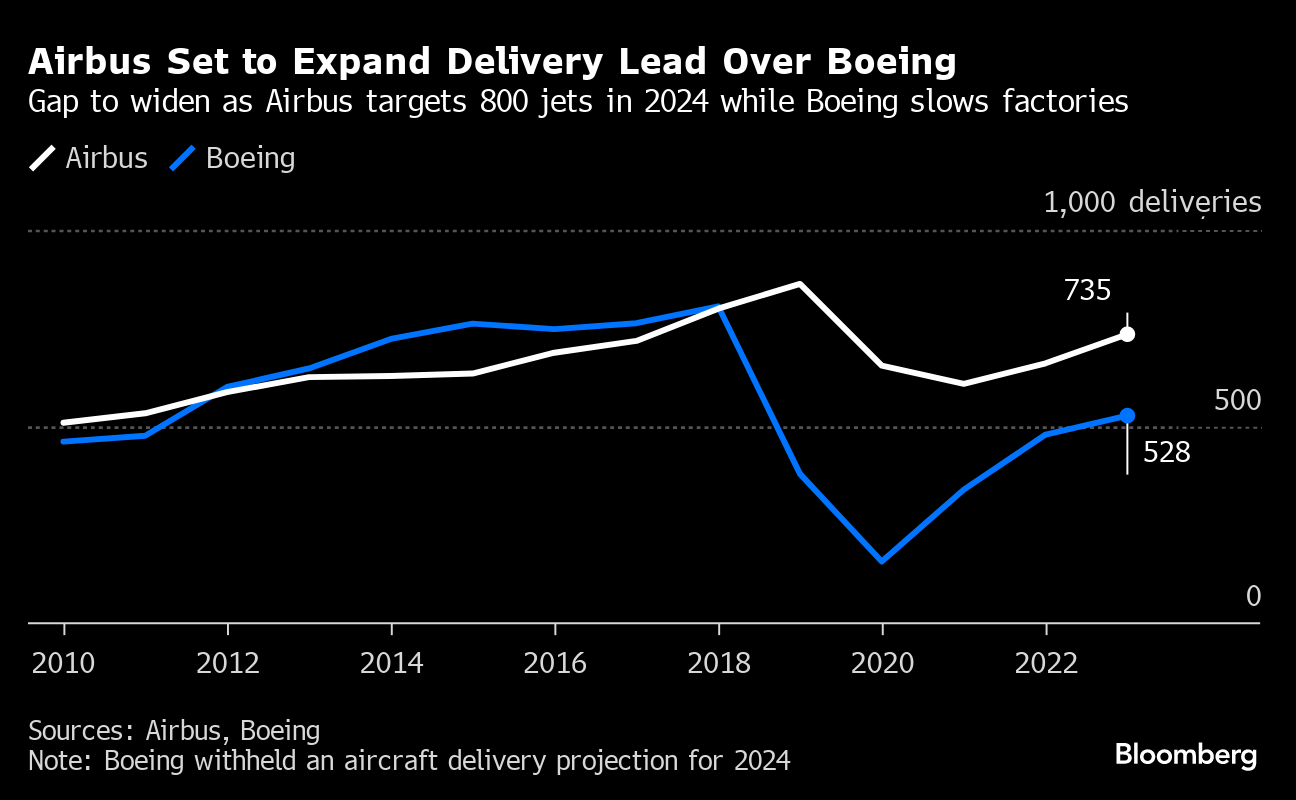

(Bloomberg) -- Airbus SE said it plans to hand over about 800 aircraft this year, striking a cautious note on its financial objectives as supply-chain woes persist and rival Boeing Co. remains mired in crisis following a near-catastrophic accident last year.

