The Adani Group has termed the March 22 Financial Times report on the conglomerate's offshore funding as "inaccurate", "mendacious" and "making insinuations that are false and damaging".

In a strongly worded letter to the FT editor on April 10, shared with the exchanges, the group said the article has created a misleading narrative, misunderstanding in the markets, created reputational impact on the Adani Group companies and has become a political issue.

This is the first time the Adani Group has said that alleged misreporting of facts by the media has become a political issue. The group asked the FT to immediately take the story down from its website.

The FT story reveals a "willingness to be selective in using publicly available facts, lazy in its approach to understanding disclosures to which the publications reporters were directed, and makes insinuations that are false and damaging".

The letter alleges that the FT story has "incorrectly mixed" primary and secondary investments, and also "ignored entirely" a secondary transaction of $2 billion—all so that the reporters could "conveniently create an illusion of a $2 billion gap in funding” to support their pre-conceived thesis of "supposed round-tripping". That all falls away once the Adani Green Energy Ltd.'s equity proceeds are taken into account, it said.

The Adani Group's promoters raised $2 billion on Jan. 18, 2021 and Jan. 23, 2021 by selling a 20% stake in Adani Green Energy to TotalEnergies of France.

Adani promoters also raised $700 million in October 2019 by selling a 37.4% stake in Adani Total Gas Ltd., a fact which was disclosed in the Adani press release. These were reported by the Financial Times but the publication "chose to ignore completely in the 22 March 2023 story", the group said.

The Adani promoter entities reinvested the stake sale proceeds to support the growth of new businesses and in portfolio companies such as Adani Enterprises Ltd., Adani Ports and Special Economic Zone Ltd., Adani Transmission Ltd. and Adani Power Ltd., according to the letter.

The group said the promoter entities have had substantial holdings in the Adani Group companies, which have increased over time. It is through the timely use of funds received by selling equity that these entities have been able to increase their investments, the letter said.

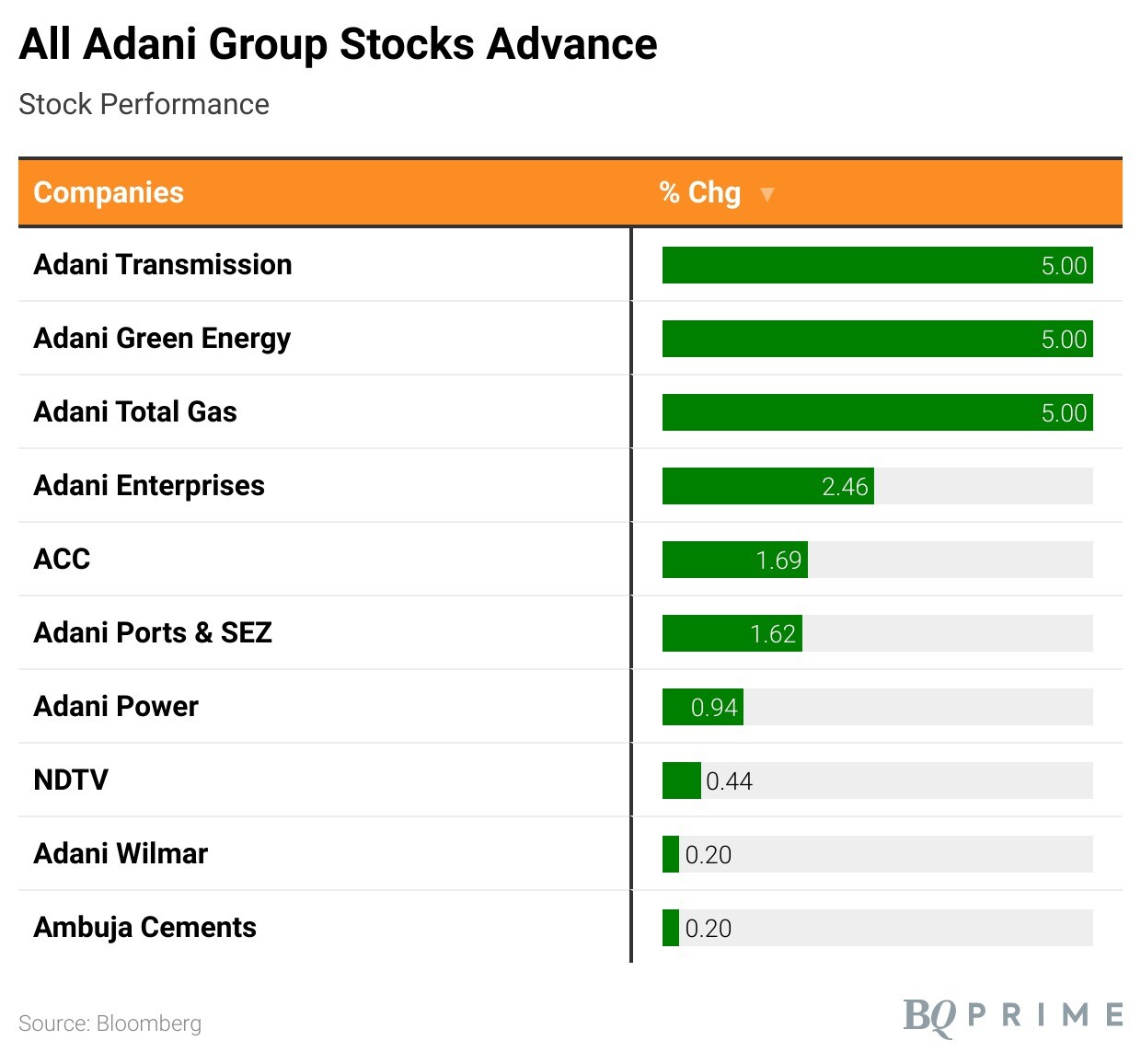

All Adani group shares ended higher on April 10.

Disclaimer: AMG Media Networks Ltd., a subsidiary of Adani Enterprises Ltd., holds a 49% stake in Quintillion Business Media Ltd., the owner of BQ Prime.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.