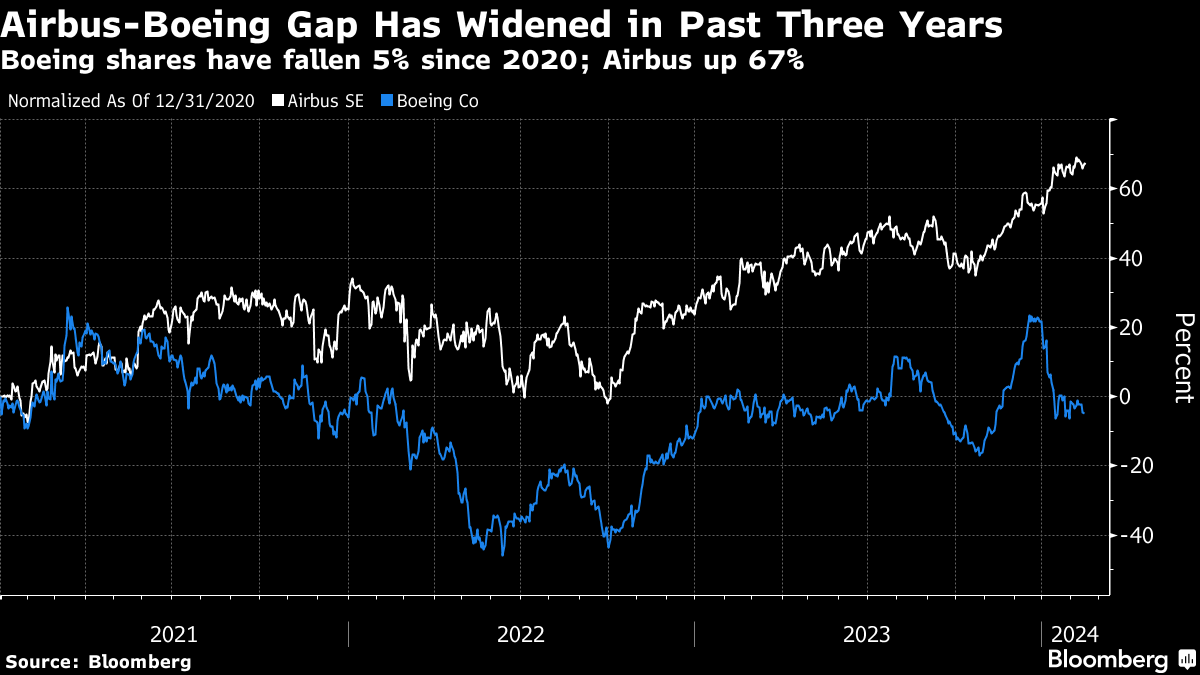

The target is about 10% above the deliveries achieved in 2023, though analysts had estimated the goal to reach about 825 units. While the planemaker plans to pay a special dividend, it also set a low bar for adjusted free cash flow in 2024, prompting the stock to slide as much as 2.6% in Paris trading.

Chief Executive Officer Guillaume Faury told analysts on a call that the delivery goal is a “good balance” between a strained supply chain and demand that remains at record levels. While investors may have hoped for a more ambitious prediction, the output target nevertheless widens the gap between the two main commercial planemakers.

Boeing has been forced by regulators to cap its own delivery plans in the wake of the accident in early January that saw a fuselage panel blow out during flight. The order has put the company at a disadvantage at a time when backlogs stretch out into the next decade.

“Be afraid of what could go wrong,” Faury said at a press conference as he discussed Airbus's safety culture. “It cannot be quantity over quality, we don't want to deliver a number of planes, we want to deliver a number of planes that are of high quality and are safe.”

The European planemaker had adjusted earnings before interest and tax of €5.8 billion ($6.2 billion) last year, on revenue of €65.4 billion. Airbus said it will pay a €1.8 regular dividend, as well as a special €1 payout per share as its net cash exceeded €10 billion.

Airbus fell as much as €3.84 to €146.42. The stock has gained about 7.2% this year.

Analysts surveyed by Bloomberg estimated adjusted operating profit of €5.4 billion for last year. The company expects adjusted free cash flow to hit about €4 billion this year, down from €4.4 billion in 2023, while adjusted operating profit will reach as much as €7 billion.

Airbus typically sets a low bar for its cash projection and then exceeds the target. For last year, the company had initially aimed for adjusted free cash flow of €3 billion.

Airbus took a €600 million charge at its space business, and the company said that it will “successfully manage the transformation of Airbus Defence and Space” this year.

The planemaker beat its annual delivery target in 2023, when it handed over 735 planes, more than the 720 it had initially predicted. The current backlog of aircraft on order stands at 8,598 units, Airbus said.

Handing over its A321XLR long-range model will be delayed by a few weeks into the third quarter, Airbus said, because of the complexity tied to certification of the program.

For the A350 widebody model, Faury said he expects a strong order intake this year, and for deliveries to top last year's figure. The larger A350-1000 model had a particularly successful 2023, in part because Boeing is years behind bringing its competing 777X model to market.

Airbus has struggled to ramp up output of its bestselling A321neo model even as the backlog for the model stretches past the end of this decade. The Toulouse, France-based company reiterated its long-term ambition of building 75 A320neo jets a month by 2026.

Read More: Safran Says Aerospace Supply Shortages Will Persist Through 2024

Alongside existing part shortages, Airbus is contending with potentially flawed components on Pratt & Whitney engines powering its A320neo aircraft. More than 400 planes, or almost a third of the total Pratt-powered A320neo fleet, were grounded last month, according to a recent note from Citigroup Global Markets.

Airbus has said that it will work with Pratt to ensure sufficient engines for new aircraft along with ensuring an adequate supply of spare engines for the in-service fleet.

“You have to take care of each and every stakeholder and we're trying to find that balance each and every day,” Faury said.

--With assistance from Anthony Palazzo.

(Updates with comment on safety culture)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.